Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

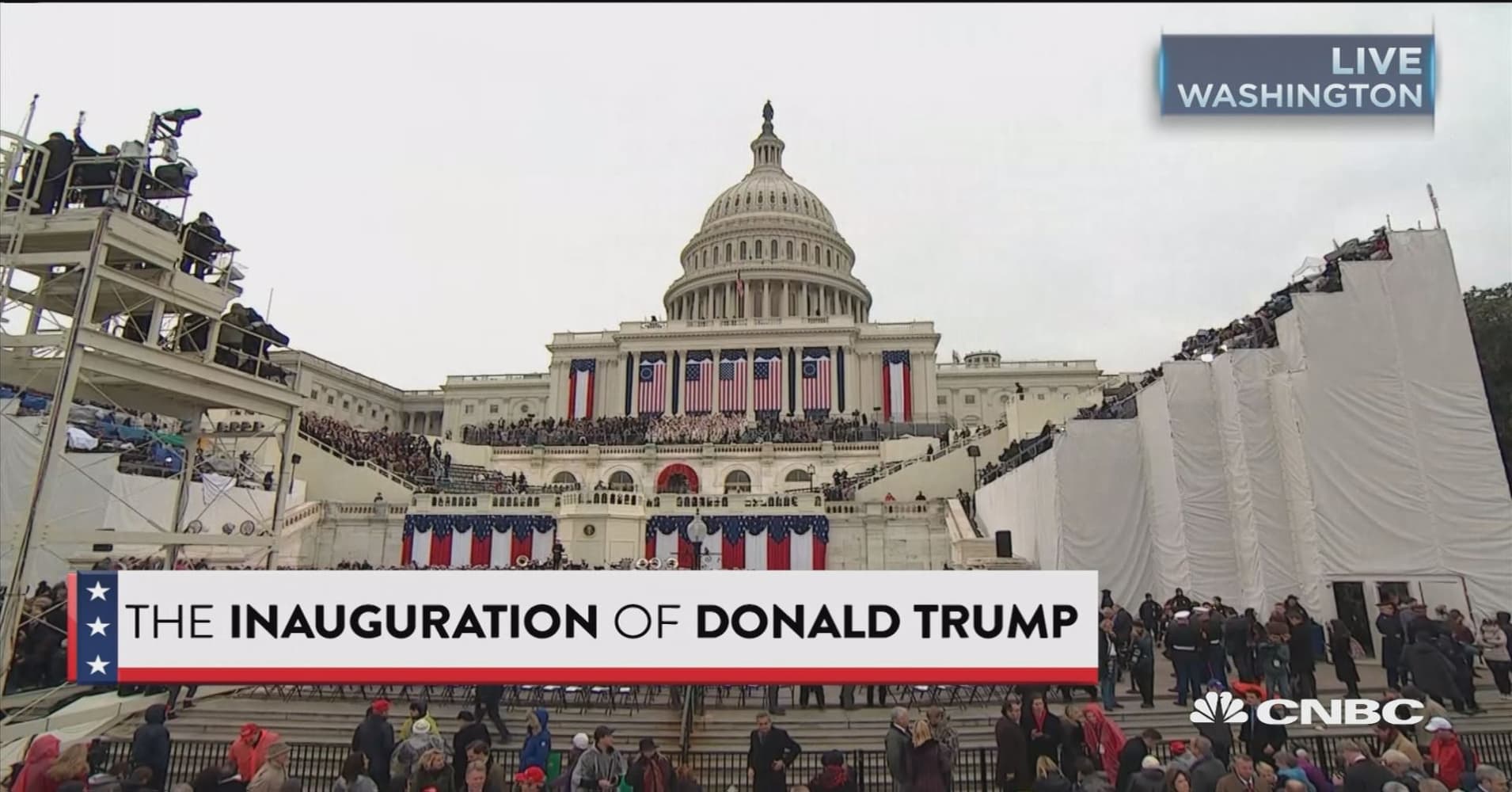

As was being widely rumored yesterday, the newly installed Trump Administration has indefinitely suspended a scheduled reduction in the annual premium for Federal Housing Administration (FHA) insurance. A 25-basis point reduction in that premium was announced by then Housing and Urban Development (HUD) Secretary Julian Castro on January 9, scheduled to go into effect on January 27. Mortgagee Letter 2017-07 was issued about an hour after Donald Trump took the oath of office as President, counteracting the earlier Mortgagee Letter 2017-01. The new letter says "FHA will issue a subsequent Mortgagee Letter at a later date should this policy change." The Mortgage Bankers Association (MBA) reacted immediately to the shift. David H. Stevens, President and CEO, issued the following statement on behalf

|

|