In back-to-back blog posts in the National Association of Home Builder's (NAHB's) Eye on Housing Blog, Paul Emrath details both the extent of the current shortage of lumber facing homebuilders and its impact on home prices. Emrath says that shortages of framing lumber are now more widespread than at any time since NAHB began consistently tracking it in1994 and that a large majority of builders seeing lumber prices specifically affecting affordability.

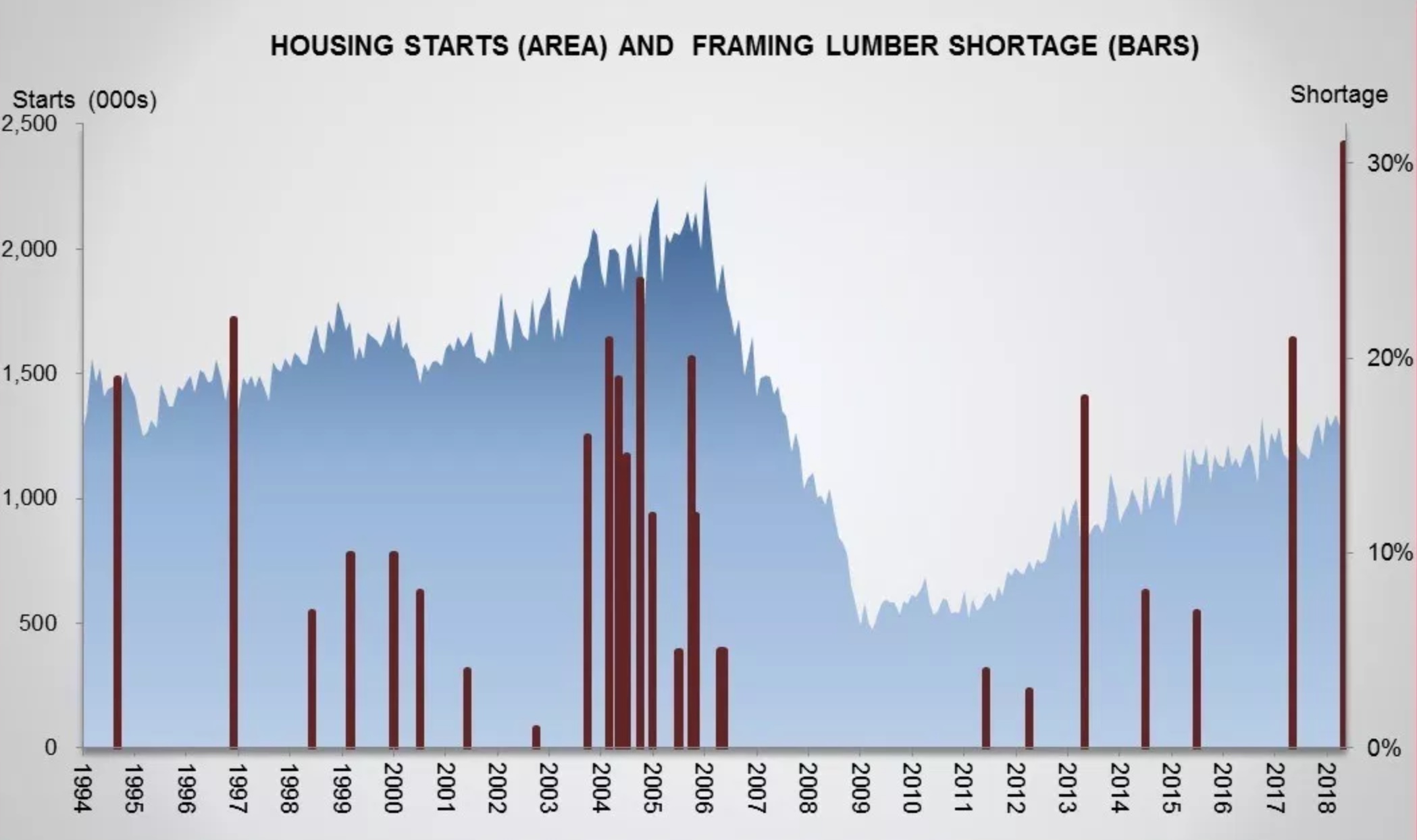

Emrath's conclusions grow out of results from special questions included in the April and May NAHB/Wells Fargo Housing Market Index surveys. Over 30 percent of single-family builders responding to the May survey's special questions reported a shortage of framing lumber, far more than reported shortages in any of the other 22 building products and materials listed. In second place were trusses, reported as scarce by 24 percent of respondents, lightweight steel and OSB at 20 percent each and plywood at 19 percent. In the last survey where these questions were included, 21 percent reported framing lumber shortages and no other products were cited by more than 15 percent of respondents.

Emrath said it is probably no coincidence that numbers one through five on the shortage list are made of either lumber or steel, both targeted with tariffs by the Trump Administration in the last year. The last time framing lumber was named by nearly as many builders as in short supply was in October 2004. Then 24 percent of builders expressed concern, but that was in the midst of a housing boom when starts were regularly exceeding 2 million units, compared to only about 1.3 million today.

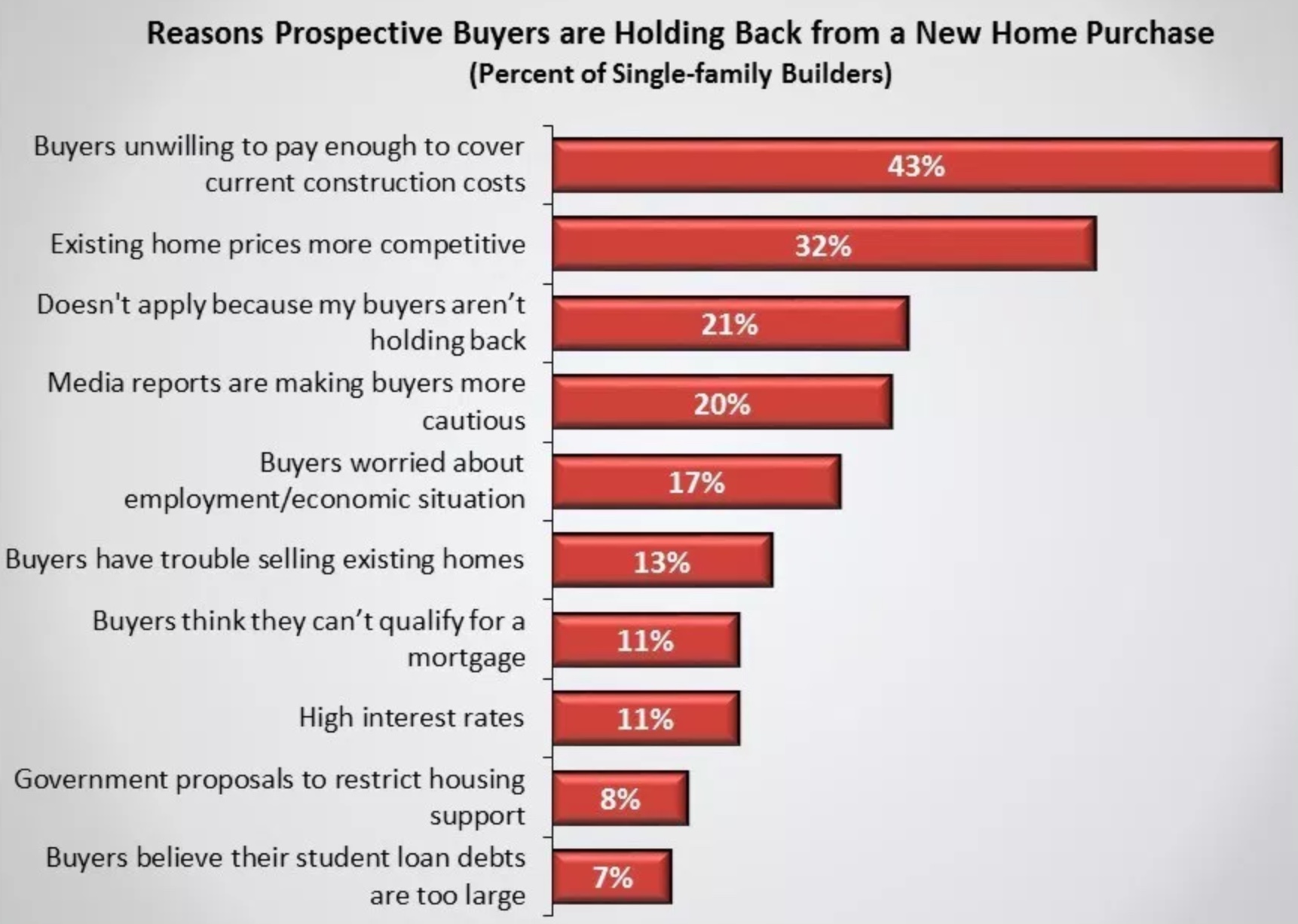

The April survey asked single-family builders if their prospective customers are holding back from buying a home, and if so, why? Twenty-one percent said the question didn't apply, they saw no buyer reluctance at the moment. But 43 percent said construction costs in general are dampening homebuying and over 90 percent of those respondents cited lumber prices specifically as an affordability issue.

The second reason customers may be holding back was that existing homes are more competitive. Student loan debt was cited by only a small number of builders despite how frequently it is mentioned by others in the housing industry. The top two reasons for buyers holding back as of April 2018 are related, of course, as rising construction costs are a key reason existing home prices are currently more competitive.

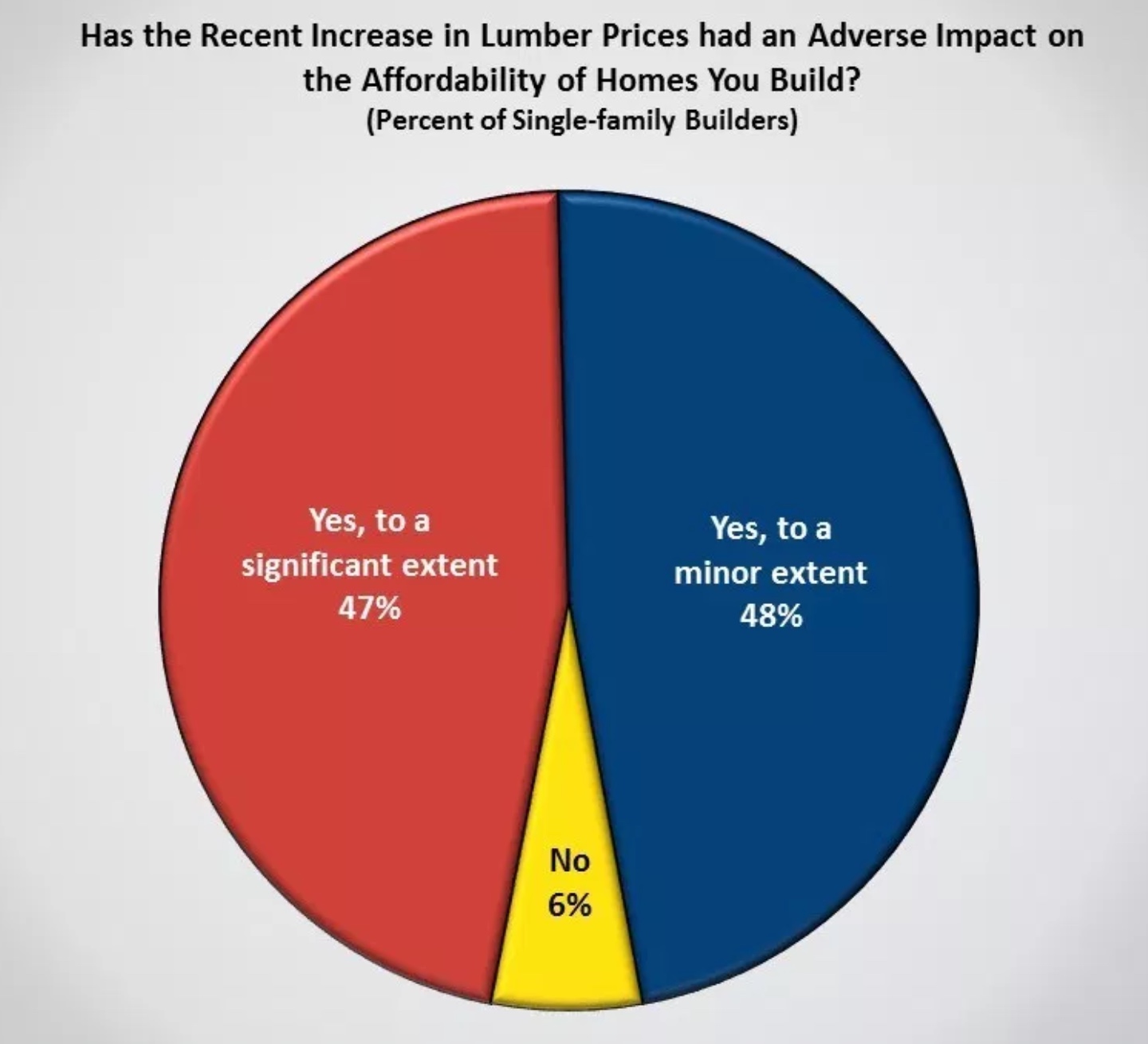

The increase in lumber prices is a key reason for rising construction costs over the last 18 months, but a shortage of labor and the costs of compliance with government regulations also play a part. Another question on the April HMI asked builders if the increased costs were having an adverse impact on the affordability of the homes they build and nearly all (95 percent) said yes with most citing lumber prices. The 95 percent was evenly split on whether the adverse impact was significant or minor.