With both interest rates and home prices rising it is nearly impossible to find a housing forecast that doesn't include the word "cooling." The November outlook from Freddie Mac is no exception. The company's Economic and Housing Group, in fact, applies that word to the entire issue of economic growth, noting the waning effects of fiscal stimulus and ongoing Federal Reserve tightening of monetary policy. Housing is just the icing, as it were, on the topic.

They do offer a positive caveat, if there is such a thing. While the recent negative trends in sales could persist, they believe the market along with the economy will adjust to the shock of higher mortgage rates and resume modest growth.

The third quarter GDP came in stronger than expected at 3.5 percent, down 0.7 percent from the previous quarter, due in part to a 4 percent increase in consumer spending and a 3.3 percent increase in government spending. The economists expect growth to slow, averaging 3 percent this year, 2.4 percent in 2019 and 1.8 percent the year after. The midterm elections had little effect on their outlook; with split-party control they see little likelihood of major changes to federal spending - thus a boost in growth next year and a drag on it thereafter.

The labor market continues to be a strong point. The unemployment rate held at a multi-decade low of 3.7 percent in October. Initial jobless claims also remained at record-lows, falling nearly 0.5 percent to 214,000 in the first week of November. The 4-week moving average for continuing jobless claims hit another 45-year low, falling 0.5 percent to 1.63 million in late October. Still, wage growth remains modest, up only 0.2 percent in October, although a stronger 3.1 percent year-over-year. Freddie Mac expects unemployment to average 3.9 percent this year, 3.6 percent in 2019, then increasing to a more sustainable long-term rate of 4 percent in 2020.

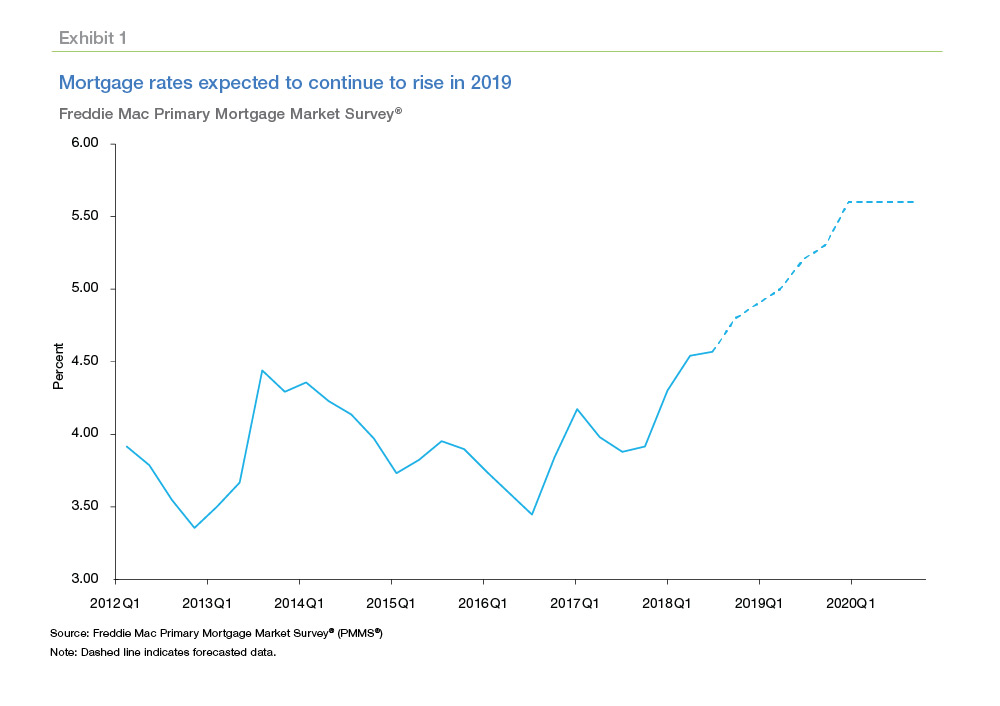

Mortgage rates will continue to edge higher from the most recent weekly reading of 4.94 percent, a high not seen since early 2011, as Treasury yields continue to rise. The average 30-year fixed rate will be 4.6 percent this year, 5.1 percent next year, and 5.6 percent in 2020. "A moderation in the rate of increase in mortgage rates may be just enough to let the housing market catch its breath and resume growth," the forecast says.

A pause here to note the accuracy of at least one Freddie Mac prediction. The 30-year fixed rate this year, 4.6 percent, is only 0.1 point higher than what was forecast by the company back in December 2016.

Almost all housing trends have turned negative in recent months. Housing starts dropped 5.3 percent to 1.2 million in September, although partially because of natural disasters. As a result, Freddie Mac has revised its 2018 forecast by 30,000 starts to 1.26 million and the 2019 estimate down 50,000 units to 1.30. By 2020, housing starts are forecasted to climb to 1.4 million units.

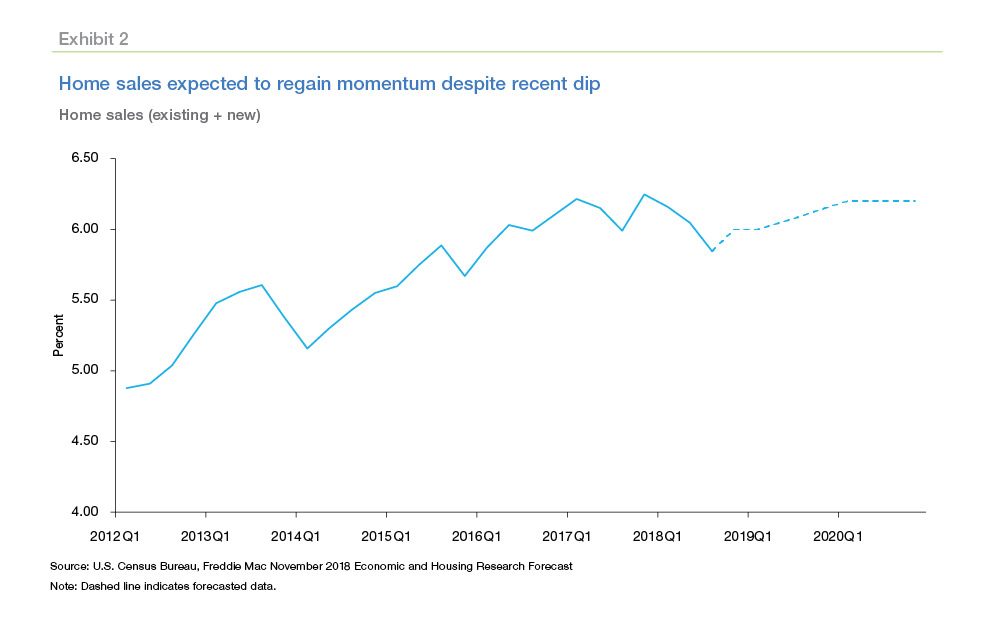

Total home sales were also down, falling 3.3 percent to 5.85 million in the third quarter. Existing single-family home sales retreated by 3.4 percent to 5.15 million in September, the lowest rate since 2015. New home sales also fell 5.5 percent to 553,000 in September, and both August and July sales were revised down 6.9 percent and 0.8 percent, respectively. The inventory of new homes is up 16.8 percent since this time last year. Freddie Mac takes this as an indication that "new home buyers may have been exhausted by the relentless march higher of home prices."

But if new home sales are to resume growth in 2019 it may require that builders shift focus to smaller and more modestly priced homes to offset affordability concerns. This will be a significant challenge given current cost pressures. Builders are responding with modest expansion of modular and other non-site building solutions.

Total home sales are expected to be down by 1.6 percent from 2017 to 6.02 million this year then slowly regain momentum, increasing 1 percent to 6.08 million in 2019 and 2 percent to 6.20 million in 2020. The growth in home sales will be entirely driven by a modest expansion in new home sales, while existing home sales will likely remain in a range close to their current level.

Price growth appears to be moderating; the Freddie Mac House Price Index remained flat at 0.9 percent in the third quarter of 2018. The expectation is for a 5.1 percent growth rate in 2018, slowing to 4.3 percent and 2.9 percent in 2019 and 2020, respectively.

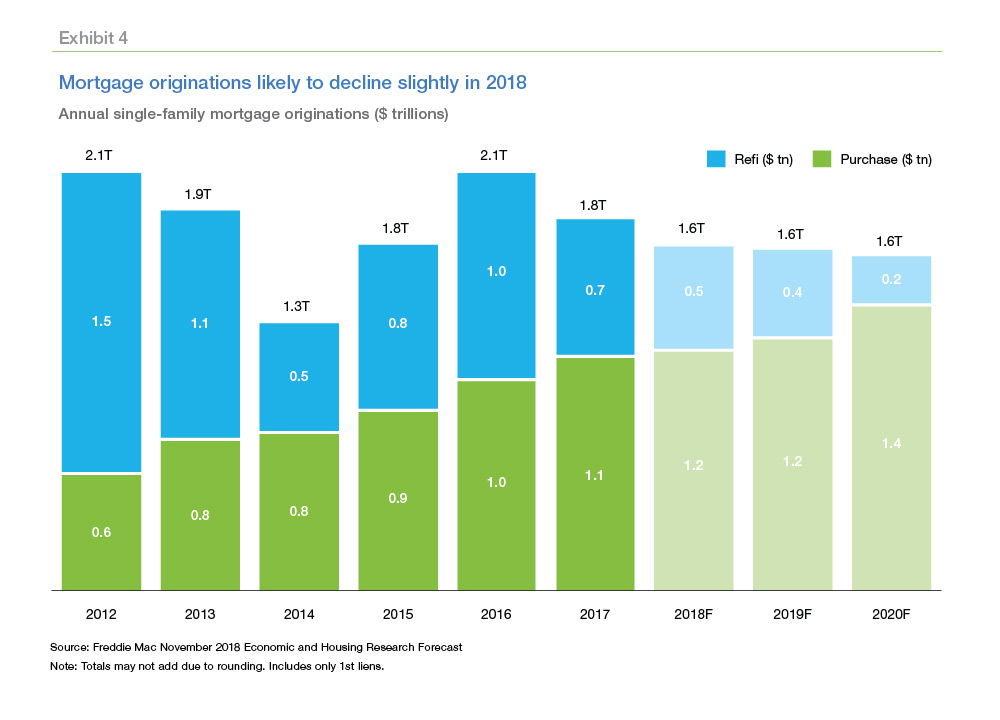

All of this, of course, leads to a downwardly revised forecast for mortgage originations. Freddie Mac expects them to decline 9.9 percent year-over-year to $1.63 trillion in 2018, falling slightly to $1.62 trillion in 2019 and dropping once more to $1.60 trillion in 2020. With mortgage rates holding near 7-year highs, refinance originations will likely take a hit, with the refinance share of originations falling to 29 percent in 2018, 25 percent in 2019, and 15 percent in 2020.