CoreLogic says flipping is back. The term applies to the act of buying, renovating and/or repairing a house, then reselling it, all within a short timeframe. Investors who specialize in flipping are always out there, but when prices are rising, or appear about to, lots more people join in the game.

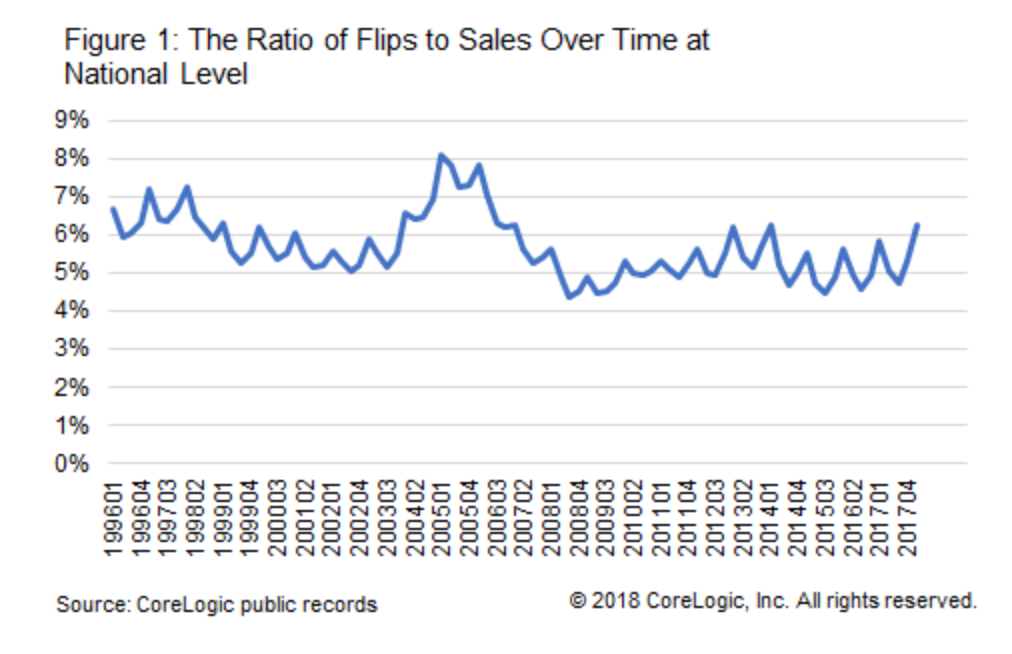

Bin He, writing in CoreLogic's Insights blog, looked at the current levels of flipping, using as the criteria a house that is bought then sold in under 12 months. He found that 6.2 percent of home sales in the first quarter appeared to be flips. This matches the previous post-crash high in the first quarter of 2013.

But, he points out, it was a different world back then. Prices were just beginning to rebound from their 2012 lows, the supply of homes was outstripping demand, and distressed sales had a 30 percent market share. That share had dwindled to 4.4 percent at the end of 2017, (and the National Association of Realtors reported on Thursday that only 3.5 percent of existing home sales in April fit the distressed category.) Inventories are notoriously tight, with many home selling after competitive bids. Prices? Well everyone knows what has happened there in the last five years.

CoreLogic puts the acquisition cost for a typical flipping candidate at about $170,000 in 2006. That cost bottomed out under $100,000 in the 2011-2012 period. Today it is back to $160,000. He says the high acquisition cost and tight inventories along with rising flipping activity can only mean investors are speculating, betting on continuous home price growth.

Is it just us, or is this story not only an old one, but a little disturbing?