Last year was a record setting one when it comes to mortgage origination according to Black Knight's January Mortgage Monitor. It puts the total volume of originations during 2020 at $4.3 trillion, the highest in the company's records. Refinance originations, to no one's surprise were also at an all-time high of $2.8 trillion and $1.5 trillion in purchase loans was originated, the largest annual volume since 2005. The fourth quarter also made history with all-time single quarter highs for purchase mortgages at $346 billion and refinancing at $869 billion. In total, $1.3 trillion worth of mortgages were originated during the quarter.

Even though the record low mortgage interest rates, which paved the way for such a spectacular year, have been rising in recent weeks, Black Knight says 2021 at least got off to a promising start. The company examined lock activity through the middle of February and says, assuming a 45-day lock to close timeline, first quarter refinance activity can be expected to remain at those late 2020 levels. Purchase locks in the first half of February were up 6 percent compared to January and 37 percent year-over-year while refinance locks in that early February period edged back by about five percent from January but were still more than double the volume of that same two-week span in 2020.

Black Knight says it expects impacts from the rising rates to begin late in this quarter or early in the next. The 30-year conforming rate has increased 35 basis points since the first of the year, 25 basis points in the last two weeks alone.

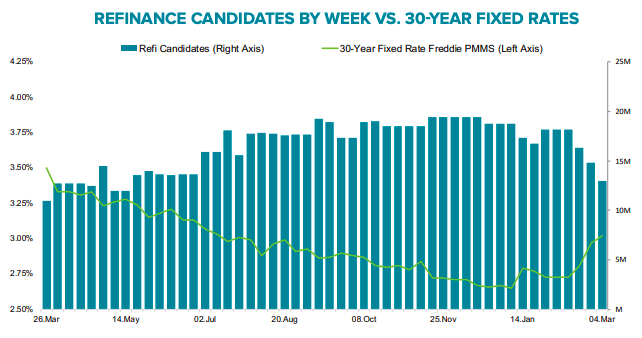

With those rising rates, there has also been a drop-off in high-quality refinance candidates. As of March 4, with Freddie Mac reporting a rate of 3.02, the refinance pool is at 12.9 million potential borrowers. This is down from 18.1 million on February 11, a 29 percent decline in just three week and the smallest that population has been since May 2020.

That rate locks have increased, Black Knight says, could indicate the rising interest rates may have spurred formerly procrastinating homeowners to act. By the end of March, the company expects 2.8 million homeowners will have refinanced, but this same data suggests a 25 percent decline from the 4th quarter in purchase activity. This would result in an overall 10 percent quarterly decline.

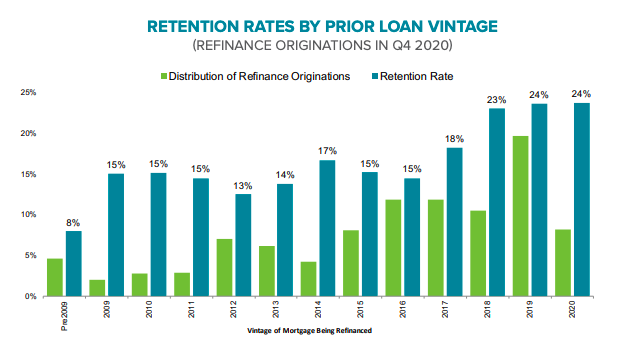

While the company expects refinancing to be strong for a while longer, servicers' performance in retaining those borrowers is getting worse. Only 18 percent of the estimated 2.8 million homeowners who refinanced in the fourth quarter stayed with their servicers, the lowest retention rate on record. Servicers were slightly more successful in hanging on to those doing rate/term refinancing (23 percent) than those who were taking cash out, only 11 percent of which were retained. Those higher credit quality rate and term refinancers who were not retained got a new mortgage rate more than 1/8th of a point lower than those who remained with their servicer.

Eight percent of Q4 refinances had taken out their mortgages earlier in 2020, but the largest volume by vintage was the 20 percent with an existing mortgage originated in 2019. They were also the most likely to stay with their servicers with a retention rate of 24 percent.

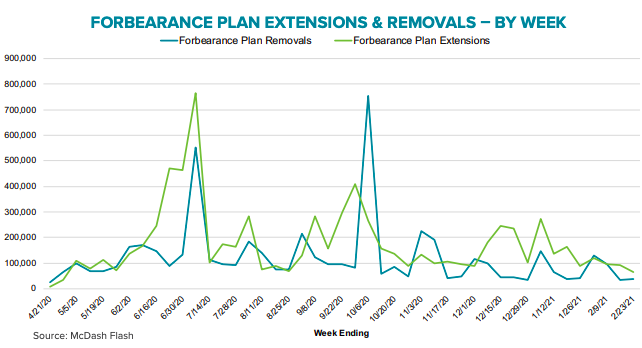

Black Knight reports on participation in the COVID-19 related forbearance programs every week, but the Mortgage Monitor delves more deeply into some of the program's impacts. The number of active plans continues to decline, but so does the rate at which homeowners are leaving the program. About 600,000 plans are set to reach their fourth and what was to be their final expiration at the end of the mouth, but the availability of plans has now been extended, at least for FHA, VA, and GSE programs, to the end of September and the Monitor says it is unclear what to expect this month. At both the three-month and six-month term expirations significant numbers of homeowners exited, but at the 9-month point that termination activity significantly underperformed expectations.

Of the remaining 2.7 million borrowers in forbearance, 23 percent (625,000) had their first forborne payment in April 2020 and another 13 percent (355,000) in May. Those two cohorts will dictate both the size and timing of final forbearance expirations. At this point the rate of improvement among those early enrollees has dropped to 3 percent a month. Black Knight says homeowners who have remained in the program this long may well remain for the duration of the program, however long that might be.

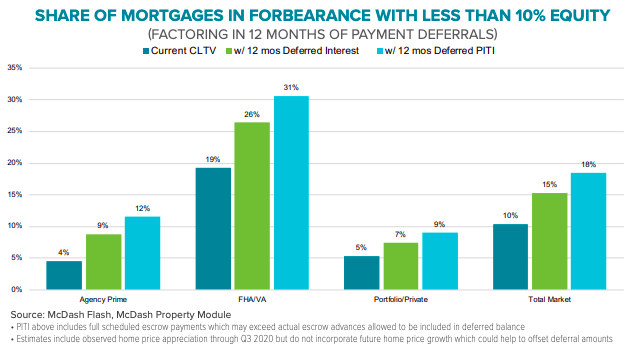

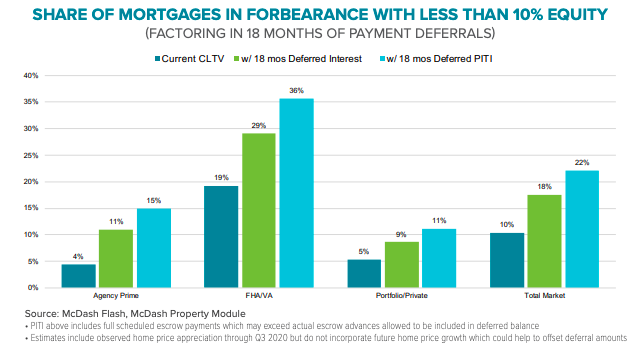

Equity has been held out as providing an exit ramp for distressed homeowners, something that didn't exist in such large numbers in the housing crisis. In the third quarter of 2020 the rapid growth of home prices meant that only 10 percent of forborne homeowners had less than 10 percent equity in their homes, typically, the Monitor says, the minimum amount necessary to be able to sell the home in a traditional manner to avoid foreclosure.

But, over 18 months of forbearance, the average homeowner would accrue $12,300 in unpaid interest and, for those who already have less than 10 percent equity, the total would be $14,900. In addition, there would also be an average of $9,000 in unpaid taxes and insurance premiums. This would push the share of borrowers with limited equity to 18 percent - higher (perhaps 29 percent) among FHA/VA borrowers who tend to have higher combined loan-to-value ratios.

These calculations do not factor in further home price growth. Borrowers also have the option of deferring payback until the home is sold, refinanced, or reaches maturity, which potentially allows lots of time for equity to grow.

Forbearance appears to have been a source of relief for many. Of 6.9 million homeowners who entered the program, 61 percent (4.2 million) have exited and 3.7 million of those are either back to performing on their loans or have paid them off. Of those who have exited but remain delinquent, 282,000 (4 percent) are in loss mitigation. That percentage was 7 percent three months ago, suggesting that servicers are working through that population. Another 171,000 borrowers (3 percent) are neither in mitigation nor forbearance, but 107,000 of those were delinquent prior to the pandemic.