The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending June 4, 2010.

The Mortgage Bankers Association application survey covers over 50% of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. In a low mortgage rate environment, a trend of increasing refinance applications implies consumers are seeking out a lower monthly payment which can increase disposable income and consumer spending (or give consumers a chance to pay down other debts like credit cards). A falling trend of purchase applications indicates a decline in home buying interest, a negative for the housing industry and the economy as a whole.

Excerpts Taken From The Release...

The Market Composite Index, a measure of mortgage loan application volume, decreased 12.2 percent on a seasonally adjusted basis from one week earlier. This week's results include an adjustment to account for the Memorial Day holiday. On an unadjusted basis, the Index decreased 21.1 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is

down 0.7 percent.

The Refinance Index decreased 14.3 percent from the previous week. The four week moving average is up 3.6 percent for the

Refinance Index. The refinance share of mortgage activity decreased to 72.2 percent of

total applications from 73.8 percent the previous week. This is the

first decline in the refinance share in five weeks.

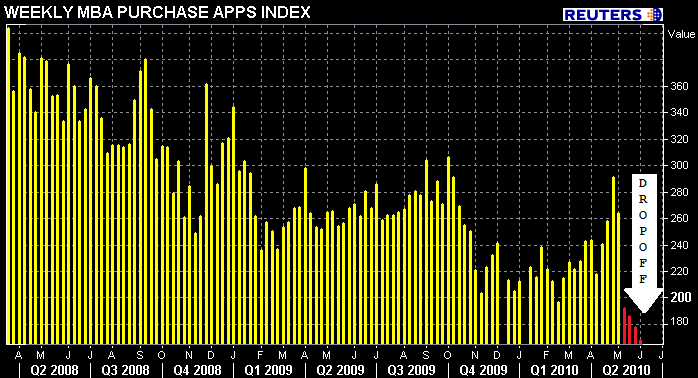

The seasonally adjusted Purchase Index decreased 5.7 percent from one week earlier. The unadjusted Purchase Index decreased 16.3 percent compared with the previous week and was 30.4 percent lower than Memorial Day week last year. The four week moving average is down 11.7 percent for the seasonally adjusted Purchase Index.

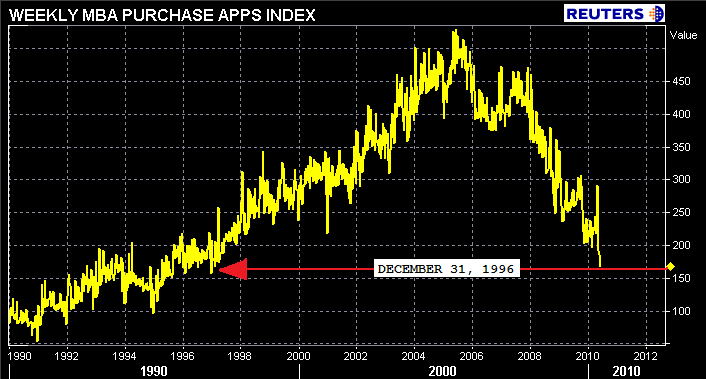

Here is a long term chart that puts the post-tax credit demand drop-off in perspective...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.81 percent from 4.83 percent, with points decreasing to 1.02 from 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 4.26 percent from 4.24 percent, with points decreasing to 0.95 from 1.11 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for one-year ARMs decreased to 6.94 percent from 6.96 percent, with points increasing to 0.30 from 0.27 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity decreased to 5.1

percent from 5.2 percent of total applications from the previous week,

which is the third consecutive weekly decrease.

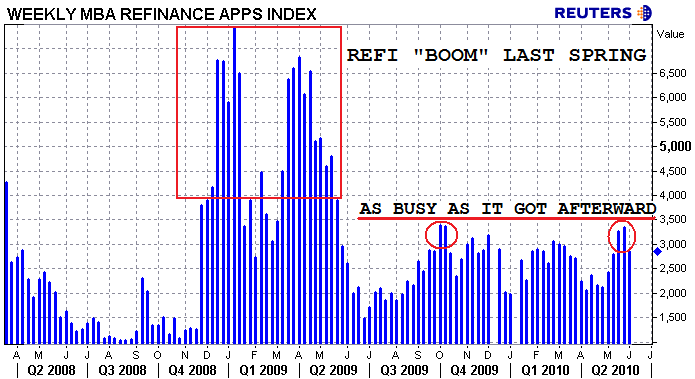

The chart below compares the MBA Refinance Index to the MBA average 30 year fixed mortgage rate. I overlaid the these two data points together to illustrate the "this is as good as it gets" relationship between refinance demand and mortgage rates. The Refi Index is currently at the same level today vs. Refi Index level when mortgage rates last fell to 4.81% in December 2009.

Michael Fratantoni, the MBA's Vice President of Research and Economics, sums up the mortgage lending environment perfectly...

"Purchase and refinance applications dropped this week, even after an adjustment for the Memorial Day holiday. Purchase applications are now 35 percent below their level of four weeks ago, as homebuyers have not yet returned to the market following the expiration of the homebuyer tax credit at the end of April...Although rates remained essentially flat, refinance applications dropped this past week for the first time in a month. Despite the historically low rates, many homeowners have already refinanced recently, remain underwater on their mortgages, have uncertain job situations, or have damaged credit following this downturn, and therefore may not qualify to refinance."

Plain and Simple: Housing is settling into a long, slow recovery process.

HOUSING: The Good, The Bad and The Ugly

THIS POST shares plenty of perspective on some of the issues hindering new loan production. There is an ongoing debate between industry professionals in the comments of that post, don't miss it.

There's a chance we see refinance applications rise in next week's release because mortgage rates have moved noticeably lower over the past four days, but I don't have high hopes. While the par 30 year fixed mortgage rate has indeed dropped a few bps, total consumer borrowing costs are about the same as they were last week. This implies borrowers with loans already in process at one lender will be less likely to jump ship and re-apply at another lender who is offering lower costs. If you are a consumer wondering why your total mortgage borrowing costs don't seem to be moving any lower: THIS POST explains why.