At a press conference accompanying release of the results from its Fourth Quarter 2011 National Delinquency Study (NDS), the Mortgage Banker Association's (MBA) Chief Economist and Senior Vice President for Research and Education Jay Brinkmann said he is frequently asked how long it might be before delinquencies and foreclosures return to "normal." He said he typically answers that "we are about halfway there."

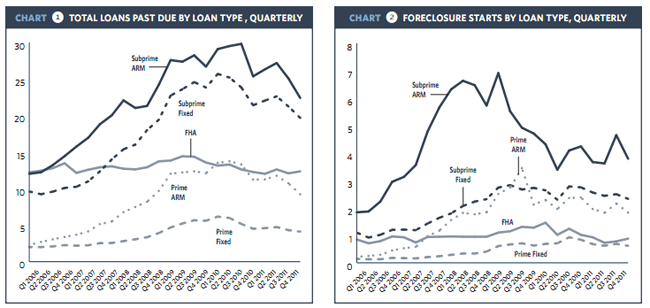

Delinquencies during "normal" times averaged around 5 percent but spiked to 10.1 during the recession. Now the rate is at 7.6, half-way there. Foreclosure starts generally run around 0.40 percent but hit 1.41 percent in 2009 and are now just below 1percent; almost halfway there. Foreclosures however are not halfway there. They were running around 1 percent pre-recession and rose to over 4.5 percent at the peak. They are now only slightly below 4.5 percent.

The real question, he said, was where we will end up; what will be the new normal? The new parameters for lending are promising with lower housing prices, and tighter lending standards but the economy may be growing more slowly so a 5 percent delinquency rate might not be the new normal.

Brinkmann pointed to improvements in most of the measures of foreclosure activity. The only increase in the third quarter was in early delinquencies, i.e. 30 to 60 days, which were up 3 percent from the third quarter to the fourth, probably due to seasonal issues such as the holidays and the beginning of the heating season.

The rate of 60+ day delinquencies was down 5 percent from Quarter 3 and 10 percent from Q4, 2010 and loans in the 90+ bucket decreased by 39 percent from the previous quarter and 54 percent year-over-year. Foreclosure starts were down 9 percent and 28 percent over the two earlier periods and the foreclosure inventory declined by 5 percent and 26 percent.

The improvement in delinquencies cuts across all types of loans except those backed by FHA and is particularly evident among those loan products which have been most problematic. Subprime ARMs now have a delinquency rate of 22.4, an improvement of 267 percent since the third quarter and subprime fixed-rate loans are down 157 percent to 19.67 percent. Prime ARMs improved by 151 percent to 9.22 percent and Prime fixed-rate loans were at 4.12 percent, down 20 percent from the previous quarter. FHA loans had an increase in delinquencies of 27 percent, mostly early stage delinquencies and Brinkmann expanded on this later in the press conference.

In most recessions foreclosure statistics mimic unemployment figures, however in the current downturn the problems in housing began before unemployment started to rise, peaked at about the same time, and now appears to be clearing more quickly. Foreclosures are not echoing this trend either.

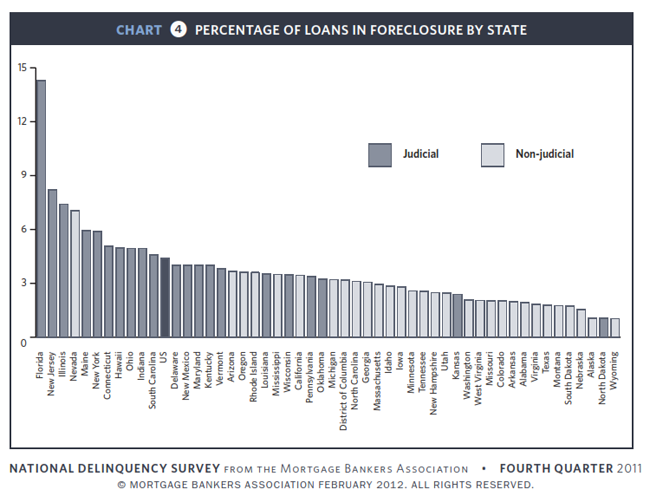

Mike Fratantoni, MBA's Vice President for Research and Economics said that the aggregate statistics on foreclosures are covering two very different stories. Nationwide, slightly more than 40 percent of all mortgage loans serviced are in states primarily using judicial foreclosure processes. Even in the best of times those 22 or 23 states are disproportionately represented by the number of loans in foreclosure - in early 2008 that share was 47.9 percent and today it is 62.5 percent.

However, the rate at which foreclosures are initiated in judicial states deviates hardly at all from states in non-judicial states; it is the timelines to complete those foreclosures that are causing rising foreclosure inventories in judicial states. The difference in the backlog of foreclosure inventory between the two types of states is significant and is growing worse.

As stated earlier, FHA has not evidenced the improvements noted in other loan types. Brinkmann said the sheer numbers of FHA loans have skyrocketed during the recession. Where it typically backed about 3 percent of the nation's loans it is now backing 34 percent. Thus the largest percentage of FHA's book of business is of a vintage where historically loans have the greatest risk of default - at 3-3-1/2 years after origination.

In response to a reporter's question about how the increased delinquencies might affect FHA going forward Brinkmann said that the real question is whether the actual level encountered by an organization is higher than it planned for and while he does not know what FHA had projected, he had heard from knowledgeable persons that even this higher delinquency rate is lower than actuarial expectations.

Asked about strategic defaults, Brinkmann said where large numbers of borrowers are underwater, every divorce and every job loss can mean a foreclosure and estimates of strategic defaults among these are probably overstated.

The recent settlement with five major banks and there servicers probably won't have much of an impact on the foreclosure inventory Brinkmann said. While it may speed up some that are underway because the uncertainty is removed, new processes imposed by the settlement may in initially cause slowdowns elsewhere.

MBA is seeing some indication that HARP 1.0 and to a lesser extent HARP 2.0 which is just getting off the ground may be impacting loan originations. Perhaps 10 to 20 percent of recent refinancing originations may be from those programs. There is no way of knowing whether this is having an impact on delinquencies as individual loans have little effect in a database of 43 million loans. Brinkmann said, however, that the incentives offered by HARP are the right ones.

The NDS has been produced by MBA for 160 consecutive quarters and currently covers 42.9 million loans representing 88 percent of all senior one-to-four family mortgages. The current survey saw an increase of 634,000 loans from the third quarter but 767,000 fewer loans than one year ago. Data was reported by 120 lenders including mortgage bankers, commercial banks, and thrifts.