The Departments of Treasury and Housing and Urban Development have released their joint December 2011 Housing Scorecard. The report is essentially a summary of housing and housing finance data released by public and private sources over the previous month and/or quarter. Most of the data such as new and existing home sales, permits and starts, mortgage originations, and various house price evaluations have been previously covered by MND.

The scorecard incorporates by reference the monthly report of the Making Home Affordable Program (MHA) through the end of November. This includes information on the universe of MHA programs including the Home Affordable Modification Program (HAMP), HOPE Now, and Second Lien Modifications (2MP) designed to help homeowners with a second lien that is preventing or delaying a first lien modification. Metrics are also included on the Principal Reduction Alternative (PRA) program which requires servicers of non-GSE loans to evaluate the benefit of principal reduction for mortgages with a loan-to-value ratio f 115 percent or larger when testing for a HAMP first-lien modification, the Unemployment Program (UP) which grants full or partial forbearance for up to a year to homeowners who have lost their jobs, and the Home Affordable Foreclosures Alternatives Program (HAFA) which allows borrowers to exit homeownership through a deed-in-lieu or a short sale. While it is not a program, the report also covers FHA-HAMP modification activity which has involved 7,350 trial modifications of FHA loans of which 4,659 are now permanent.

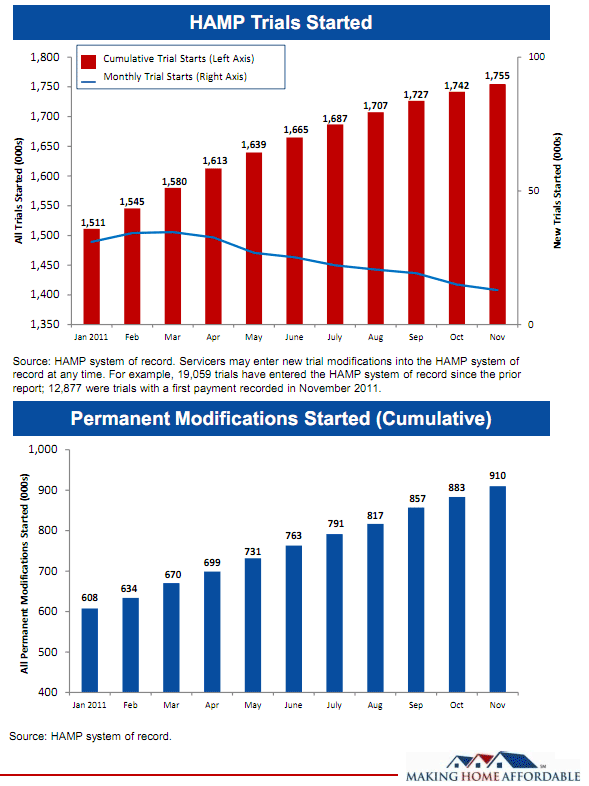

During November the administration initiated 19,059 trial modifications under the HAMP program compared to 21,445 in October. This brings the total of trials begun since the program started in April 2009 to 1.755 million, 909,953 of which have been converted to permanent modifications; 26,877 of these during the month of November. Over 750,000 of these permanent modifications remained in force at the end of the reporting period.

The Scorecard lists as the most common reasons for the cancellation of trial modifications regardless of servicer as insufficient documentation, payment default, and borrower ineligibility regarding the minimum 31 percent debt-to-income ratio.

When homeowners are not accepted for trial modification or those modifications are cancelled, borrowers may be given other alternatives. The HAMP program reports that 39.7 percent of borrowers in cancelled modifications have been offered alternative programs and 6.1 percent have engaged in a short-sale or deed-in-lieu of foreclosure. Ten and one-half percent of borrowers have brought their loans current and 6.4 percent have paid them off. Foreclosures were started on 16.3 percent of the borrowers and completed on 10.6 percent. Where the borrower was not accepted for the program 20.5 percent brought their loans current, 26.5 percent were offered an alternative modification and foreclosures were started on 15.2 percent and completed on 7.6 percent. Deed-in-lieu and payoff figures were nearly identical for both ineligible and canceled borrowers.

Under HAFA, servicers have started 38,613 interventions of which 24,365 have been completed, all but 700 of which were short sales. Eighty-three hundred borrowers remain active in the program.

PRA currently has 15,875 active modifications out of 57,656 started. There are 36,454 permanent modifications in place with a median principal reduction of $66,308.

At the end of November 13,762 unemployed borrowers were under an UP partial payment forbearance and 2,871 under a plan with no payment required.

The 2MP program has accepted 115,750 borrowers as eligible and nearly half, 54,826 have started the second lien modification process. Of this number 9,772 second liens have been fully extinguished at an average value of $60,688, 1,100 liens have been disqualified and 44,000 modifications remain active.

Interest in the various foreclosure prevention activities apparently remains high. The HOPE Now Hotline received 65,838 calls in November and 42,189 borrowers were referred for free housing counseling The Making Home Affordable website received 2.6 million hits during the months and has received 132 million hits over its history.