A client just told us they got huge repurchase request last week, one that would have seriously impaired their capital. It turned out that his partner had made up a phony letter that looked completely real, and that it was his idea of an April Fool’s joke. Unfortunately, his partner told us he seriously thought he was going to have a heart attack.

Do you think it’s hard getting loans approved these days? Before FNMA came out with Delegated Underwriting in the early 80’s, you had to mail your loan files to them and they’d underwrite them. You’d spend maybe four weeks processing the loan and getting the appraisal done, and then FNMA could take up to another month to send you an approval and list of conditions. It sure seems weird when compared to how the business gets done today.

What’s your company worth? If you’re simply a production company without

any servicing, it may be worth nothing. We recently represented a

buyer, a larger mid-Atlantic mortgage company ”buying” a smaller one.

The buyer wanted the sellers loan production, but they didn’t want the

ongoing re-purchase liability. Instead, the sellers liquidated their

company and distributed to themselves whatever cash was left. They then

brought most of their team to the new company and will get a slightly

better split on their loans for the first year.

The above comment

has all sorts of interesting implications. The sellers had spent 14

years building their company, and what, in the end, had they gotten for

it? (1) It provided a good living for the three owners for those 14

years, and (2) they got to distribute the cash they’d build up.

But

about 95% of their net worth was really just their cash, and they got

almost nothing for the stuff that wasn’t cash, spent a fair amount

getting out of leases, and unfortunately, couldn’t monetize their

reputation or their relationships. So next time you think about how

you’re building a sustainable business that you might sell someday, you

might want to lower your expectations.

We know a lot of great

people at Flagstar, but don’t you think the dilution on their stock is

getting a bit much? The bank announced that it’s selling 500 million of

new shares at fifty cents, a 35% discount to the price in mid-March.

The good news is that the $250 million to be raised will strengthen the

bank and keep it moving forward. Is there someone out there who’d like

to look up the number of shares outstanding after this issue v. say, in

2007?

Uncle Sam owns 7.7 billion shares of Citigroup through TARP, and how, you might ask, has it done? Well, the government paid $3.25 a share, and when we checked the other day, the stock was $4.20. That means a profit of $7.3 billion! Thank you, Henry Paulson, but let’s now sell the stock, take the profits, and get the government the heck out of the private sector.

When your bank is doing really badly, nothing is fun! Deeply troubled Frontier Bank (WA) fired its president last week for taking a vacation with his family to Hawaii. The Board felt it was inappropriate for him to have any fun with the bank in such deep trouble.

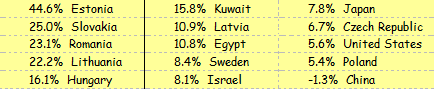

The equity markets have been strong in more places than just the U.S. this past quarter. Here are Q1 returns in local currency.

Another good sign of an improving economy is the level of defaults reported by the mortgage insurers. Primary insurance defaults were 68,000 in February, way down from the 95,000 monthly averages over the past twelve months.

We have two laws we’d like to see passed: (1) For every new law the legislature passes, they must repeal two old ones. And as means of controlling costs (2) No matter what the program is, after five years and every five years thereafter, its budget is automatically given a 10% cut. The latter will force management to stay disciplined and to do some pruning and cutting at least once every five years. If we ever ran for office, this would be a big part of our platform.

By the way, if you’re truly interested in learning useful things about the mortgage industry, you should be subscribing to the Rob Chrisman's daily industry color on Pipeline Press. It keeps you from having to look at 6-7 different websites to get all the guideline changes.

The market cap of Netflix is up 52% to $3.9 billion in the past year v. Blockbuster Video which has dropped 47% to only $62 million, and this leads to two questions: (1). Is this one of those things where Blockbuster’s just fighting a losing battle, where a distribution channel is just not able to compete? And (2) Isn’t it ultimately all about the quality of management?

Our view is that better management at Blockbuster could have seen trends in how consumers wanted to rent movies, and they could have moved sooner to offer video rentals by mail. While our Garrett, Watts business is all about getting the small stuff right, it’s still critical to look at big picture trends and ideas. The guys at Blockbuster didn’t.