Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

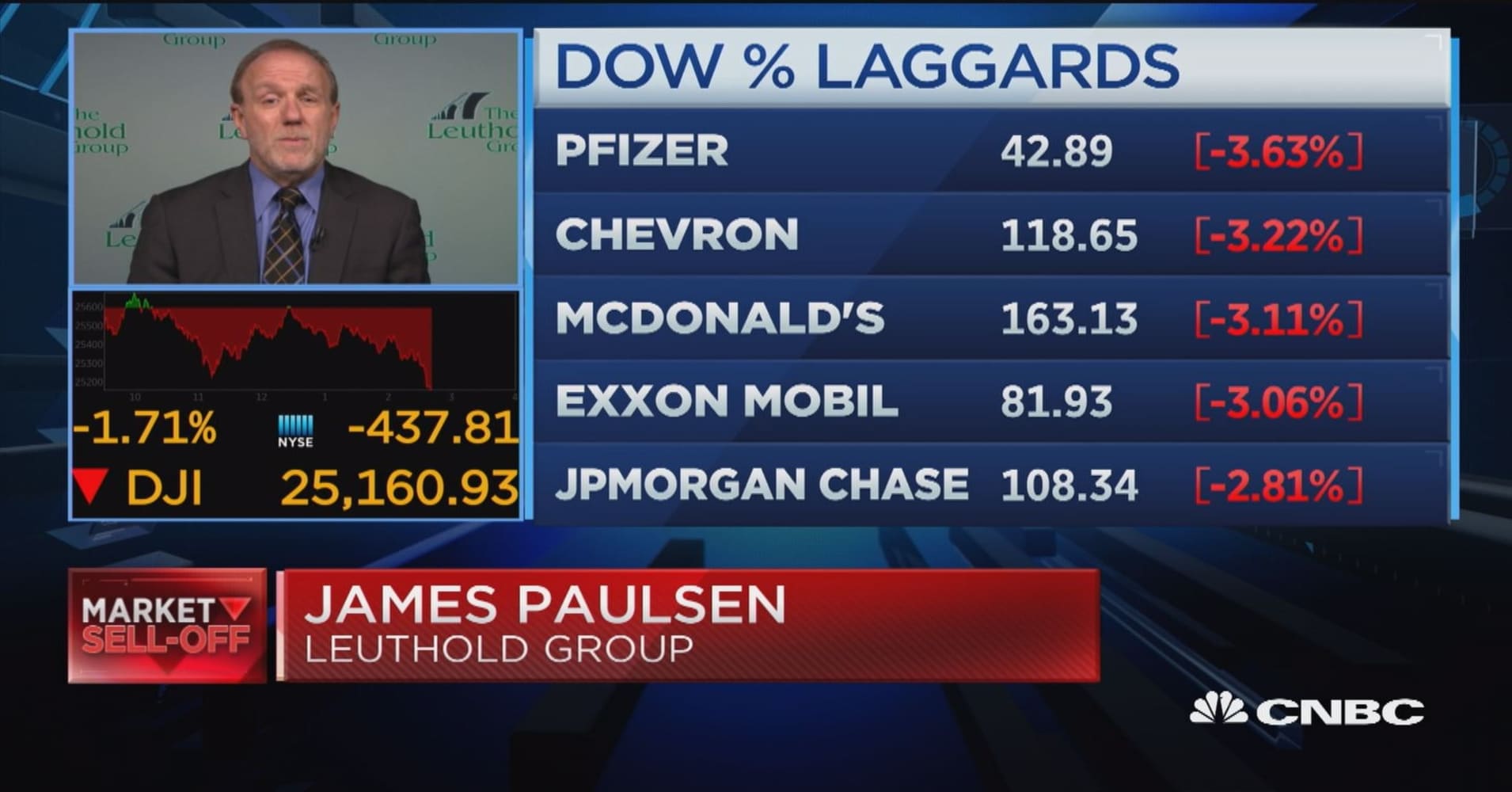

Anything more than 20 points is a big day of selling in terms of the S&P, but that's a small enough number to be relatively common, periodically. From there, a sell-off of more than roughly 33 points becomes much less common. By the t...

|

|