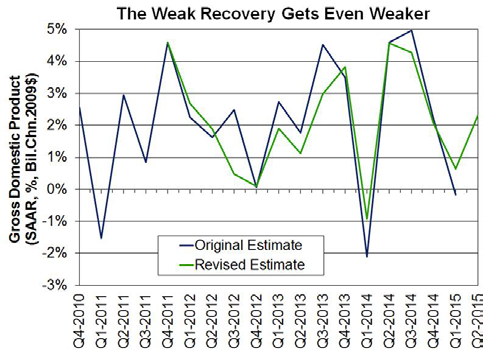

Fannie Mae's economic team said on Monday that the economic outlook for the second half of 2015 is less upbeat than anticipated. Second quarter economic growth came in lower than expected and a build-up in business inventories suggest that Fannie Mae's forecast for the third quarter was also too optimistic. Even though Q1 growth was improved by later revisions, the full-year 2015 growth outlook remains at 2.1 percent. Driving that growth will be consumer spending, housing and government spending.

The dollar will continue to weigh on manufacturing and trade and new declines in crude oil prices will create a headwind for the oil and gas sector. Interest rate volatility will probably pick up as the September Fed Open Market Committee (FOMC) meeting approaches and international uncertainties, although they have lessened, remain downside risks.

Fannie Mae's August forecast notes that it has been nine years since the Federal Reserve last raised the fed funds rate. After its last meeting in July the FOMC stated it was looking for "some further improvement" in the labor market before raising the target rate and Fannie Mae believes that the July jobs report offered sufficient evidence of improvement for the Fed to move. They expect the pace of any hike will be very gradual with only one 25-basis point increase this year. Meanwhile, underlying inflation, while remaining substantially below the Fed's target, has firmed from the soft readings earlier in the year. In June, the core PCE deflator rose at a 1.6 percent annualized rate over the last six months, compared with 0.8 percent at the start of the year. (It should be noted this report was written before the stock market took its worst plunge in four years on Friday and was continuing to decline on Monday.)

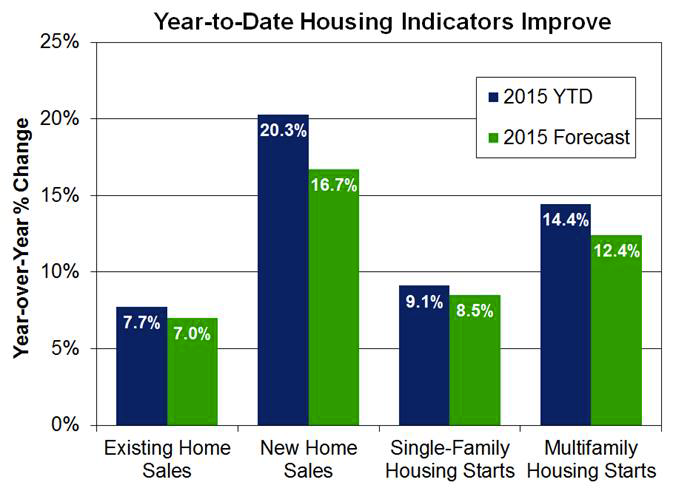

The forecast looks to housing to be a bigger contributor to growth this year. Activity was mixed in June but all indicators were higher in the first six months of the year than during the comparative period in 2014. Existing home sales in June were at the strongest pace since February 2007 and inventories remain tight while marketing time is the shortest in four years.

Both the National Association of Realtors (NAR) and CoreLogic said distressed home sales were at many-year lows. NAR put the June share at 8 percent, the lowest since it began keeping records in late 2008 while CoreLogic showed them accounting for 9.9 percent of total home sales in May, the lowest for that month since 2007.

In contrast to the strength in existing home sales, new home sales dropped sharply in June, and sales in the prior three months were revised down significantly while leading indicators suggest some weakness for overall sales. The NAR pending home sales index fell in June for the first time this year. While the purchase mortgage application index rose during the last week of July, it remains below recent highs reached in June and early July. The home sales outlook still outshines that of last year as both pending sales and purchase applications are higher than a year ago, the latter by 18 percent.

The sales figures along with lean inventories have supported continued price growth. CoreLogic's national home price index (not seasonally adjusted)-the measure used by the Fed to estimate the value of owner-occupied real estate-rose 1.7 percent in June, its sixth consecutive monthly gain and was up 6.5 percent year-over-year, the largest gain since June 2014. Prices are 7.4 percent below the peak reached in April 2006.

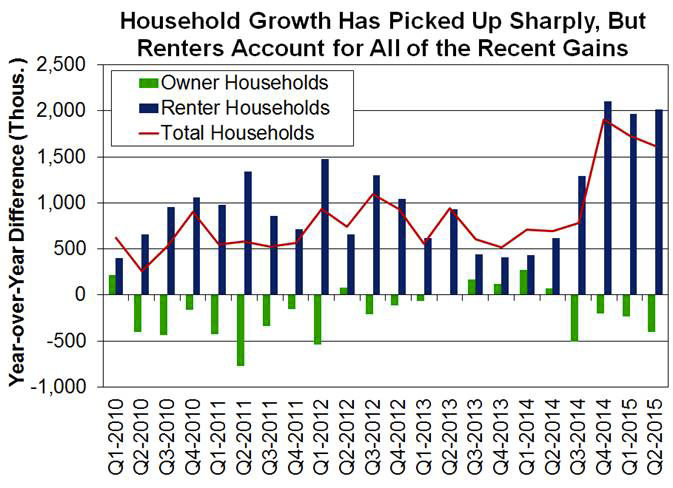

Household formation is finally improving - up by 1.6 million in the second quarter compared to a year earlier and the third consecutive quarter of strong annual growth. These new households however, are almost all renting and the rental vacancy rate is at 6.8 percent-the lowest rate since 1985. This is putting upward pressure on rents and providing a tailwind to new multifamily construction and residential investment. Meanwhile, the homeownership rate continued to trend down, falling 0.3 percentage points in the second quarter to 63.4 percent-the lowest level since 1967.

Fixed mortgage rates declined during the last week of July for the third consecutive week to 3.91 percent, marking the lowest level since early June. Fannie Mae expects mortgage rates to be largely unchanged for the rest of the year and then are likely to trend up gradually next year, averaging 4.3 percent during the final quarter of 2016. Gradual easing of credit and low rates should help support housing market recovery even as the Fed begins to hike rates.

The economists say that, given stronger data than expected for existing home sales coupled with disappointing data on single-family housing starts they have upgraded their forecast of existing home sales and downgraded projected single-family starts and new home sales. Total housing starts are expected to increase about 10 percent and total home sales to rise nearly 8.0 percent in 2015. They also marked down their projected purchase and refinance originations. They expect total mortgage originations to increase approximately 20 percent to $1.42 trillion, compared with a 24 percent gain in the prior forecast, with the refinance share remaining at 47 percent.