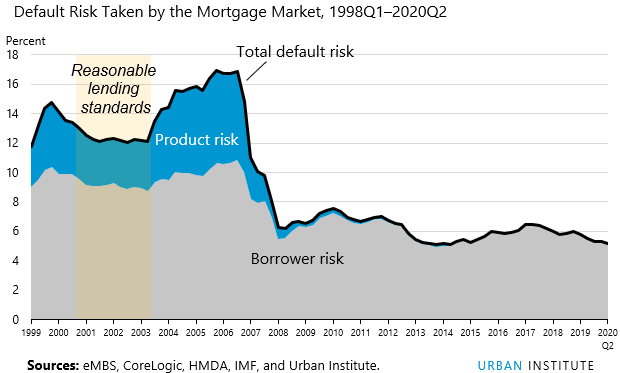

The Urban Institute's (UI's) Housing Finance Policy Center has updated its credit availability index (HCAI) to reflect data for the second quarter of 2020. The Index shows a slight dip from an adjusted 5.3 percent in the first quarter to 5.2 percent in the second quarter. Tightening in the GSE and government channels has driven a retraction of credit availability through the first half of 2020, as the risk in the portfolio and private-label securitization market remains a shadow of what it once was.

The HCAI measures the percentage of owner-occupied home purchase loans that are likely to default-that is, go unpaid for more than 90 days past their due date. When the HCAI declines it indicates the lenders have a greater unwillingness to tolerate defaults and they are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates a higher tolerance for defaults and that lenders are taking more risks, making it easier to get a loan.

The agency market began to tighten at the end of Q1 2020 due to the COVID-19 crisis. This continued into Q2. Credit overlays have cut mortgage availability for borrowers with less than perfect credit while portfolio and private label lending have backed away from purchase originations and their market share has contracted significantly.

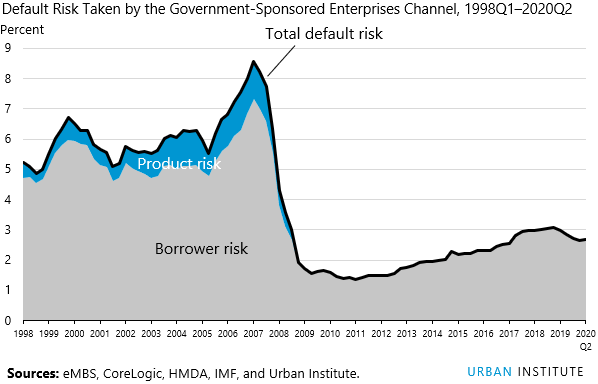

Access to GSE loans, those guaranteed by Fannie Mae and Freddie Mac, began to grow in the third quarter of 2011 as the financial crisis ebbed. From there, the total risk taken by that channel more than doubled, from 1.4 to 3.1 percent by the first quarter of 2019. This was still modest by pre-crisis standards. It then slipped back for over a year, falling to 2.7 percent in the first quarter of this year and remaining there in Q2.

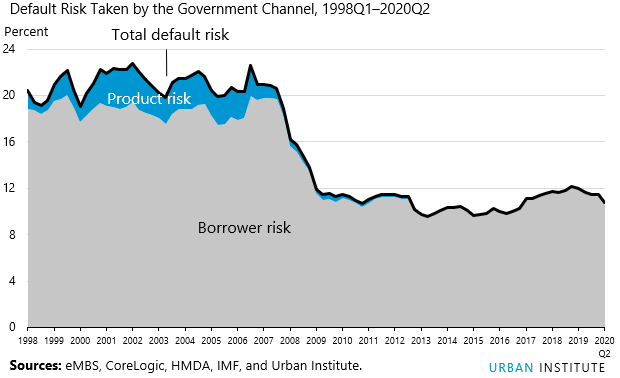

The total default risk the government loan (FVR) channel is willing to take bottomed out at 9.6 percent in Q3 2013 and fluctuated in a narrow range above that number for three years. The channel, which includes loans from FHA, VA, and the USDA, also peaked in Q1 2019, reaching 12.2 percent for the first time since 2009. In Q2 2020, the risk receded to 10.8 percent, moving closer to 2016 levels but still far below the pre-bubble level of 19 - 22.8 percent.

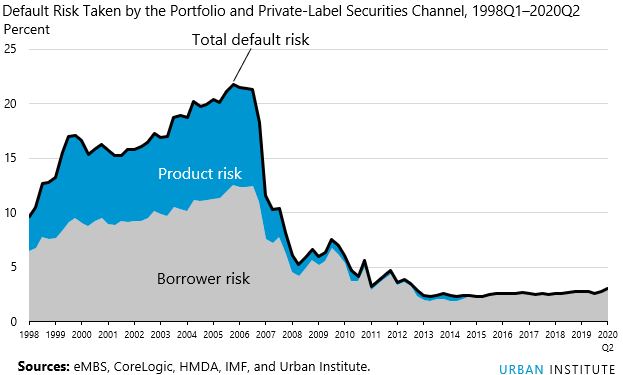

The portfolio and private-label securities (PP) channel took on more product risk than the FVR and GSE channels during the bubble but then both product and borrower risks dropped sharply. The numbers have stabilized since 2013, with product risk well below 0.5 percent and total risk largely in the range of 2.3-3.0 percent; it was 3.0 percent in Q2 2020. However, the PP market share plummeted during the COVID-19 crisis, as borrowers increasingly used government or GSE channels or could not obtain a mortgage at all.

UI says there is significant remaining space to safely expand the credit box. Even if the current default risk were doubled across all channels, it would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.