The Lender Processing Services (LPS) Mortgage Monitor Report for December show improvement in a number of the metrics it tracks. Many measures of delinquency rates are down, inventories are clearing in some states, and recent loan originations are "among the best quality on record."

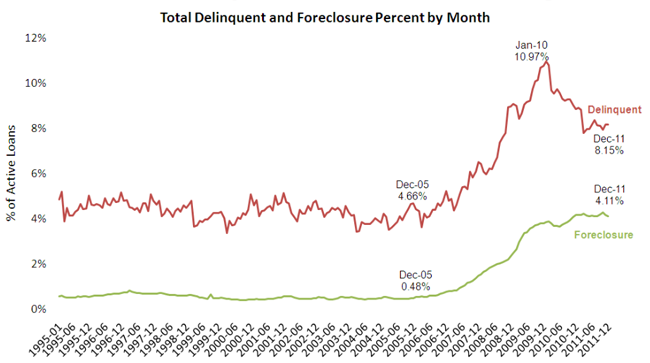

The overall delinquency rate did not change from November, remaining at 8.15 percent but is down 7.7 percent since December 2010. Seriously delinquent loans, those 90 or more days overdue or in foreclosure decreased 0.6 percent to 7.67 percent, a -5.9 percent change from one year earlier.

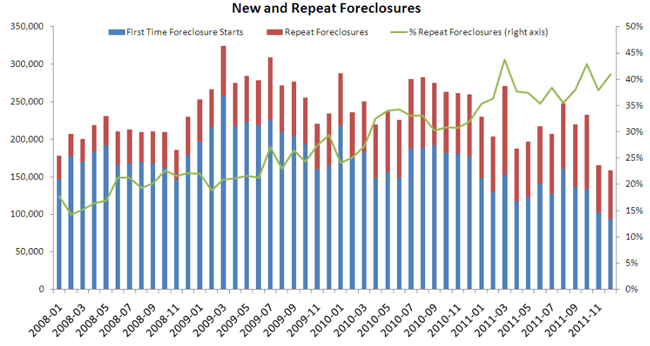

The foreclosure rate which was 4.16 percent in November fell to 4.11 percent in December and is down 1.0 percent year-over-year. Foreclosure starts showed the most dramatic change. There were 159,092 starts in December compared to 165,205 in November, a -3.7 percent change and starts were 38.7 percent below the level in December 2010. This is the lowest level of foreclosure starts since at least 2008.

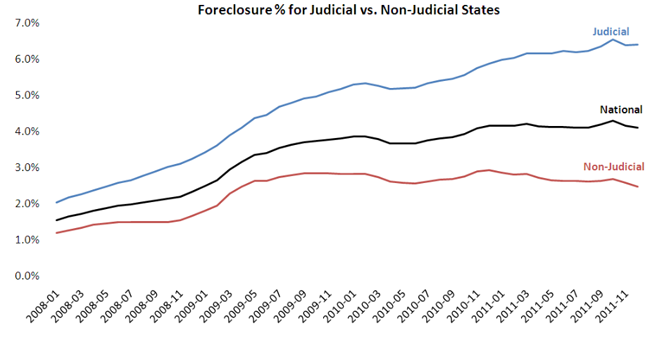

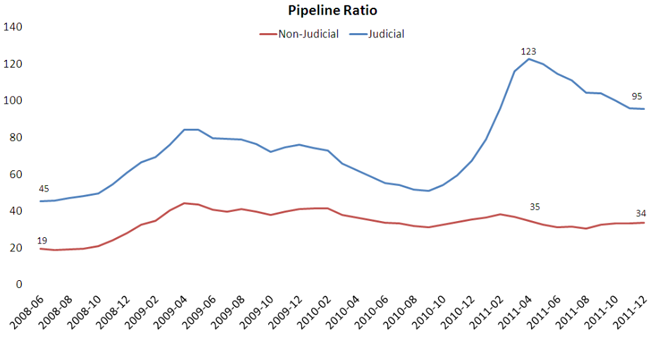

While 90+ day delinquencies are about the same in judicial and non-judicial states there remains a large distinction between these states in other measures of foreclosure activity. LPS found that half of all loans in foreclosure in judicial states have not made a payment in more than two years as the foreclosure process drags on. The foreclosure sales rate in non-judicial states is four times that in judicial states (6.8 percent vs. 1.6 percent). Foreclosure inventories stand at about 3.5 percent nationwide; in non-judicial states those inventories are about 2 percent while in judicial states they are 2.5 times greater - over 6 percent. Still, pipeline ratios (the time it would take to clear through the inventory of loans either seriously delinquent or in foreclosure at the current rate of foreclosure sales) has declined significantly from earlier this year in judicial states while remaining flat in non-judicial states.

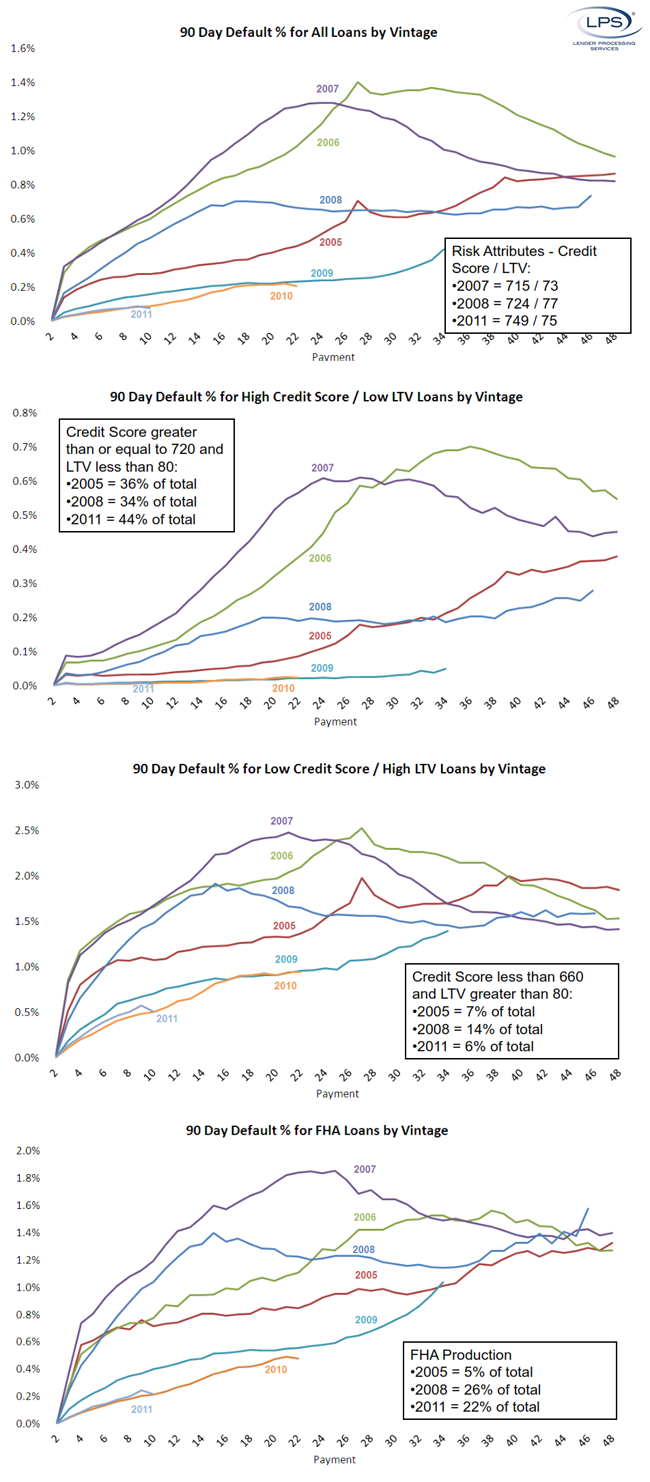

Loan originations (month ending November 11) numbered 537,720 compared to 597,888 in October, a decline of 10.1 percent and 29.3 percent below originations one year earlier. The loans originated over the last two years, however, are among the best quality on record according to LPS. 2010-11 vintage originations showed 90-day default rates below those of all other years, going back to 2005. December origination data also shows that recent prepayment activity - a key indicator of mortgage refinances - has remained strong, with 2008-09 originations, high credit score borrowers and government-backed loans having benefited the most from recent, historically low interest rates.