Two reports on U.S. home prices were released on Monday. The two, the CoreLogic Home Price Index (HPI) and the Clear Capital Home Data Index (HDI) cover different time periods and use somewhat different methodology so the data is not comparable between the two. Here is a brief summary of each.

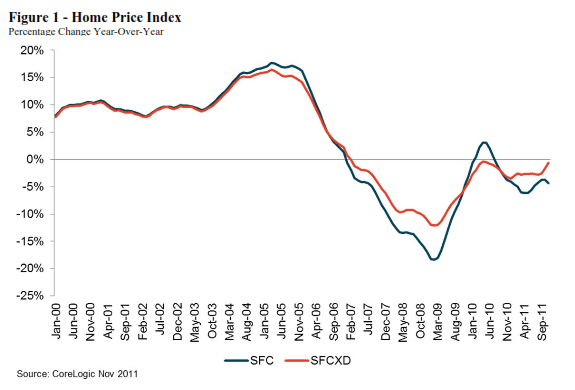

CoreLogic, using a repeat sales index, reports that prices in the U.S. decreased 1.4 percent in November compared to October, the fourth consecutive monthly decline. On a year-over-year basis prices, including distressed sales, were down by 4.3 percent. This follows a -3.7 percent change in October 2011 compared to October 2010. When distressed sales are eliminated, year-over-year sales were down 0.6 percent in November following a drop of 1.6 percent in October.

Mark Fleming, chief economist for CoreLogic said "With one month of data left to report, it appears that the healthy, non-distressed market will be very modestly down in 2011. Distressed sales continue to put downward pressure on prices, and are a factor that must be addressed in 2012 for a housing recovery to become a reality."

Including distressed sales, the peak-to-current change in the national HPI (from April 2006 to November 2011) was -32.8 percent. Excluding distressed sales the change was -23.1 percent.

The states with the highest percentage of price appreciation in November (including distressed sales) were Vermont (+4.3), South Carolina (+2.8) , and the District of Columbia (+2.1). The highest rates of depreciation were posted in Nevada (-11.2), Illinois (-9.7), and Minnesota (-7.8).

Clear Capital reports on both December activity and provides an end of year summary. It generates its indices in rolling quarter intervals that compare the most recent four months to the previous three months and includes unweighted data on both fair market sales and sales of owned real estate (REO).

U.S. prices declined 0.4 percent in December, giving back some of the year's earlier gains Clear Capital says this is the first "cooling off" following six months of modest gains. During that period (June-December) prices were almost flat at -0.1 percent.

While national prices were flat in December some local markets showed substantial volatility. Dayton, Ohio for example saw a 5.0 percent increase in prices in December while Atlanta Georgia was down over 18 percent.

The national REO saturation rate was at a low point for the year in December at 24.8 percent and was also showing consistent signs of stability. Again, it is a local situation with the saturation in Detroit at 48.4 percent and many other markets in the 30-45 percent range while Hartford and Raleigh, North Carolina have rates only slightly over 5 percent.

On a year-over-year basis Clear Capital's HDI reported a decrease of 2.1 percent, again reflecting an increasing stabilization of prices and decreasing REO saturation.

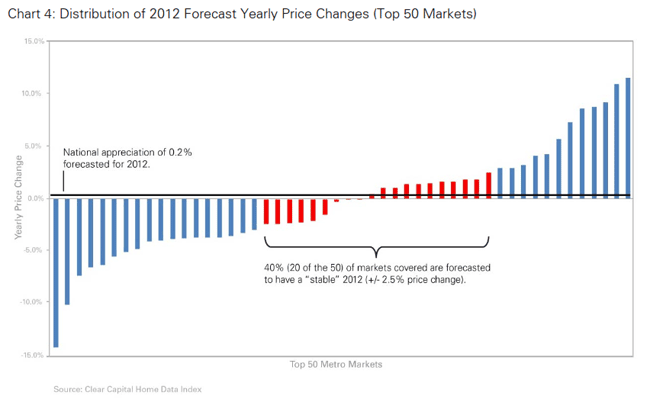

Clear Capital is forecasting continued stabilization into 2012, with U.S. home prices expected to show a slight gain of 0.2 percent across all markets, ending five straight years of declines but leaving home prices at levels last seen in 2001. However, while national changes are projected as minimal, the company expects substantial local volatility, with half of the 50 major metro markets in the sample expected to post gains for the year. "Individual metros will experience the full gamut of price movement, from double-digit growth to double-digit drops," the company says.

Florida is expected to stage a strong comeback in four of its markets. Orlando will have a price increase of 11.7 percent; Miami and Tampa will be among the five highest performing metros in the country with 8.8 percent and 7.4 percent growth respectively, and Jacksonville will gain 4.3 percent. This growth will be the result of several factors including the beating they took during the downturn. They have also experienced large increases in the values of their lower-priced homes and have a high level of cash transactions (51.8 percent) indicating heavy investor activity.

The forecasted volatility of the 50 metros in Clear Capital's sample is illustrated in the figure below. The black horizontal line represents the predicted 0.2 percent national price increase; only 20 of 50 markets fall within +/- 2.5 percent of the line. These represent the so-called "stable" markets.