Earlier this week we summarized a new White Paper from Freddie Mae detailing the growing importance of single-family properties within the U.S. rental market, especially in rural areas. With the large number of such rentals - an estimated 25 million out of 43 million total units - and the recent history of growth in this segment, Freddie Mac says it is important to consider "where the money for acquisitions comes from, how properties are financed, and what are the fundamental terms of that financing." Not only can the answers impact millions of renters, but also tens of millions of properties owners and the answers often vary by the kind of ownership.

While single-family rentals (SFR) have traditionally been the province of small and very small investors (those owning 1 to 10 units and 11 to 50 units respectively), the Great Recession brought a new type of investor into the mix; institutional investors and companies which own more than 2,000 individual units. There was also growth in the middle tier, those with 50 to 1,999 properties in portfolio. The latter two types are still minority players with institutional investors having only a 1 percent share of the SFR stock and the middle tier owning 4 percent. Very small landlords still account for 88 percent.

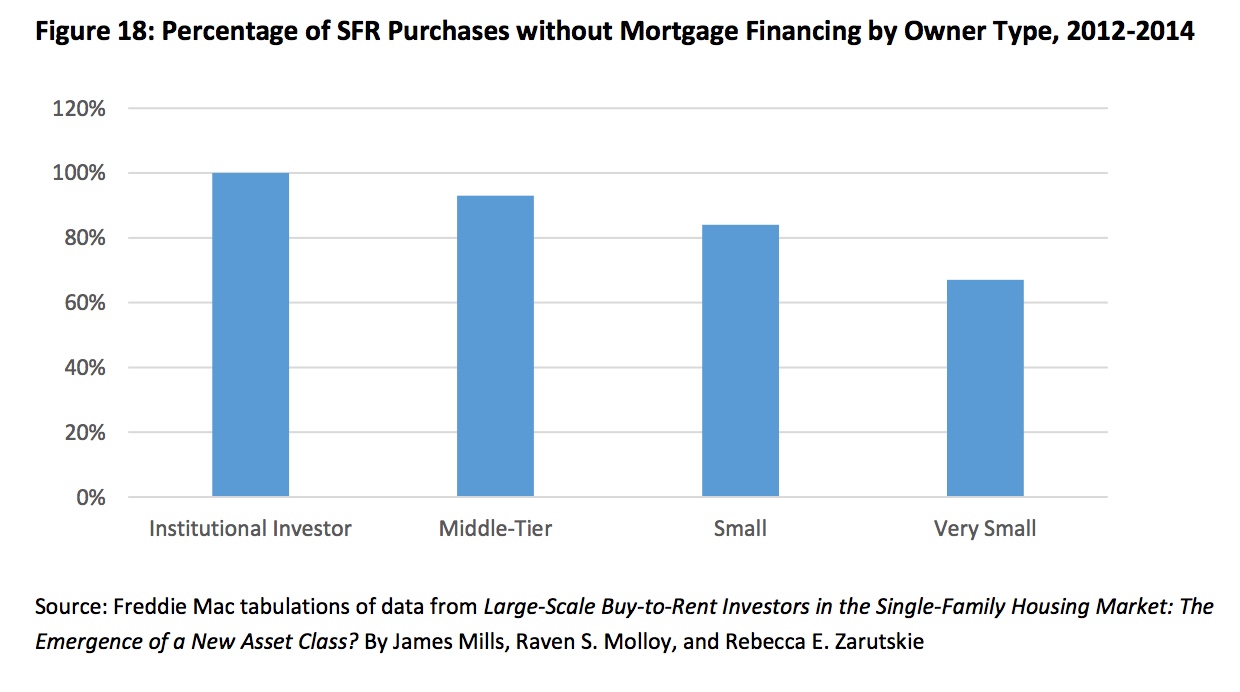

The larger the owner type, the less likely they are to finance properties with individual mortgages and in fact very few institutional investors do so. They often get funds in advance of purchase from private equity, bank lines-of-credit, or public bonds and buy with cash.

When institutional investors amass a sufficient portfolio they issue bonds backed by those homes. Since November 2013 there have been 48 rated single-sponsor borrower deals closed for a total debt of $29 billion. The two largest borrower/sponsors, accounting for half of the total, have been Invitation Homes which has closed 13 transactions for $11.4 billion and Progress Residential with 11 transactions totaling $5.9 billion.

The terms are various; some are variable rate with 24-month terms and three one-year extensions, some are five or ten-year fixed-rate bonds. Rating agencies specializing in these products include Kroll, Morningstar, and Moody's. The typical transactions offer 5-7 series ranging from "non-rated" to AAA. Subordination levels range from 15 to 0 percent.

The pace of these institutional transactions appears to be picking up. There were ten in 2017, eight of which were single-borrower, for a total of $5 billion and ten to the date of the report in 2018 totaling $7 billion. All but one of those was a single-borrower deal.

Less than 10 percent of properties owned by Middle-tier investors are financed with a mortgage, yet they do not seem to enjoy the larger investors' ready access to capital, especially capital market executions. Freddie Mac says it assumes they must cobble together funds and financing to purchase, refinance, and recycle capital for further acquisitions and thus miss their ability to grow through efficient capital deployment and with the benefits of standardization and scale.

Likewise, only about 20 percent of properties owned by small investors were purchased with mortgage financing. While no reliable data is available, Freddie Mac concludes properties are probably acquired for cash from bank lines-of-credit or private equity. Where mortgages have been used by Middle and Small investors, they appear to be mostly shorter-term, full recourse transactions, many with variable rates that are generally have higher than loans backed by traditional multifamily properties.

While far from a mature market, there have been a few rated multi-sponsor/borrower securitizations since 2013. These are pools of multiple small and middle-tier investors (typically with fewer than 100 homes), sponsored by larger lenders. These have typically been for $100 to $300 million, backed by 70 to 100 loans with each loan generally collateralized by 50 or more homes. CoreVest and B2R Finance have been players in this sector, sponsoring nine of the 11 total transactions which brought in $2.4 billion.

Very small investors are eligible for conventional single-family mortgages which can be acquired by Freddie or by Fannie Mae. The parameters for these loans limit eligibility to 10 investment homes held by a single borrower.

In January 2017 Freddie Mac received approval from its conservator/regulator, the Federal Housing Finance Agency (FHFA) to develop and execute a pilot project to acquire and securitize SFR. This would allow the company to develop and test a new secondary market focused on SFR that were affordable to households making 80 percent of less of area median income (AMI). The pilot had limit of $1.3 billion and was subject to FHFA review and possible extension.

Freddie Mac does not mention this in its White Paper, but at about the same time, Fannie Mac initiated a related project which culminated in a $1 billion transaction with Invitation homes in April 2017. While the Freddie Mac pilot seems to have flown under the radar, Fannie Mae's hit the prop wash.

Characterized by the company as a mortgage through Wells Fargo, it covered 48,000 homes owned by Invitation and was discovered through an Invitation SEC filing. The National Association of Realtors (NAR), and the National Community Stabilization Trust (NCST) protested vigorously. The NAR sent a letter to FHFA that said in part, "Rather than focusing on allowing well-qualified Americans to build wealth through affordable mortgage options, Fannie Mae is actively financing large institutions to compete with them. These investors do not expand the affordable housing stock. Rather, in this limited market they drive up the price of rents and remove affordable inventory from the hands of American homeowners." The letter went on to tie the deal to NAR's ongoing attempt to get FHFA to lower g-fees, saying, "Charging individual borrowers substantially higher fees than the actual risk they present, while at the same time subsidizing investors able to raise billions of dollars on their own, undermines the GSEs' public mission." An FHFA spokesman promised NCST it would monitor the Fannie deal before approving more like it. This may explain why, on August 21, 2018, FHFA announced that Freddie Mac's pilot would not be extended. Freddie Mac however has detailed the experience in hopes it might be instructive to other market participants.

The company focused on middle-tier sponsors and on affordable homes in institutional portfolios and formulated a network of eight primary market SFR lenders and servicers. In addition to developing credit policies and standards for asset management, insurance, property quality and inspection, it also developed risk-transfer execution to dilute taxpayer risk and attract private capital.

By the end of 2018, the company expects to have committed to or purchased loans for the full $1.3 billion allotment which will include $1.1 billion of loans, 16 transactions, 15,000 homes in 27 states and 90 MSAs. Over 90 percent of the homes have rents at or below 80 percent of AMI and 98 percent are affordable at or below 100 percent. Only two of the transactions were with institutional investors, the balance was with the middle-tier

The company also developed a new SFR securitization model, FRESR which allow them to issue securities on pools of SFRs from its own or others' portfolio. It executed in first FRESR transaction with CoreVest in December 2017.

Only 3.5 percent of the homes financed during the pilot were rural, but it was Freddie Mac's intention to study the rural SFR market and develop and test offering terms in 2018 and 2019 then deliberately begin purchasing rural loans in 2020.

Freddie Mac concluded that its pilot demonstrated that a secondary market focused on affordable SFRs and middle-tier investors could be efficiently developed and grown to scale nationwide.