The Mortgage Bankers Association today released the Weekly Survey on Mortgage Application Activity for the week ending January 15, 2010.

The MBA survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole. Furthermore, in a low mortgage rate environment, such a trend implies consumers are seeking out lower monthly payments which can result in increased disposable income and therefore more money to spend on discretionary items or to pay down other debt.

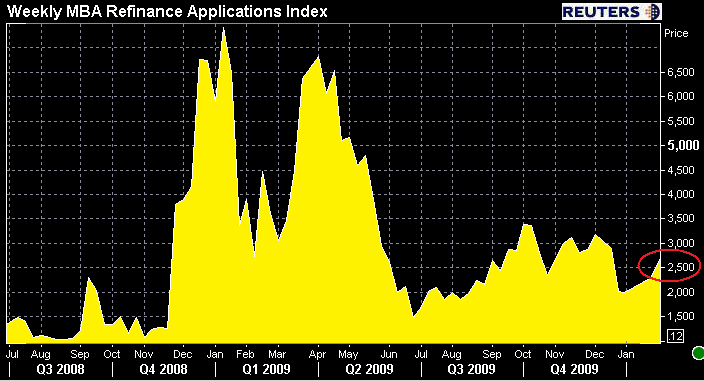

In the previous release, which covered the ending January 8, 2010, mortgage applications increased 14.3 percent. The Refinance Index increased 21.8 percent. The refinance share of mortgage activity increased to 71.5 percent of total applications from 68.2 percent in the previous week. The seasonally adjusted Purchase Index increased 0.8 percent from one week earlier. Recently, the purchase apps index hit a 12 year low....

From today's release...

The Market Composite Index, a measure of mortgage loan application volume, increased 9.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 10.4 percent compared with the previous week and decreased 52.3 percent compared with the same week one year earlier. The four week moving average for the seasonally adjusted Market Index is down 1.0 percent.

The Refinance Index increased 10.7 percent from the previous week.The four week moving average is down 2.4 percent for the Refinance Index. The refinance share of mortgage activity increased to 71.7 percent of total applications from 71.5 percent the previous week.

The seasonally adjusted Purchase Index increased 4.4 percent from one week earlier. The unadjusted Purchase Index increased 9.8 compared with the previous week and was 19.1 percent lower than the same week one year ago.The four week moving average is up 1.1 percent for the seasonally adjusted Purchase Index, .

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.00 percent from 5.13 percent, with points decreasing to 1.05 from 1.17 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.33 percent from 4.45 percent, with points increasing to 1.19 from 1.04 (including the origination fee) for 80 percent LTV loans. The average contract interest rate for one-year ARMs decreased to 6.72 percent from 6.83 percent, with points remaining unchanged at 0.31 (including the origination fee) for 80 percent LTV loans.

So both the refinance index and purchase index improved off of ANEMIC levels of activity last week (sorry...not trying to be a frustrating fred or debbie downer...it is what it is). I usually try to look a little deeper into the loan origination process for the underlying logic behind fluctuations in loan app demand, such as originator commission schedules or strategies to reduce closing table costs for the borrower, but this one is probably not too complex.

Besides the boost in borrower loan demand that one might expect following a holiday season, this instance of increases in borrower interest can actually lean heavily on falling mortgage rates. After moving higher most of December into January, mortgage rates have recovered some lost ground over the past week. It would make sense, given the outlook for higher rates in the near future, that last minute float boat borrowers would be looking to "get off the fence" ASAP....especially when a few IO ARMS about to go index +margin. READ MORE