The proposed down payment standards for new mortgages might push 60 percent of potential borrowers into high-cost loans or out of the housing market altogether according to a paper released today by the Center for Responsible Lending. The paper, Balancing Risk and Access: Underwriting Standards for Qualified Residential Mortgages, is the result of a study to weigh the effects of proposed underwriting guidelines for qualified residential mortgages (QRM), mortgages that are exempt from the risk retention requirements laid out in the Dodd-Frank Wall Street Reform Act.

The Center, a nonprofit, nonpartisan research and policy organization with a stated mission of "protecting homeownership and family wealth by working to eliminate abusive financial practices" has, along with other consumer and industry groups, raised concerns about a potential disproportionate impact of restrictive QRM guidelines on low-income, low-wealth, minority and other households traditionally underserved by the mainstream mortgage market. The study examines the way different QRM guidelines may affect access to mortgage credit and loan performance and estimates the additional impacts on defaults resulting from guidelines above and beyond QM product requirements.

The researchers, Roberto G. Quercia, University of North Carolina Center for Community Capital, Lei Ding, Wayne State University, and Carolina Reid, Center for Responsible Lending used datasets from Lender Processing Services (collected from servicers) and Blackbox (data from loans in private label securities collected from investor pools.) They identified from among 19 million loans originated between 2000 and 2008 the 10.9 million that would meet the current QRM guidelines, i.e. loans with full documentation that have no negative amortization, interest only, balloon, or prepayment penalties. Adjustable rate mortgages must have fixed terms of at least five years and no loans over 30 years duration.

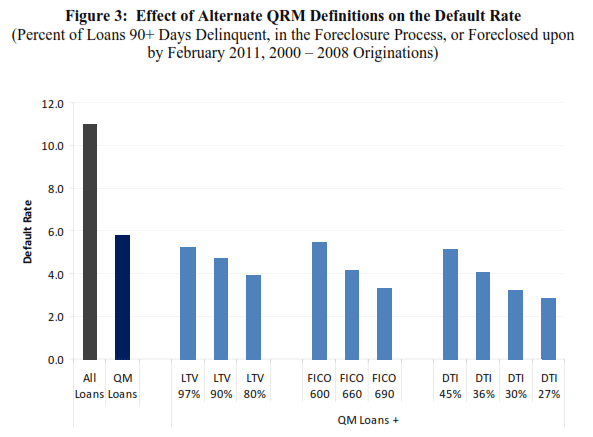

The default rate for the universe of loans was 11 percent, for prime conventional loans, 7.7 percent, and for loans (regardless of type) that would have met the QM product feature limits, 5.8 percent. In other words, the research "suggests that the QM loan term restrictions on their own would curtail the risky lending that occurred during the subprime boom and lead to substantially lower foreclosure rates without overly restricting access to credit."

The next step was to apply some of the suggested additional criteria for QRM to the loans; a minimum down payment of 20 percent, a range of higher FICO scores, and lower debt to income (DTI) ratios. The goal was to determine the benefit of each as measured by an improvement in default rates without an undo reduction in borrowers able to qualify for an affordable loan.

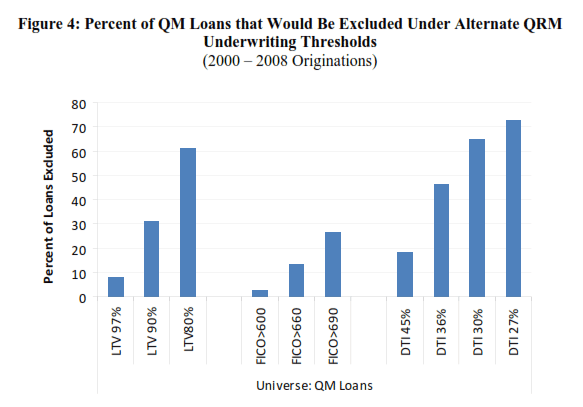

When various permutations of loan-to-value (LTV), FICO scores, and DTI ratios were applied to the loans lower default rates were achieved. These improvements, however, were accompanied by the exclusion of a larger share of loans. As Figure 4 shows, some of the restrictions resulted in the exclusion of as many as 70 percent of loans.

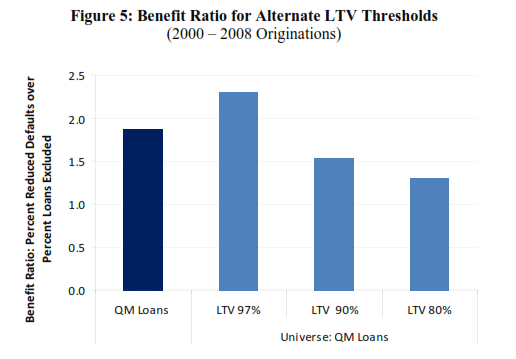

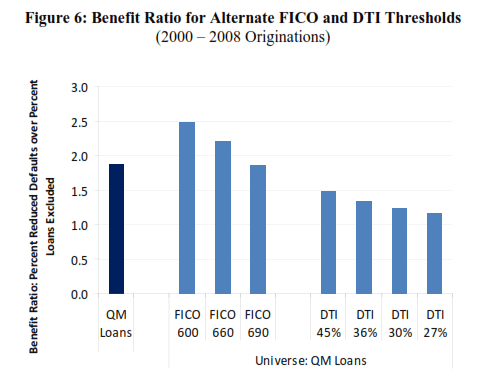

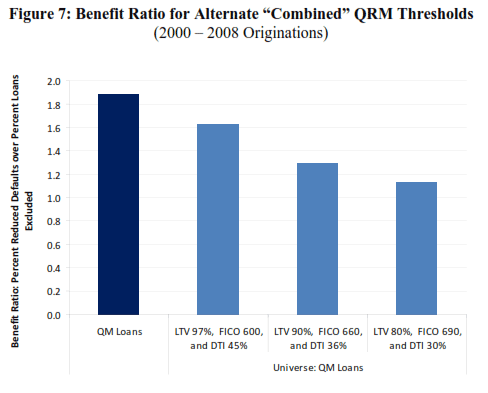

To quantify this, the authors developed two additional measures. The first, a benefit ratio, compares the percent reduction in the number of defaults to the percent reduction in the number of borrowers who would have access to QRM loans with the proposed guidelines. For example, an underwriting restriction that resulted in a 50 percent reduction in foreclosures while excluding only 10 percent of borrowers would have a higher benefit ratio than one with the same reduction in foreclosures that excluded 20 percent of borrowers.

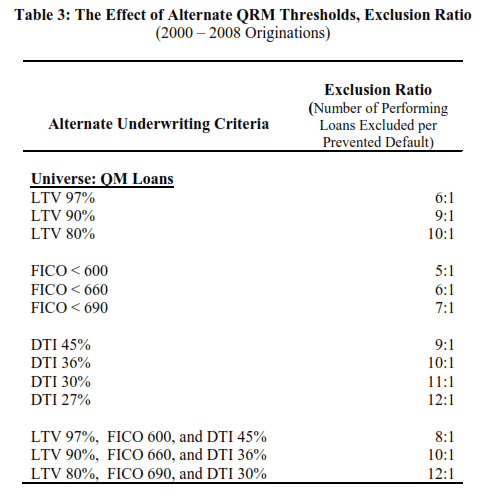

One finding was that LTVs of 80 or 90 percent resulted in particularly poor outcomes while an LTV of 97 percent had added benefits of reduced defaults relative to borrower access. This suggests that even a very modest down payment may play an important role in protecting against default while excluding a smaller share of borrowers than would a higher down payment requirement.

Since underwriting is unlikely to impose restrictions in isolation, the study analyzed a combination of possible QRM restrictions. They found that the strictest guidelines produced the worst outcomes and that none of the patterns of proposed restrictions performed as well as the QM restrictions on their own.

The second measure, an exclusion ratio, looks at the number of performing loans a certain threshold would exclude to prevent one default. In this measure, the number of excluded loans can be viewed as a proxy for the number of "creditworthy" borrowers who would be excluded from the QRM market.

Imposing 80 percent LTV requirements on the universe of QM loans would exclude 10 loans from the QRM market to prevent one additional default. Adding to this a FICO above 690 and 30 percent DTI ratio would exclude 12 creditworthy borrowers to prevent one default.

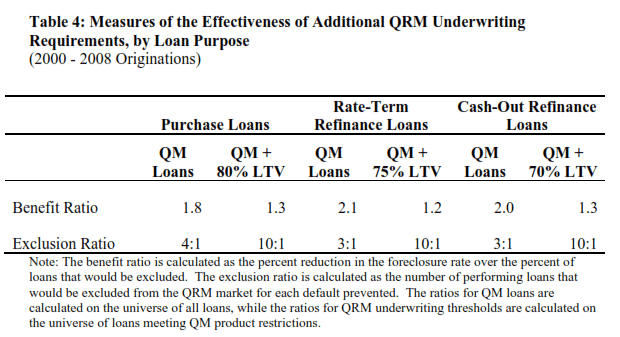

The current QRM criteria are more restrictive for rate-term and cash-out refinancing than for purchase loans. The study found that the QM product restrictions are the most effective in balancing the demand between reducing defaults and ensuring access to credit.

The study also found that imposing additional LTV, DTI, and FICO underwriting requirements on QM loans had disproportionate effects on low-income borrowers and borrowers of color. Just over 75 percent of African-American borrowers and 70 percent of Latino borrowers would not qualify for a 20 percent down QRM mortgage and significant racial and ethnic disparities are evident for FICO requirements as well. At FICO scores above 690, 42 percent of African-Americans and 32 percent of Latino borrowers would be excluded against 22 percent of white and 25 percent of Asian households. At the most restrictive combined thresholds (80 percent LTV, FICO above 690, DTI of 30 percent) approximately 85 percent of creditworthy borrowers would not qualify with African American and Latino disqualifications each above 90 percent.

The Center says in conclusion that its research provides "compelling evidence that the QM product loan guidelines on their own would curtail the risky lending that occurred during the subprime boom and lead to substantially lower foreclosure rates, while not overly restricting access to credit."