Most of the categories covered by the Mortgage Bankers Association's (MBA's) 1st quarter National Delinquency Survey are now back to pre-housing crisis levels. In the case of foreclosure starts, the results were the lowest since the second quarter of 2000.

The delinquency rate for mortgage loans on one-to-four unit residential properties were down 77 basis points (bps) from a year earlier to 4.77 percent of all loans outstanding. This was the lowest level since the third quarter of 2006 and unchanged from the fourth quarter of 2015.

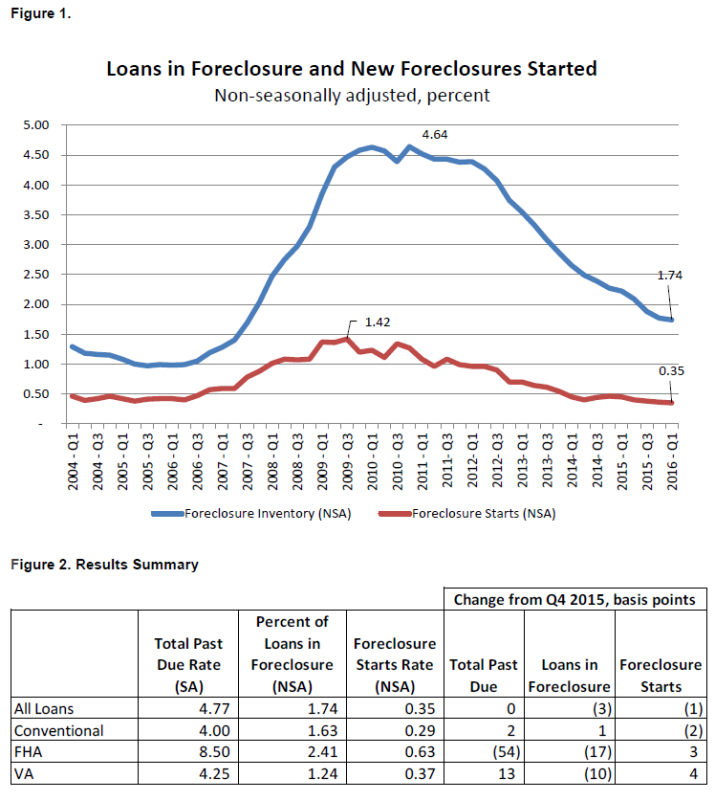

The delinquency rate includes loans that are one payment or more past due but not those that are in the process of foreclosure. That rate (frequently called the foreclosure inventory) was 1.74 percent for the quarter, down 3 bps from the previous quarter and 48 bps from the first quarter of 2015. It was the lowest foreclosure inventory rate seen since the third quarter of 2007.

The serious delinquency rate includes loans that are 90 or more days past due and/or in the process of foreclosure and that rate fell 15 bps from the previous quarter and 95 bps from a year earlier to 3.29 percent. That rate was also at the lowest point since the third quarter of 2007.

Foreclosures were started during the quarter on 0.35 percent of outstanding mortgages, a decline of 1bp from the previous quarter and 10 bps from a year earlier.

Marina Walsh, MBA's Vice President of Industry Analysis, said, "The delinquency rate of 4.77 percent has returned to typical pre-recession levels and is lower than the historical average of 5.4 percent for the time period from 1979 to the first quarter of 2016.

"The rate at which new foreclosures were initiated in the first quarter was 0.35 percent, the lowest in 16 years, and 10 basis points below the historical average of 0.45 percent. A total of 28 states and Washington, DC either saw decreases or no change in the foreclosure starts rate this quarter, while the remaining 22 states experienced increases in the foreclosure starts rate. Only two of these 22 states have strictly non-judicial processes in place.

"Continuing a consistent downward trend that began in the second quarter of 2012, the foreclosure inventory rate fell again in the first quarter of 2016 to 1.74 percent, a decrease of three basis points from the previous quarter. Of the 50 states and Washington, DC, 44 states either had no change or saw declines in the foreclosure inventory rate.

"While the overall foreclosure inventory rate for the first quarter was considerably lower than the peak of 4.64 percent at the worst of the crisis, it was still above the average of 1.5 percent for the time period between 1979 and the first quarter of 2016. The good news is that foreclosure inventory rates continued to decline in both judicial and non-judicial states this quarter. However, about two-thirds of the twenty states with foreclosure inventory rates above the national average were judicial states."

MBS said that beginning with the first quarter of 2016 it combined all non-government loans into a single conventional loan category resulting in three loan types, conventional, FHA, and VA. Conventional loans, which make up 78 percent of loans serviced, had a 4.00 percent past due rate during the quarter, FHA an 8.50 percent rate, and the VA 4.25 percent. The percent of loans in foreclosure was 1.63 for conventional loans, 2.41 for FHA, and 1.24 for VA.