Good Morning All.

We had what I hope was an enlightening conversation yesterday afternoon about the status of loan pipelines and the recent improvement in loan pricing. The feedback provided indicates "fall out" is under control for a variety of reasons...but I want to focus on one specific relationship between mortgage rates and rate sheet rebate.

One thing I am noticing, even though loan pricing has greatly improved over the last four sessions, total consumer borrowing costs haven't really moved lower. Most deals are still getting done at 4.75-5.00 rates depending on loan characteristics.

WHY?

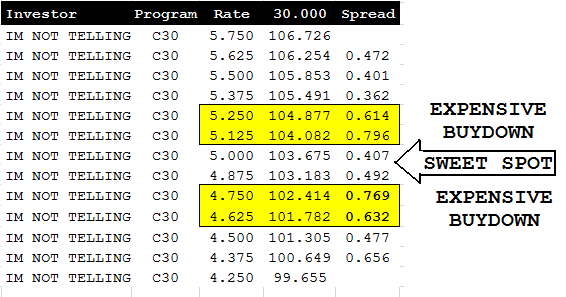

Take a look at your rate sheets. As rates fall below 4.875%, the spread between note rates gets larger and larger. Permanently "buying down the rate" is EXPENSIVE. The pricing grid below is an example. This is what one lender was offering yesterday on C30 product.

To quantify "expensive" I ran a breakeven analysis on a $200,000 loan.

P&I @ 4.875% = $1,058.42

P&I @ 4.75% = $ 1,043.29

MONTHLY PAYMENT DIFFERENCE: $15.13

COST TO BUYDOWN RATE FROM 4.875% TO 4.75%: 0.769% of $200,000 = $1,538

MONTHS TO RECOVER UPFRONT DISCOUNT FEE: 101.65 or 8.5 years

Let's see how expensive it is to buy down your rate to 4.625%...

P&I @ 4.750% = $1,043.29

P&I @ 4.625% = $ 1,028.28

MONTHLY PAYMENT DIFFERENCE: $15.01

COST TO BUYDOWN RATE FROM 4.750% TO 4.625%: 0.632% of $200,000 = $1,264

MONTHS TO RECOVER UPFRONT DISCOUNT FEE: 84.2 or 7.0 years

Borrowers should consider front loading this cost if they plan to stay in their home for longer than the time it takes to recover the upfront fee they paid to buydown their note rate.

Plain and Simple: Expensive buydown schedules combined with ongoing processing/qualifying/valuation/disclosure issues are keeping pull-through relatively stable (credit and collateral are biggest reasons for fallout). On a total loan cost basis, the borrower's position isn't deep enough in the money to warrant "jumping ship" on their current commitment.

The only way I see total mortgage borrowing costs moving lower (rates + plus points) is if lenders are able to offer 101.750 rebate (101.500 after juice) on a 4.500% note. That leaves 25bps in margin for secondary and allows a loan officer to offer a no points deal after LLPAs. If this never happens and mortgage rates/points breakeven hover near current levels...I think an L.O's best sales strategy (when selling rate) is to cover some of the borrowers closing costs.

Savy?

The Euro has rallied above 1.20US$, S&Ps are +6.50 at 1065.50, the 10yr TSY note is -0-08 at 102-12 yielding 3.219% (+2.9bps) and rate sheet influential MBS prices are lower.

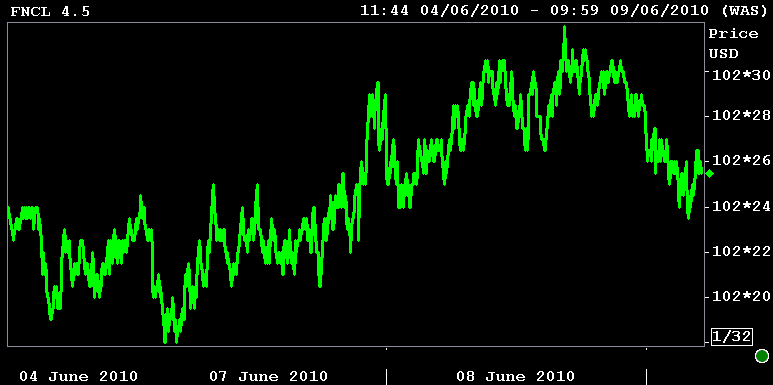

The FN 4.0 is -0-06 at 100-00. The FN 4.5 is -0-02 at 102-26. The secondary market current coupon is 1.7bps higher at 4.011%. CC yield spreads are tighter vs. benchmarks but off the tights of the session. Here are my marks: +79.1bps/10yTSY. +69.3BPS/10yIRS. Again the street probably has CC yield spreads tighter, but I haven't been increasing my prepay speed assumptions as rates have rallied so my scorecard is a little less aggressive.

FYI: 30 day lock pricing is based on the July 4.5 MBS coupon which is currently priced at 102-12 or 102.3753

The 2s/10s curve is 2bps steeper as traders look to bake in a supply concession (cheaper prices) before for the 1pm $21 billion 10yr TSY note auction. If stocks keep rallying 10s will find support at 3.24%, which was testing overnight.

We have a busy day ahead. HERE is the calendar.