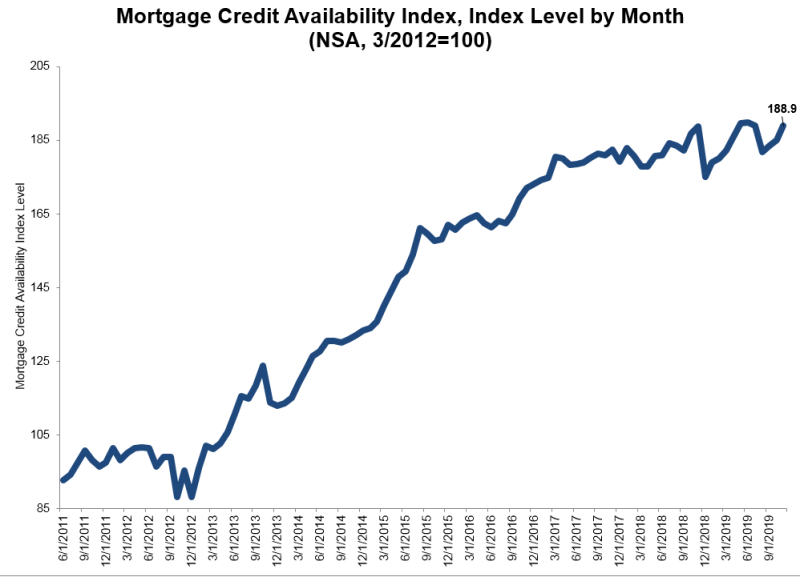

The Mortgage Bankers Association's (MBA's) Mortgage Credit Availability Index (MCAI) moved significantly higher in November, gaining 2.1 percent compared to October. The index measures borrower access to mortgage credit and has components for each of the major product types. A higher index number indicates that access is improving. The Index level for the month was 188.9.

The Government MCAI increased by 2.9 percent and the Conventional MCAI moved 1.4 percent higher. The two components of the Conventional MCAI, the Jumbo MCAI and the Conforming MCAI rose 2.2 percent and 0.2 percent respectively.

"Credit availability rose for the third straight month in November, with an

increase in supply across all loan types," said Joel Kan, MBA's Associate Vice

President of Economic and Industry Forecasting. "Most notably, the jumbo index

climbed to yet another record high, as investors increased their willingness to

purchase loans with lower credit scores and higher LTV ratios. Additionally,

the government index saw its first increase in nine months, driven by

streamline refinance programs.

Added Kan, "Expanding credit availability will continue to support active

levels in mortgage lending, even as refinance activity starts to level off."

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) gathered from over 95 lenders and investors. These are combined with data from Ellie Mae's AllRegs proprietary product to calculate a summary measure indicating the availability of mortgage credit at a point in time

The MCAI and its components were benchmarked in March 2012 and are designed to show relative credit risk/availability for their respective indices. The Conforming, and Jumbo sub-indices were indexed at 100 while the Conventional and Government indices were indexed at 73.5 and 183.5 respectively to better represent where each index might have been relative to 100.