Fannie Mae's second quarter Mortgage Lender Sentiment Survey indicates that lenders are generally upbeat about the housing market. Respondents to the survey, which was conducted in May, said they had seen increased demand for GSE-eligible purchase mortgages over the preceding three months and expect that demand to continue over the upcoming quarter.

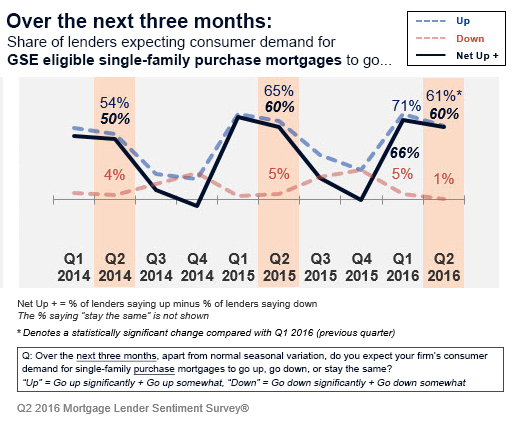

A net of 70 percent of the lenders participating in the survey reported an increased demand, about the same net as a year ago but a sharp rebound from the net of 20 percent in the first quarter survey. Looking forward, expectations for the next three months remain near where they were a year earlier with a net of 55 to 60 percent expecting increased demand depending on loan type.

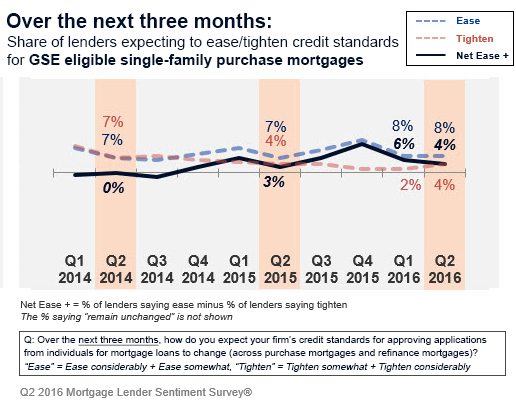

Lenders on net reported some easing of credit standards over the previous three months for all loan types but their expectations for further easing has ticked downward since the fourth quarter of 2015. Most lenders expect their credit standards to remain about the same, especially for GSE eligible loans.

"Key survey sentiment indicators suggest that lenders remain cautiously optimistic in their market outlook," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "The outlook for purchase demand growth over the next three months returned to levels similar to last year, while the outlook for refinance demand and profit margin improved moderately versus last year's levels. Additionally, the trend toward easing of credit standards appears to be tapering off, as the vast majority of lenders, around 90 percent, reported plans to keep their credit standards about the same. The survey was conducted before the recent May jobs report, and the weaker reported job gains might potentially temper this optimism."