Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

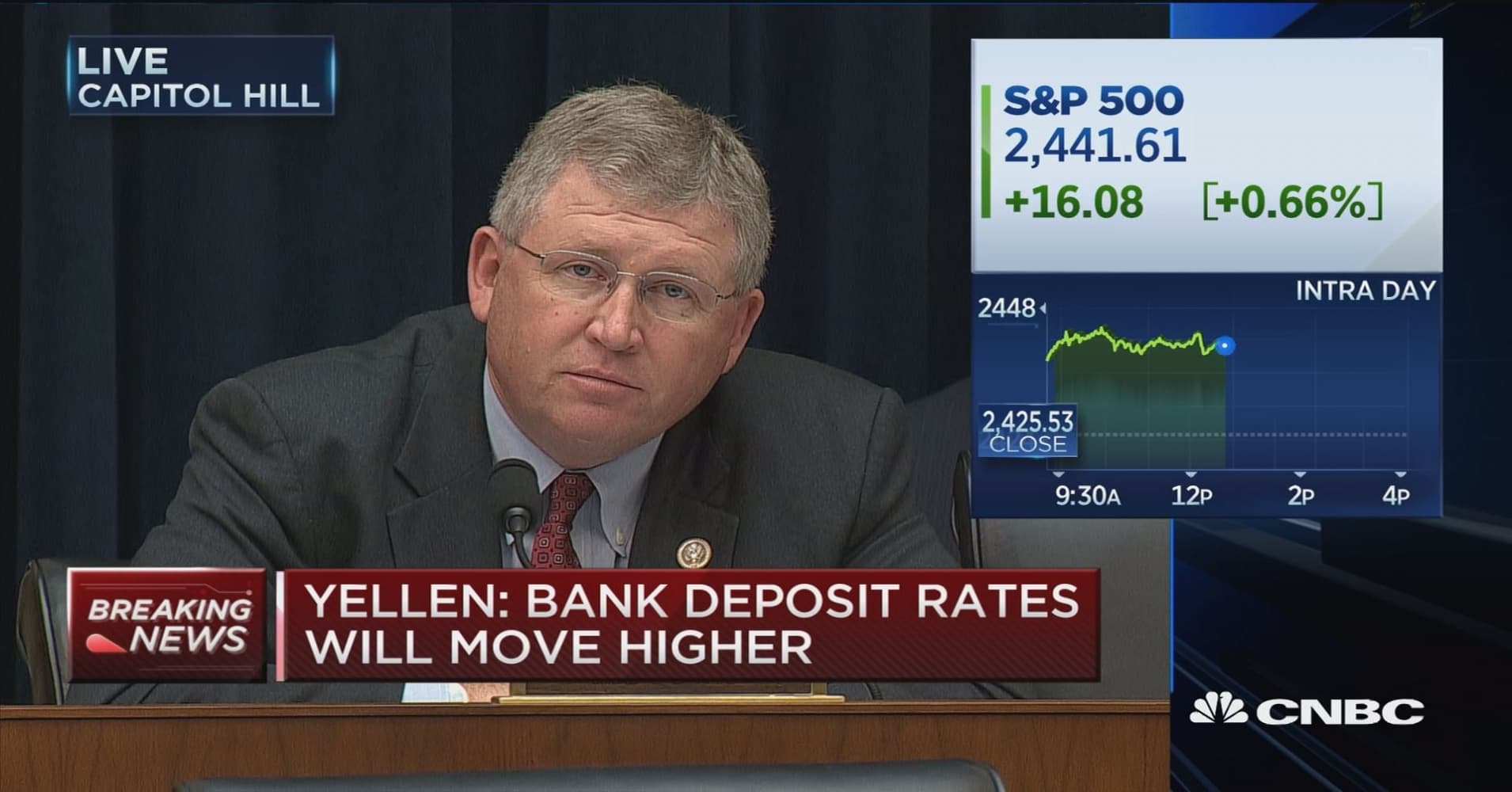

Mortgage rates had been holding in a narrow range near their highest levels in roughly 3 months over the past few days. Despite some stability in underlying bond markets, lenders had hesitated to make meaningful adjustments to rate sheets (in their defense, there wasn't much to work with). That all changed today after Fed Chair Yellen's congressional testimony. In fact, it was the prepared remarks for the testimony, released at 8:30am ET this morning that did the trick for bond markets (which underlie interest rate movement). Market participants were eager to see if Yellen would strike a similarly soft tone to some of the recent speeches from other members of the Fed. Indeed, that was the case as Yellen said the Fed doesn't need to hike much more in order to reach a neutral Fed Funds Rate.

|

|