American homeowners, even some of those most affected by the pandemic, seems to be edging back from anything resembling the foreclosure avalanche of 2007 to 2010. Black Knight, in its "first look" at April data, shows loan performance improving quickly, while in a second release, the company's weekly report on forbearance plans, we see that some of the improvement continues in fits and starts.

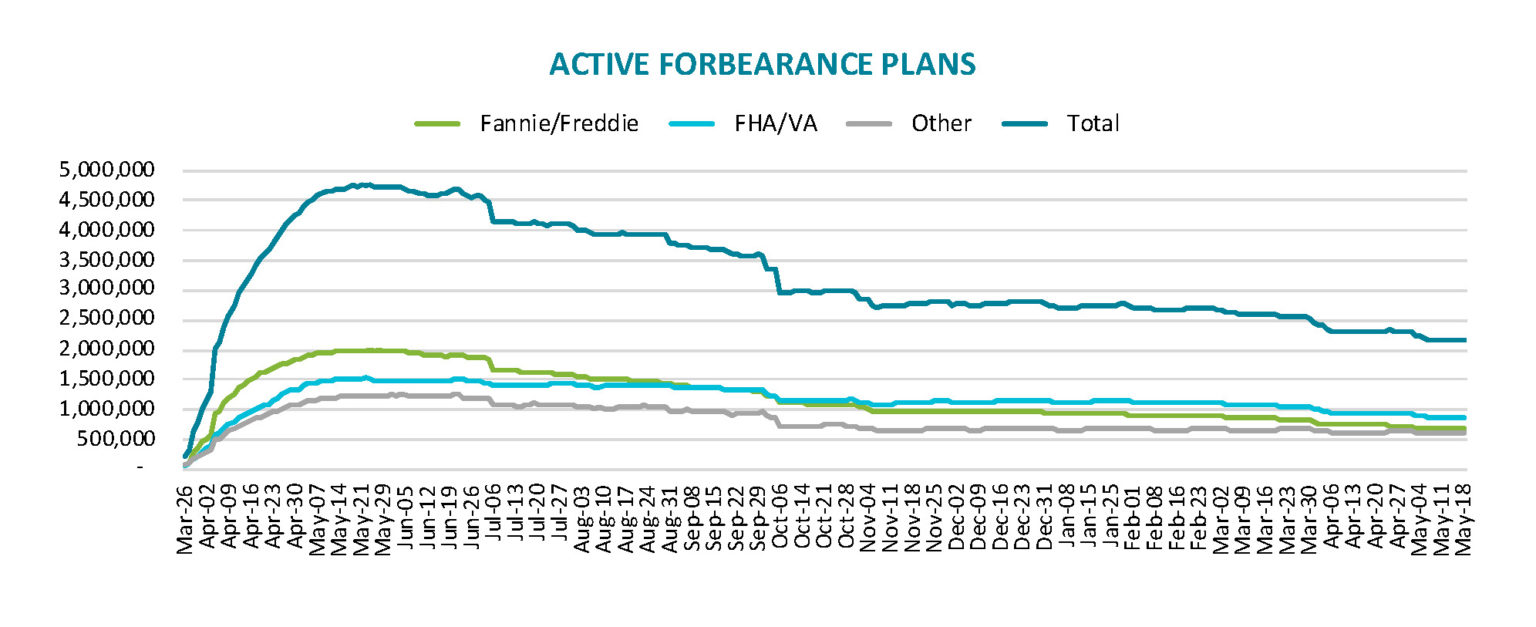

Forbearances rose during the week ended May 18, only the second increase in the last 12 weeks. The number of active plans grew by 16,000, driven by an increase in the number of former plan participants reentering the program. Black Knight said such reentries are common mid-month, especially given the recent large volume of plan removals.

The number of GSE loans in forbearance dipped by 1,000 loans, about 0.1 percent of the total, leaving 683,000 of those loans in the program. That decline was more than offset by increases of 4,000 in FHA and VA forbearances and 13,000 among loans serviced for bank portfolios and private label securities (PLS) investors. Active forbearances among those two loan types now stand at 885,000 and 611,000, respectively. As of May 18, 2.18 million loans, 4.1 percent of all mortgages being serviced, remain in COVID-19 related forbearance plans.

There are approximately 190,000 loans with expirations slated for May and another 830,000 for June. The latter will be the final quarterly review for early entries to the program before they reach their 18-month expirations in the fall.

The company also reports that the national delinquency rate declined by 7.11 percent in April to 4.66 percent. This is 27.88 percent below the rate in April 2020, when pandemic related business closures were nearing their peak. There were 2.5 million mortgages that were 30 or more days past due at the end of April, 172,000 fewer than in March and a decrease of 900,000 from a year earlier.

Black Knight points out that April marks the first time the delinquency rate has fallen below 5 percent since the pandemic hit. They estimate that, assuming the current rate of improvement continues, overall delinquencies should be back to pre-crisis levels by the end of the year.

The number of homeowners who were current on their mortgages in March but transitioned into being 30 days past due in April increased by 23 percent (the transition rate in March, however, was at record lows). At the same time, more than 400,000 past-due mortgages were brought current during the month.

The number of seriously delinquent loans (loans 90 or more days past due but not in foreclosure) declined by 151,000 during the month to 1.768 million, 1.3 million more than in April 2020. Black Knight points out that most of the seriously delinquent loans are in forbearance plans where lenders are offering several strategies for working out past due amounts when forbearance ends.

Foreclosure moratoria are still in place so both foreclosure starts and the foreclosure inventory are at record lows. Only 3,700 foreclosures were initiated during the month and the foreclosure inventory holds 153,00 loans, 58,000 fewer than a year earlier.

Mortgage prepayments were down 22.79 percent from the prior month although they remained nearly 11 percent higher than in April 2020. The monthly prepayment rate of 2.58 percent was the lowest level since May 2020 as a rise in interest rates dampened refinance activity.

Black Knight will provide more in depth data on April loan performance in its next Mortgage Monitor. It will be released on June 7.