While it reported that most delinquency figures dropped substantially in the second quarter, the Mortgage Bankers Association's National Delinquency Survey also carried some dishearting harbingers of what might lie ahead.

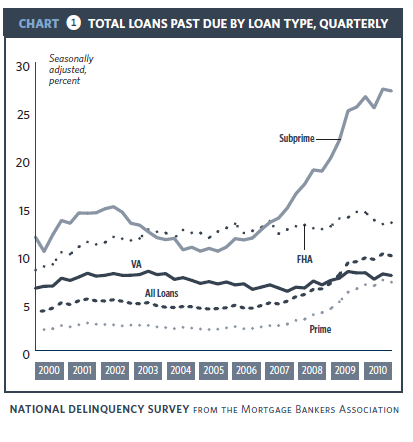

The report showed the seasonally adjusted delinquency rate for all loans at 9.85 percent, a drop of 21 basis points from the first quarter but 61 basis points higher than it was during the second quarter of 2009.

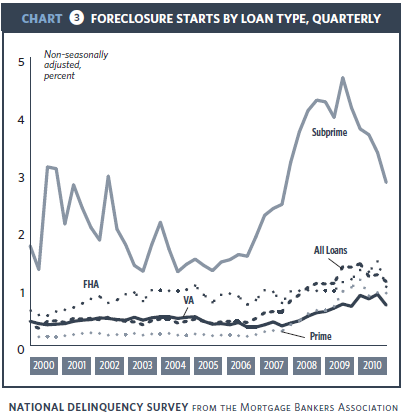

Delinquency rate figures include all loans that are at least one payment past due, but do not include loans in the process of foreclosure. When those are added into the total the delinquency rate rises to 13.97 percent compared to 14.01 in the first quarter. Foreclosure actions were started on 1.11 percent of loans, down from 1.23 percent in the first quarter and 1.35 percent in the second quarter of 2009.

Nationally, 9.11 percent of loans were seriously delinquent (90 days or more past due or in foreclosure) during the second quarter. This is a decrease of 43 basis points from Q1, however, one year earlier the rate was 7.97 percent. 60-day delinquencies also declined slightly, from 1.59 percent to 1.52 percent. One year ago that bucket held 1.68 percent of all loans.

The states with the highest overall delinquency rates were Mississippi (13.66 percent), Nevada (13.23 percent), and Georgia (12.39 percent.) Florida, Nevada, and New Jersey had the highest foreclosure inventory, while Nevada, Florida, and Arizona had the highest percentage of foreclosure starts. 11 states saw increases in the rate of foreclosure starts on a year over year basis, with the largest increases coming in Illinois, South Dakota, and New Mexico. The largest decreases were in California, Florida, and Nevada.

Across all loan types the delinquency rate currently stands at 7.10 percent for prime loans, down from 7.32 percent last quarter but up 69 basis points from Q2 2009; 17.02 percent for subprime loans (27.21 percent in Q1 and 25.35 percent one year ago); FHA, 13.29 percent (13.15 and 14.42) and VA, 7.79 (7.96 and 8.06)

The Bad News: 30-Day Delinquencies are Up

The 30-day delinquency rate for all loans increased from 3.45 percent to 3.51 percent quarter-over-quarter. After falling for the last three quarters of 2009, 30-day deliquencies have risen in the first two quarters of 2010. An uptick in early stage delinquencies was recorded by three loan types: prime adjustable rate mortgages (ARMs), subprime fixed-rate mortgages (FRMs), and FHA FRMs, all of which increased at least six basis points while the rate decreased in every other category.

Jay Brinkmann, MBA's chief economist said, "The disappointing news is that, after declining since the beginning of 2009, the rate of short-term delinquencies is going up and the increase in these short-term delinquencies may ultimately drive the foreclosure measures back up"

Brinkmann cited two causes behind the short-term delinquencies; this metric is very closely tied to first-time claims for unemployment insurance, a number which fell through most of 2009 but leveled off early this year and has started to rise again. This increase in unemployment directly impacts mortgage delinquencies. Second, some percentage of the loans modified over the last several years have become delinquent again because those borrowers, by definition, have weak credit.

Because it is difficult to interpret the seasonal effects influencing this data, the MBA says it is important to call attention to non-adjusted and year over year changes...

The non-seasonally adjusted delinquency rate increased 71 basis points for prime fixed loans, 149 basis points for prime ARM loans, 141 basis points for subprime fixed loans, and 197 basis points for subprime ARM loans from the second quarter of 2009. The delinquency rate was 107 basis points lower for FHA loans and 29 basis points lower for VA loans relative to the same quarter a year ago.

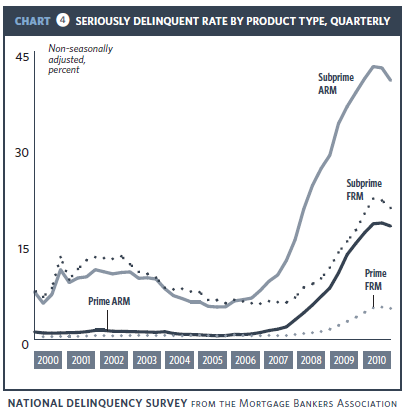

Compared with last quarter, the non-seasonally adjusted seriously delinquent rate decreased for all loan types. The rate decreased 30 basis points for prime loans (from 7.08 percent to 6.78 percent), 189 basis points for subprime loans (from 30.21 percent to 28.32 percent), 65 basis points for FHA loans (from 9.10 percent to 8.45 percent) and 26 basis points for VA loans (from 5.29 percent to 5.03 percent).

On a year-over-year basis, the seriously delinquent rate increased 134 basis points for prime loans, 180 basis points for subprime loans, 67 basis points for FHA loans and 34 basis points for VA loans.

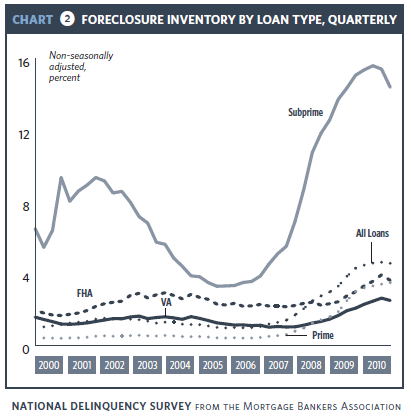

During the second quarter of 2010, the foreclosure inventory rate increased eight basis points for prime loans (from 3.41 percent to 3.49 percent) and decreased 101 basis points for subprime loans (from 15.39 percent to 14.38). FHA loans saw a 31 basis point decrease in foreclosure inventory rate (from 3.93 percent to 3.62 percent), while the foreclosure inventory rate for VA loans decreased 13 basis points (from 2.63 percent to 2.50 percent).

The non-seasonally adjusted foreclosure starts rate increased four basis points for prime fixed loans and two basis points for VA loans from a year ago. Foreclosure starts rate decreased 78 basis points for prime ARM loans, 53 basis points for subprime fixed loans, 213 basis points for subprime ARM loans, and 13 basis points for FHA loans on a year over year basis.

Brinkman says, "These latest delinquency numbers contain a mixture of somewhat good news and somewhat bad news. The good news is that foreclosure starts are down and the inventory of homes anywhere in the process of foreclosure fell for the first time since 2006 and had the largest drop since 2005. Loans 90 days or more past due, the largest share of delinquent loans, also fell. The fact that both the 90+ delinquency rate fell and the foreclosure start rate fell means that a significant number of these seriously delinquent loans have been successfully modified and reclassified as performing, current loans"

"Ultimately the housing story, whether it is delinquencies, homes sales or housing starts, is an employment story," Brinkmann said. "Only when we see a consistent increase in employment will we see an increase in sales and starts, and a sustained improvement in the delinquency numbers. Until we see the increase in the number of households that comes with an increase in the number of paychecks, all measures of the health of the housing industry will continue to be weak."