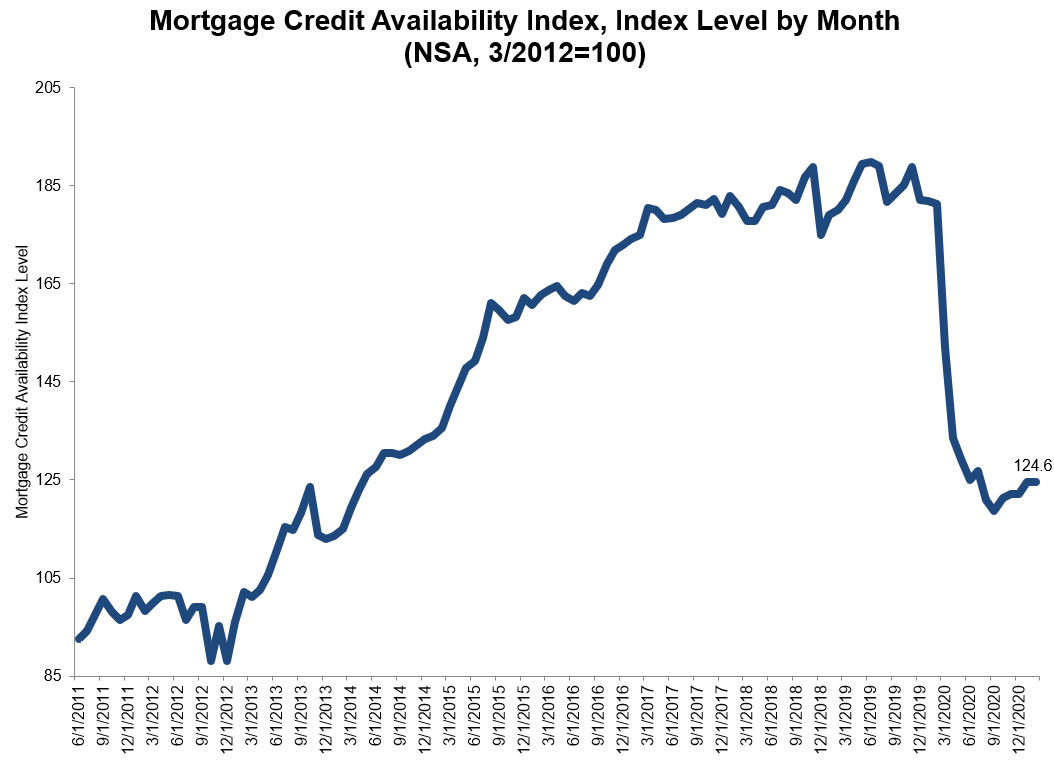

Access to mortgage credit remained unchanged in February after making modest gains over the previous four months. The Mortgage Bankers Association said its Mortgage Credit Access Index, was remained at the January level of 124.6. A lower score indicates a tightening of mortgage credit standards. The index was benchmarked to 100 in March 2012.

The MCAI had dropped from 181.3 in February 2020 down to 118.6 by September as the financial impacts of the pandemic became apparent and mortgage delinquencies rose. The index became to increase in October although the recovery has been both slow and uneven.

The Conventional MCAI decreased 0.3 percent, and the Government MCAI rose by 0.3 percent in February. Of the component indices of the Conventional MCAI, the Jumbo MCAI was up 0.2 percent, and the Conforming MCAI fell by 0.7 percent.

"Credit availability in February was unchanged from January, remaining close to its lowest level since 2014," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "The housing market is in strong shape heading into the spring, with robust growth in purchase applications, home sales, and new residential construction. Government credit supply has increased in five of the past six months, albeit in small increments, but remains tight by historical standards. This adds another obstacle for many aspiring first-time buyers who are already navigating supply and affordability constraints."

Added Kan, "Expected home sales growth this year is still likely to be driven by first-time buyers, spurred by millennials reaching peak first-time homebuyer age. Many of these potential buyers will likely utilize FHA and other low down payment loans to purchase a home."

The MCAI and each of its components are calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via a proprietary product from Ellie Mae. The resulting calculations are summary measures which indicate the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.