Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

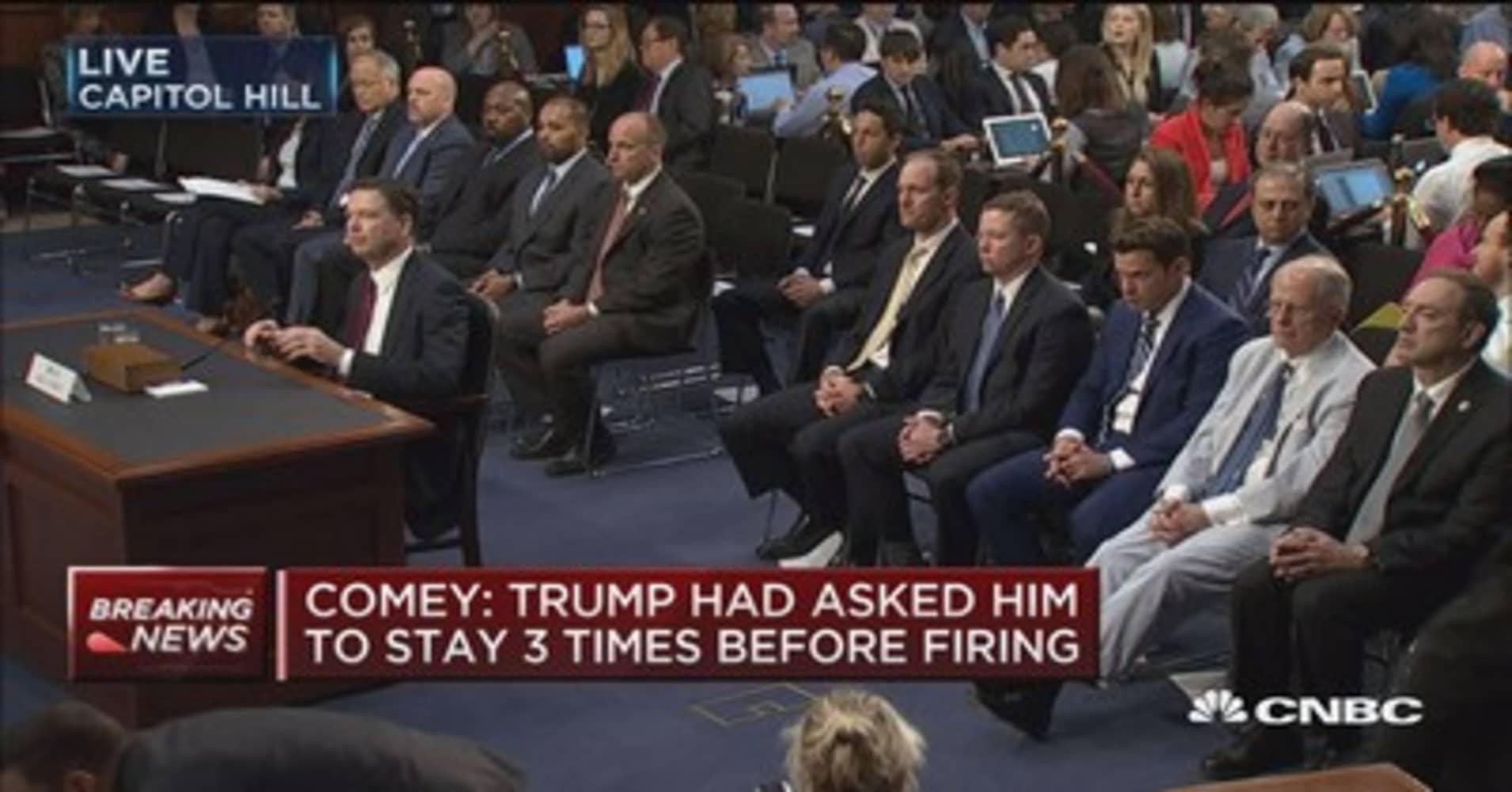

Mortgage rates rose modestly today after spending 2 days at the best levels in nearly 8 months. Financial markets were tuned in to several key events with the power to cause volatility for rates today. Of these, the Senate testimony of former FBI Director Comey probably had the biggest spotlight. Rates were already coming under some pressure yesterday as Comey's prepared remarks were released, but bond markets (which dictate rates) didn't move quite enough for most lenders to adjust rate sheets. Instead, lenders waited for this morning to pass along the bond market weakness in the form of slightly higher rates. As it turns out, traders had done a fairly good job of getting in position for the expected outcome of the Comey testimony, and there wasn't nearly as much intraday volatility as there

|

|