The Mortgage Bankers Association today released the Weekly Survey on Mortgage Application Activity for the week ending January 8, 2010.

The

MBA survey covers over 50 percent of all US residential mortgage loan

applications taken by mortgage bankers, commercial banks, and thrifts.

The data gives economists a look into consumer demand for mortgage

loans. A rising trend of mortgage applications indicates an increase

in home buying interest, a positive for the housing industry and

economy as a whole. Furthermore, in a low mortgage rate environment,

such a trend implies consumers are seeking out lower monthly payments

which can result in increased disposable income and therefore more

money to spend on discretionary items or to pay down other debt.

In the week ending January 1, 2010, mortgage applications rose by 0.5 percent thanks to a 3.6 percent increase in purchase loan apps, the refinance index fell by 1.6 percent. The refinance share of mortgage activity was 68.2 percent, a decrease from 69.6 percent in the previous week. The average contract interest rate for 30-year fixed-rate mortgages increased to 5.18 percent with points decreasing to 1.28. The average contract interest rate for 15-year fixed-rate mortgages increased to 4.62 percent, with points increasing to 0.98.

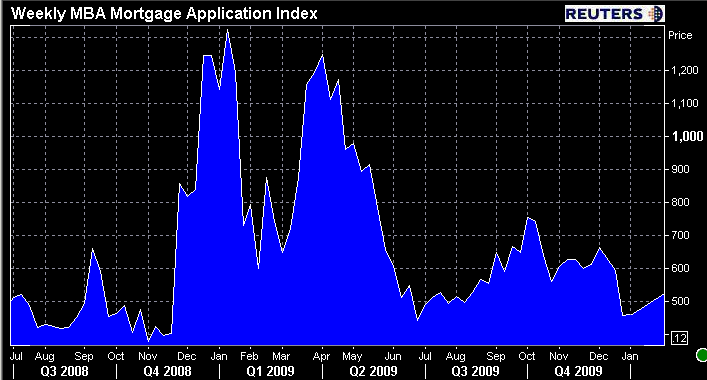

In today's release which reports on the week ending January 8, 2010, mortgage applications increased 14.3 percent on a seasonally adjusted basis. On an unadjusted basis, the Index increased 66.0 percent compared with the previous week, which was a shortened week due to the New Year's holiday. The four week moving average for the seasonally adjusted Market Index is down 6.4 percent.

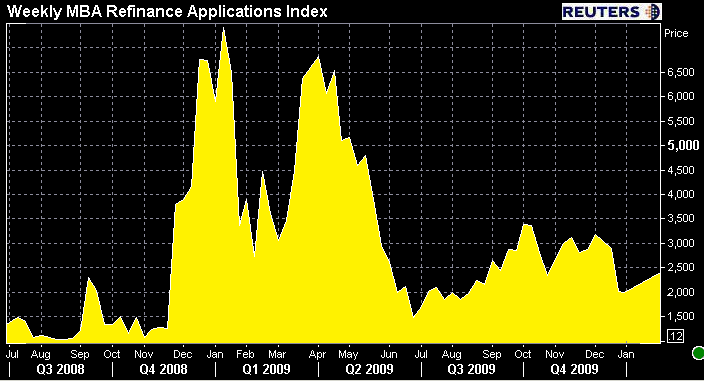

The Refinance Index increased 21.8 percent from last week's holiday adjusted index and increased 73.9 percent from last week's unadjusted index. The four week moving average is down 8.0 percent for the Refinance Index. The refinance share of mortgage activity increased to 71.5 percent of total applications from 68.2 percent the previous week.

The seasonally adjusted Purchase Index increased 0.8 percent from

one week earlier. The unadjusted Purchase Index increased 48.8 percent

compared with the previous week and was 24.9 percent lower than the

same week one year ago. The four week moving average is down 3.2

percent for the seasonally adjusted Purchase Index. Last week the

purchase apps index hit a 12 year low....

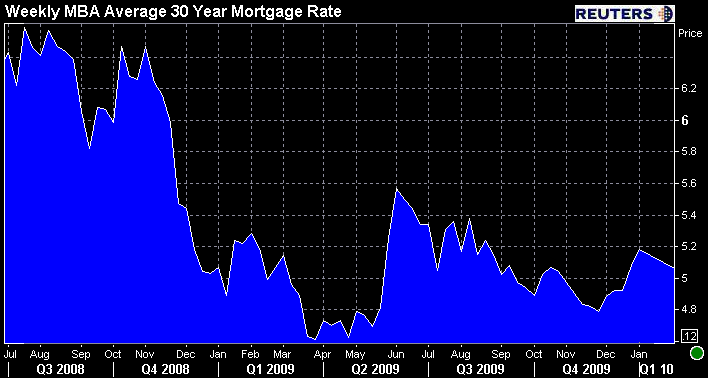

The

average contract interest rate for 30-year fixed-rate mortgages

decreased to 5.13 percent from 5.18 percent, with points decreasing to

1.17 from 1.28 (including the origination fee) for 80 percent

loan-to-value (LTV) ratio loans.

The average contract interest

rate for 15-year fixed-rate mortgages decreased to 4.45 percent from

4.62 percent, with points increasing to 1.04 from 0.98 (including the

origination fee) for 80 percent LTV loans.

The average

contract interest rate for one-year ARMs increased to 6.83 percent from

6.42 percent, with points decreasing to 0.31 from 0.50 (including the

origination fee) for 80 percent LTV loans.

If you missed the mortgage apps story last week, I called attention to a changing supply and demand dynamic in the primary mortgage market. I think I should share that observation again...

Fence sitters and ARM adjusters are not expected to be a major

source of business in 2010 as anyone who was qualified to refinance

likely already did so in 2009 when rates were at all time lows. This

would imply total loan production will continue to decline in 2010,

something we have already pointed out. More importantly it means

originators will be fighting it out for purchase applications when the

spring buying season picks up.

LOAN ORIGINATORS: if you haven't already put together a marketing campaign for a purchase driven lending environment....you are way behind.