Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

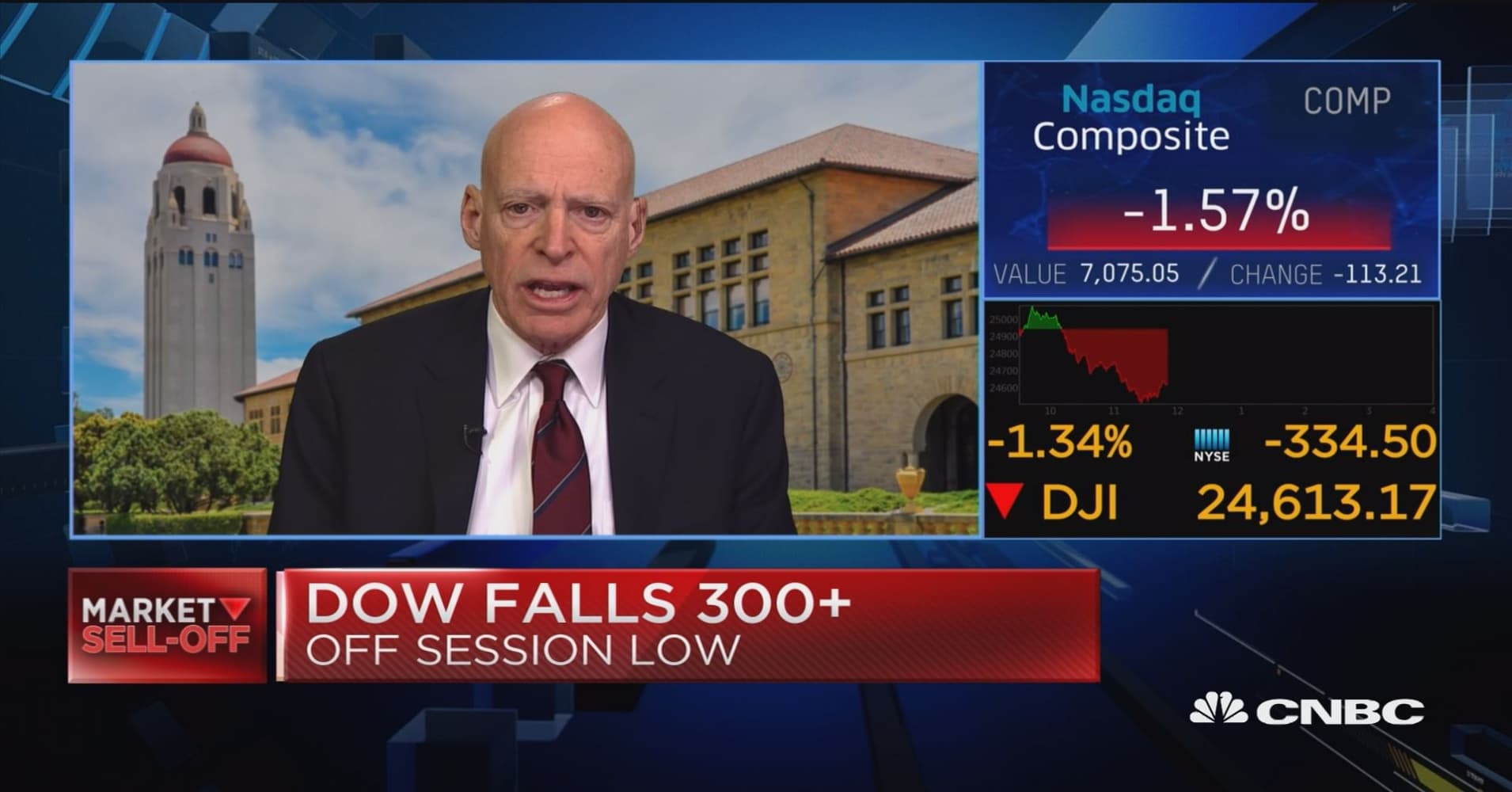

Mortgage rates held on to their recent improvements today after the important Employment Situation (the big "jobs report") showed November job creation was lower than expected. In general, weaker job creation is good for interest rates because it speaks to slower economic growth and inflation (both of which are enemies of rates). This report was particularly important because a strong result would have cast doubt on several speeches from members of the Federal Reserve. Those speeches have warned about slower economic growth in 2019 and the potential for fewer rate hikes than previously anticipated. There were no clear winners or losers at first--probably because job creation is still historically solid. Additionally, the unemployment rate remained ultra low, and wage growth remained above 3

|

|