Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

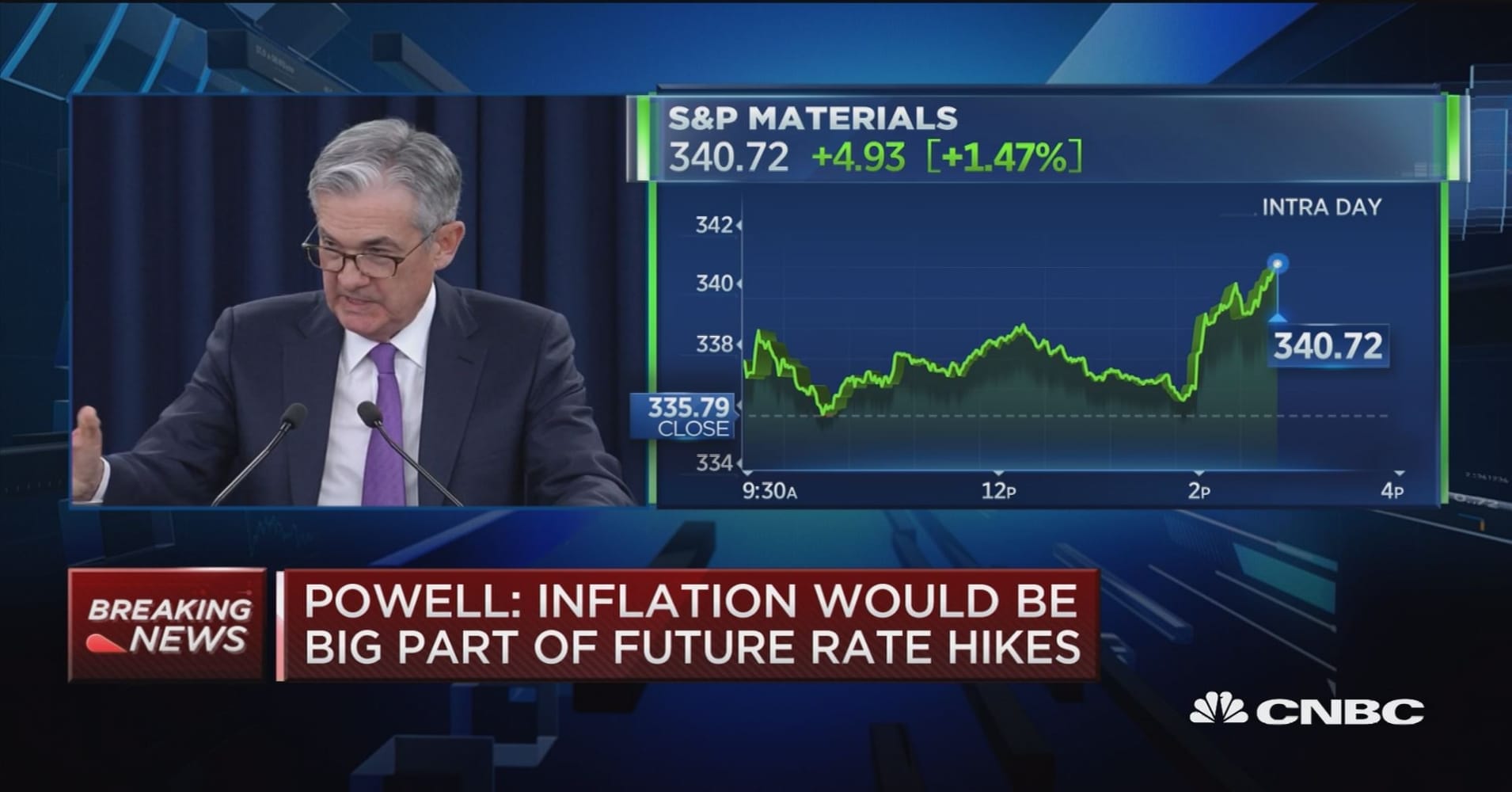

Mortgage rates fell moderately today, largely in response to the Federal Reserve's policy announcement. The Fed is in charge of setting a key short-term rate that impacts the entire financial market by varying degrees. The Fed does NOT set fixed mortgage rates, but in general, the friendlier the Fed with its monetary policy, the better it is for the entire spectrum of rates. The Fed was quite simply friendlier than expected today. Investors were already planning on some sort of adjustment in the verbiage promising ongoing rate hikes and decreases in the amount of bonds purchased directly by the Fed. We got that, and more. For all intents and purposes, today's announcement and press conference could be interpreted as the Fed saying it's done hiking rates until further notice and would only resume

|

|