Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

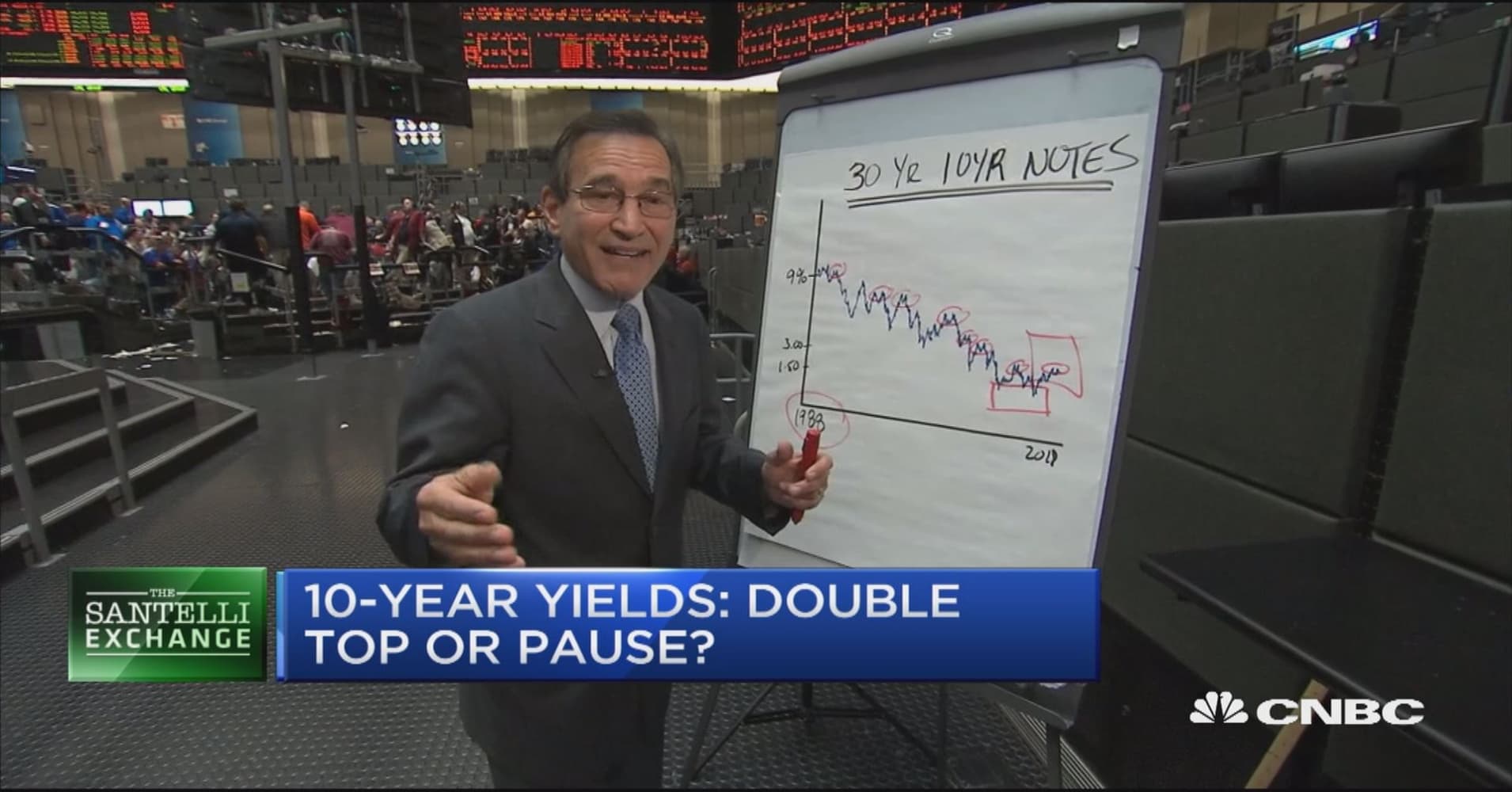

Mortgage rates fell modestly again today. Over the past 2 days, we've managed to undo more than a week of damage, with rates back at their best levels since September 17th. That may sound a bit more exciting than it actually is, however. Many prospective borrowers would still be quoted the same rate over the past 3 days with the improvements limited to the 'upfront cost' side of the mortgage cost equation. All of the above runs counter to many of the mortgage rate headlines floating around the web and airwaves today. The average headline suggests rates are as high as they've been in 7.5 years, followed by some iteration of 'all hope is lost.' OK, so perhaps not every headline put it so dramatically, but you get the idea. Why are the majority of headlines telling you one thing while I'm telling

|

|