The Urban Institute (UI) estimates that there are about 400,000 homeowners who have become "needlessly delinquent" as a result of the COVID-19 pandemic. UI analysts Michael Neal and Linda Goodman credit the Coronavirus Aid, Relief, and Economic Security (CARES) Act with providing "a much-needed lifeline" during the crisis, but conclude that there needs to be a broader approach.

The CARES Act allows borrowers to defer mortgage payments for six months with the possibility to extend that period for another six months. Homeowners need only to attest to having a pandemic-related financial hardship. The Mortgage Bankers Association (MBA), which has tracked forbearance plans on a weekly basis, reported that as of September 28, 6.87 percent of mortgage borrowers are in forbearance, including 4.46 percent of borrowers with Fannie Mae and Freddie Mac mortgages and 9.15 percent of borrowers with Ginnie Mae (VA/FHA) mortgages. About a quarter of these borrowers have continued to make mortgage payments, apparently entering forbearance as an insurance policy, but many eligible borrowers have not taken advantage of the benefit and have fallen behind on their payments.

Goodman and Neal say these estimated 400,000 homeowners may not know they are eligible for forbearance or do know but wrongly fear having to make "double payments" when the forbearance period ends. The analysts developed a methodology using delinquency rates for Ginnie Mae mortgages for March and July that allowed them to determine whether loans current in March were delinquent in July and whether they were in forbearance at that point.

That data provides information on more than 200,000 Ginnie Mae borrowers who were current in March but were at least 30 days delinquent by July. There was not equivalent data for GSE (Fannie Mae and Freddie Mac) loans, but almost half of needlessly delinquent borrowers are in the Ginnie Mae sample. The authors found four key characteristics of these borrowers.

- There is no difference in borrowers' creditworthiness. The credit scores of the needlessly delinquent group and the 559,506 delinquent borrowers in forbearance were between 662 and 664.

- There is little difference attributable to types of servicing. The shares of needlessly delinquent loans serviced by banks and nonbanks were around 2 percent, with banks slightly higher and nonbanks slightly lower. In contrast, banks have a lower share of delinquent loans in forbearance than their nonbank counterparts (6.2 percent versus 3.2 percent) with some of the difference due to the dataset used. Servicers are permitted to buy delinquent loans out of a security when the loan becomes 90 days delinquent. Bank servicers find this practice beneficial, as they have the cash to do the payout, and their cost of funds is lower than the rate on the mortgage. Nonbank servicers often do not have the cash, and their cost of funds is higher than the rate on the mortgage, making a buyout less economic.

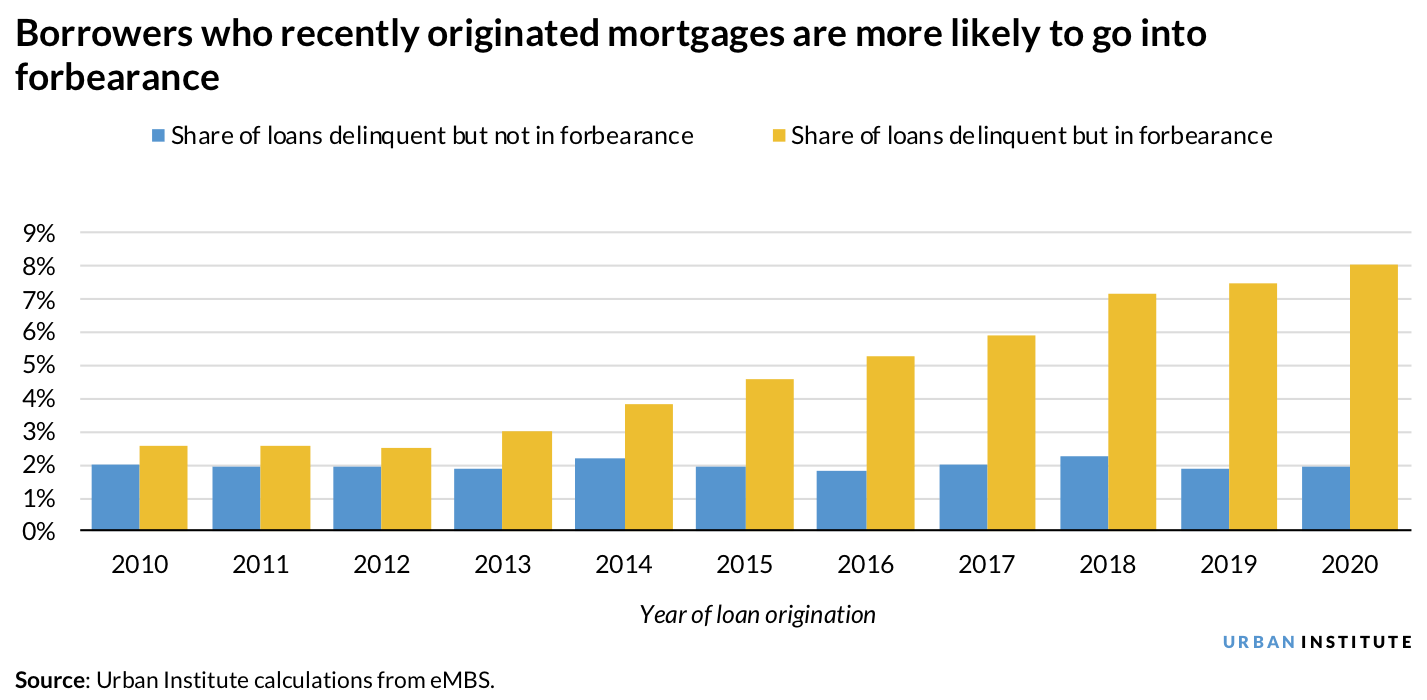

- Loan vintage was not a factor for needless delinquency. The share of those loans remains constant at around 2 percent, regardless of the year of origination. In contrast, the share of delinquent borrowers taking advantage of forbearance increases with more recent mortgages.

Needlessly delinquent loans have no strong geographic concentration. They are constant across states at about 2 percent. However, the rate for delinquent loans in forbearance varies widely, from a low of 2.86 percent in Montana and Arkansas to high of 8.86 percent in New Jersey.

The authors admit they had hoped to find a concentration of needlessly delinquent borrowers among certain servicers, in specific geographic areas or vintage years. This would make outreach easier. Instead they found about 2 percent of Ginnie Mae borrowers fell into the "needless" category across all variables, suggesting that any outreach campaign must be broad. "Servicers are an important part of this outreach, but outreach efforts must also include assistance from consumer groups. Although some government messaging around forbearance options as an alternative has occurred, broader outreach may be in order."