The Mortgage Bankers Association today released the Weekly Survey on Mortgage Application Activity for the week ending January 22, 2010.

The MBA survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole. Furthermore, in a low mortgage rate environment, such a trend implies consumers are seeking out lower monthly payments which can result in increased disposable income and therefore more money to spend on discretionary items or to pay down other debt.

Previous Report: Week ending January 15, 2010...

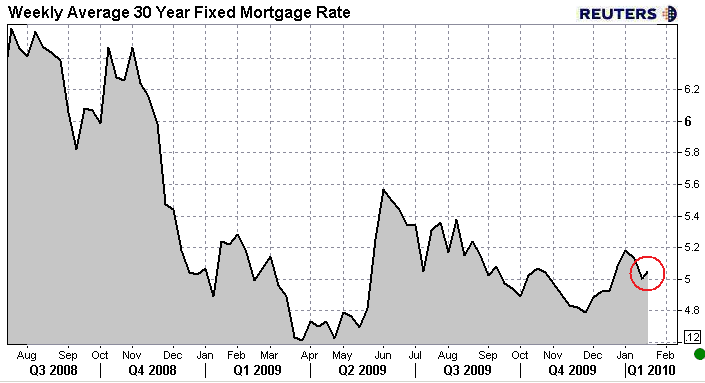

Mortgage loan application volume increased 9.1 percent on a seasonally adjusted basis. The Refinance Index increased 10.7 percent. The seasonally adjusted Purchase Index increased 4.4 percent.The refinance share of mortgage activity increased to 71.7 percent of total applications from 71.5 percent the previous week. The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.00 percent from 5.13 percent, with points decreasing to 1.05 from 1.17 (including the origination fee).

From Today's Report: Week Ending January 22, 2010...

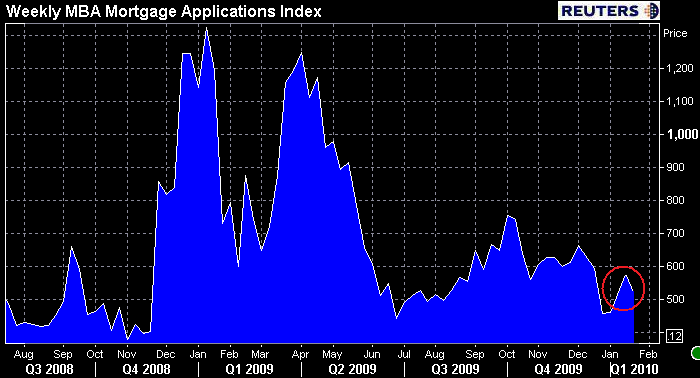

The Market Composite Index, a measure of mortgage loan application volume, decreased 10.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 10.1 percent compared with the previous week and decreased 19.8 percent compared with the same week one year earlier. The four week moving average for the seasonally adjusted Market Index is up 2.6 percent.

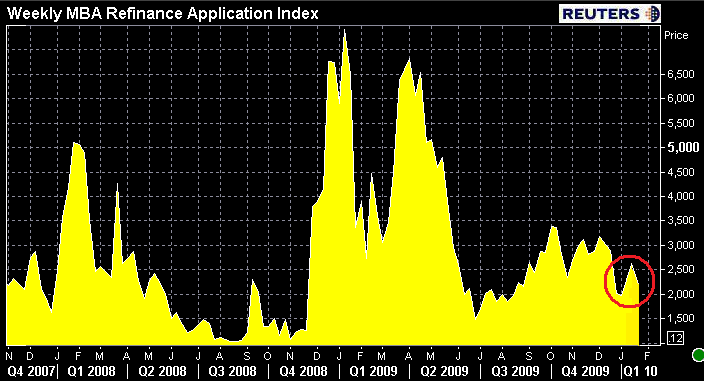

The Refinance Index decreased 15.1 percent from the previous week.The four week moving average is up 2.8 percent for the Refinance Index. The refinance share of mortgage activity decreased to 67.6 percent of total applications from 71.7 percent the previous week.

The seasonally adjusted Purchase Index decreased 3.3 percent from one week earlier. The unadjusted Purchase Index increased 2.8 percent compared with the previous week and was 4.5 percent lower than the same week one year ago. The four week moving average is up 1.3 percent for the seasonally adjusted Purchase Index.

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.02 percent from 5.00 percent, with points decreasing to 1 from 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The average contract interest rate for 15-year fixed-rate mortgages increased to 4.34 percent from 4.33 percent, with points decreasing to 1.14 from 1.19 (including the origination fee) for 80 percent LTV loans. The average contract interest rate for one-year ARMs increased to 6.84 percent from 6.72 percent, with points increasing to 0.33 from 0.31 (including the origination fee) for 80 percent LTV loans.

Michael Fratantoni, MBA's VP of Research and Economics, summed up the environment PERFECTLY:

"Although rates remain low, there appears to be a smaller pool of borrowers who are willing and able to refinance at today's rates."

This is why we think the Fed will be able to exit the mortgage market at the end of Q1 2010. Thanks to weakness in the labor market and a mini-refi boom over the past year, the pool of qualified borrowers (refinances and purchases) has shrunk considerably. This implies mortgage loan production will be slow enough to allow the Fed to exit the agency mortgage-backed securities market without causing a major disruption in MBS supply and demand technicals.

WHO WILL PROVIDE DEMAND SIDE SUPPORT IN THE AGENCY MBS MARKET?

Regardless of rich MBS valuations, banks have proven themselves to be a stable source of demand side MBS support. If/when yield spreads (relative value) cheapen up as the Fed makes their move toward stage left, there will be more incentive for hedge funds and money managers to become more neutral players (instead of being mostly sellers). On top of these two sources of funding, Asian banks, who usually focus on GNMA paper, will likely follow the lead of US banks and maintain or increase their current level of interest in US residential MBS. There isn't a better time for the Fed to make an exit...

Again, if you are a loan originator, you should be implementing an aggressive purchase environment oriented sales marketing strategy.