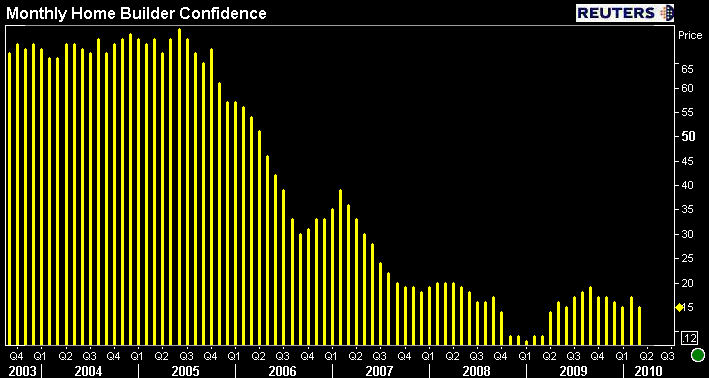

The National Association of Home Builders released their monthly Housing Market Index today.

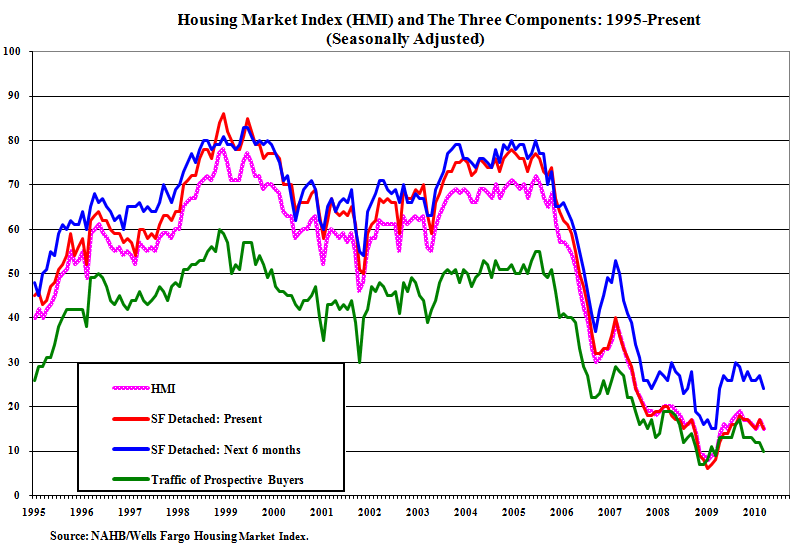

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

In March, Builder confidence lost the small amount of progress seen in February, falling two points to 15 where the index sat in January.

Here is a breakdown of the components:

- Current sales conditions declined two points to 15

- Sales expectations in the next six months declined

three points to 24

- Traffic of prospective buyers declined two points to 10.

Regionally, the HMI results were mixed in March. While the Northeast posted a five-point gain to 23 and the West posted a one-point gain to 15, the Midwest HMI slid three points to 10 and the South HMI edged down one point to 18.

The NAHB cites poor weather conditions and distressed property sales as reasons for the lack of buyer and builder confidence.

NAHB Chairman Bob Jones says:

“Unusually poor weather conditions certainly had a negative effect on builders’ business in February.....At the same time, the continual flow of distressed properties priced below the cost of production is having an adverse effect on new-home appraisals and also making it tough for builders’ customers to sell their existing homes.”

NAHB Chief Economist David Crowe says:

“The lack of available credit for new projects, the large number of distressed properties for sale and the continuing hesitancy of potential buyers due to the weak job market are definitely weighing on builder confidence at this time....That said, the inventory of new homes on the market is at an extremely low level, and we do expect a 25 percent improvement in new-home construction in 2010 over 2009 to rebuild inventory and meet expected pent-up demand.”