Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

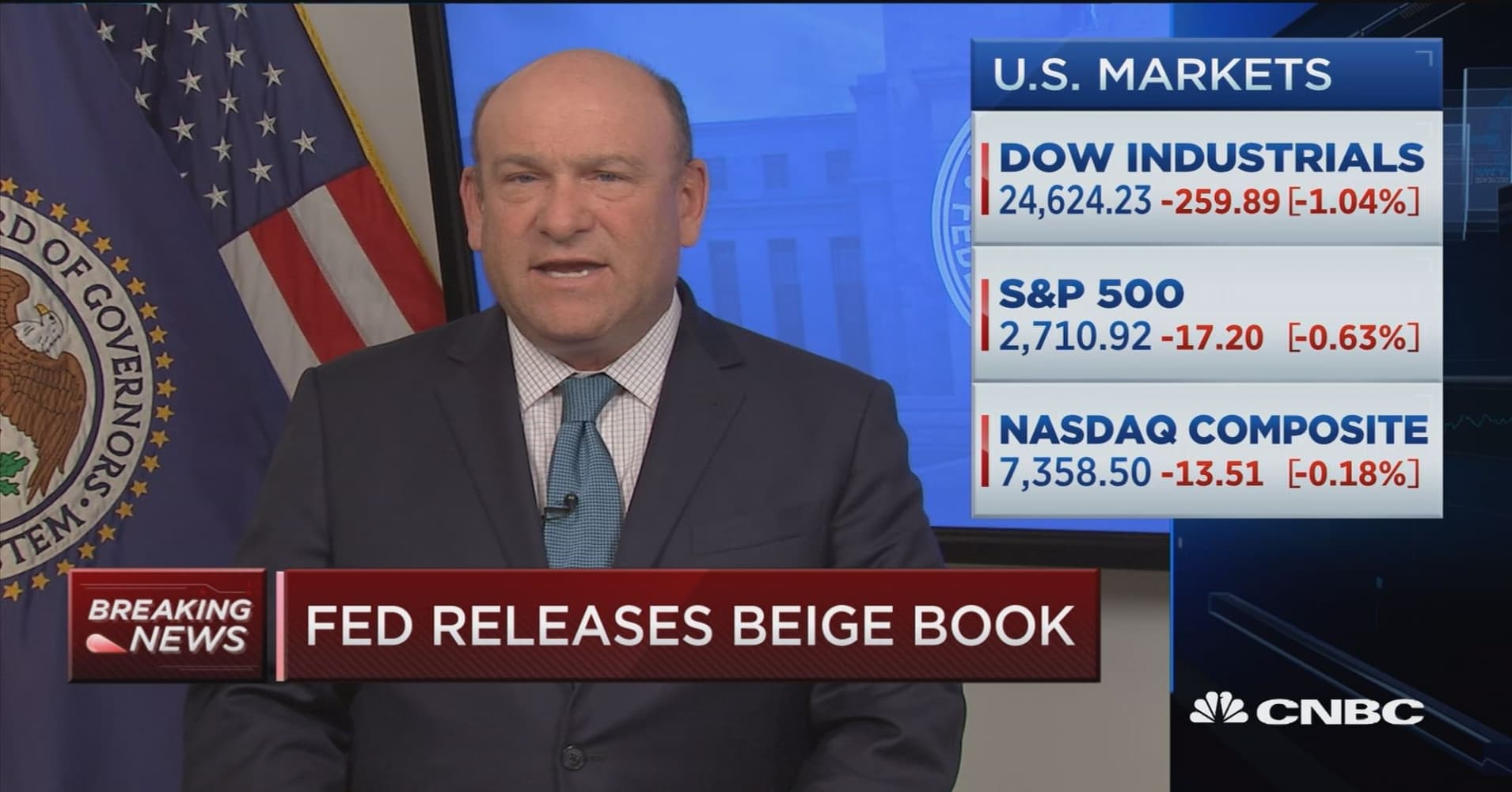

Mortgage rates stayed fairly close to yesterday's levels as underlying bond markets experienced some volatility throughout the course of the day. If mortgage lenders were forced to create rate sheets earlier in the morning, things would have looked very good at around 6am this morning. Financial markets were still reacting to yesterday's after-hours news of Gary Cohn's resignation. This resulted in stocks and bond yields moving lower. Markets were more willing to get back to business today, with stocks and bond yields ("rates") rising together at 9:30am. By the end of the day, both had returned in line with yesterday's latest levels. This not only leaves mortgage rates in roughly the same territory, but it also suggests the downtrend in stocks and rates that began in late Febraury is potentially

|

|