September began on a strong note last week as the Dow jumped almost 3%, or 297 points. Whether the strength continues this week could depend on the Federal Reserve’s assessment of the economy (Wednesday) and trade balance figures (Thursday), but there isn't much data on tap so technical factors may motivate the market.

So far, it appears investors aren’t so optimistic. Stock futures are falling and interest rates are rallying. One hour before the opening bell, S&P 500 futures are down 7.50 points to 1,096.00 and Dow futures are 60 points lower at 10,376. The 2-year Treasury note is +0-02 at 99-25 yielding 0.49% and the 10-year Treasury note is +0-20 at 99-27 yielding 2.643%. The October delivery FNCL 4.0 is +0-08 at 102-22.

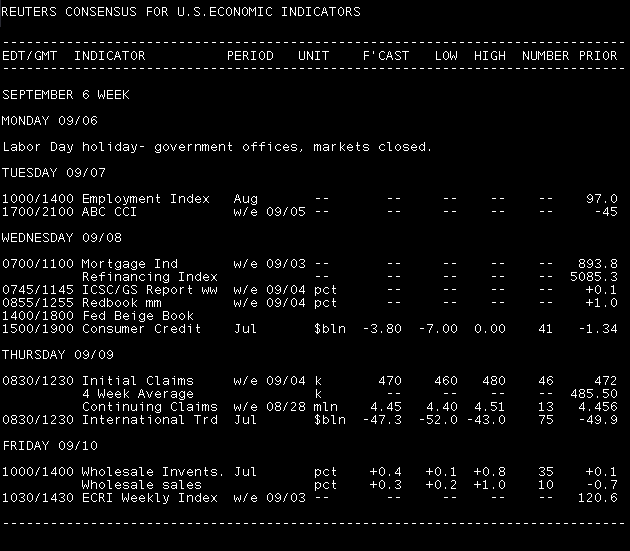

Key Events in the Week Ahead:

Tuesday:

No economic data.

Treasury Auctions:

- 11:30 ― 3-Months Bills

- 11:30 ― 6-Month Bills

- 1:00 ― 3-Year Notes

The August prepayment report will be released on Tuesday afternoon.

Wednesday:

7:00 ― MBA Applications increased 2.7% in the final week of August. The gain was led by refinances advancing 2.8% from the previous week (which put the index at its highest level since early May 2009), and the purchase index climbing 1.8% from one week earlier. Both component were helped by the 4.43% average interest rate on a 30-year fixed-rate mortgages, which fell 12 basis points from the prior week.

“The refinancing boom continues,” said economists from Nomura, noting the refinancing index breached 5,000 in the report. “However, low rates have yet to stimulate any pick up purchase applications. This suggests home sales are likely to continue to languish at very low levels in the coming months.”

2:00 ― The Federal Reserve’s Beige Book, an report on the economy based on anecdotal data from each of the 12 regional Fed banks,

Economists at BBVA said the latest Beige Book “will be a good source to figure out whether the economic recovery is running out of steam.” Consumer spending is picking up only modestly and labor markets are improving gradually, according to BBVA. “It is also anticipated that the report would show that both residential and commercial real estate remain weak.”

Economists from Nomura said the report, sometimes ignored by markets, will be “critically important” given the state of uncertainty these days.

“We expect the report to note clear signs of slowing across the economy ― in contrast to the latest ISM report but in line with many other indicators,” they added. “We expect particularly downbeat comments on the construction sector and the labor market. If correct, our proprietary Beige Book index should fall more deeply into negative territory.”

3:00 ― Outstanding Consumer Credit is anticipated to fall $3.5 billion in July as banks build up cash reserves consumers retrench from taking on debt. The index has fallen for the past five consecutive months, including a $1.3 billion cutback in June, a $5.3 billion drop in May, and a $14.9 billion decline in April.

“Consumers continue to trim credit card debt, but levels of ‘non-revolving credit’ (auto loans, etc) have stabilized,” said economists at Nomura. “We expect similar patterns to continue in the current slow-growth environment.”

Treasury Auctions:

- 11:00 ― 10-Year Notes

- 11:30 ― 4-Week Bills

Thursday:

8:30 ― After the Trade Deficit exploded by nearly $8 billion to $49.9 billion in June, economists anticipate the gap to narrow in July. The belief is that imports, which jumped 3% in June, only surged temporarily as firms restocked shelves, while exports should resume growing after a 1.3% decline.

“Given the underlying sluggishness in domestic demand, there's no fundamental support for such high import levels, and we expect the trade deficit to fall in coming months,” said economists at IHS Global Insight. “Oil is always a wildcard and will probably dampen the decline in the deficit, with oil imports rising in both volume and price.”

8:30 ― Initial Jobless Claims remain far above what economists have been hoping for. New claims have fallen the past two weeks yet the four week average is 486k, well above levels historically consistent with labor growth in the economy. The total number of people continuing to receive unemployment benefits was 4.456 million for the week ending August 21.

“The drop in claims over the last two weeks suggests the 504k reading in mid-August was a temporary aberration, and that the economy has slowed but not slipped into recession,” said economists at Nomura in a fairly optimistic tone. “At the current level, we think the four-week average is consistent with positive private payroll growth, but perhaps a rising unemployment rate.”

Treasury Auctions:

- 1:00 ― 30-Year Bonds

Friday:

10:00 ― The final piece of data in the holiday-shortened week is Wholesale Trade, a measure of business sales and inventories. Economists polled by Reuters anticipate the index to rise 0.4% in July, following a 0.1% gain a month before. Forecasts on sales range from +0.2% and +0.6%, while predictions on inventory were unavailable following a 0.7% dip in June.

“Wholesale inventories are expected to increase in July as suggested by industrial production (IP) indicators,” said economists at BBVA, who noted that accumulating inventory could reflect optimism on business conditions and labor markets.

“The national IP index increased strongly in the month reflecting solid growth in durable goods production,” they added. “Part of this output could have added to stockpiles. In addition, the ISM-manufacturing inventory index reached the 50 point benchmark in July and continued to expand in August. This suggests that firms might be rebuilding inventories after a relatively long process of depletion caused by the economic downturn.”