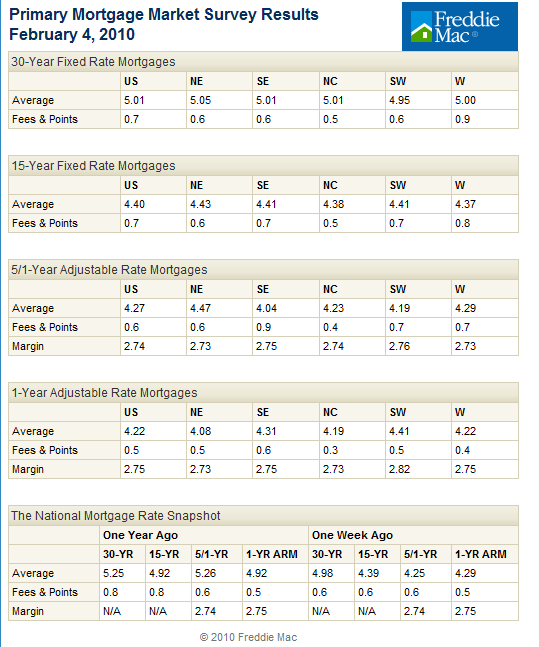

Rates rose slightly during the week ended February 4 according to data released today by Freddie Mac. The weekly Primary Mortgage Market Survey showed that the average rate for 30-year fixed-rate mortgages (FRM) was 5.01 percent with 0.7 point compared to a week earlier when the rate was 4.98 percent with 0.6 point. The 15-year FRM averaged 4.40 percent, up one basis point from the previous week. Fees and points were unchanged at 0.6.

Adjustable Rate Mortgages (ARM) rates were mixed. The five-year Treasury-indexed hybrid ARM had an average rate of 4.27 percent with 0.6 point compared to 4.25 percent with 0.6 point last week while the 1-year Treasury-indexed ARM was down to 4.22 percent with 0.5 point from 4.29 percent also with 0.5 points.

Here is a summary of the survey results:

Frank Nothaft, Freddie Mac vice president and chief economist said about the survey, "Mortgage rates remained relatively stable for a second week amid news of a strengthening housing market. Residential fixed investment rose for two consecutive quarters over the last half of 2009 following a steady quarterly decline since the beginning of 2006," he added. "Pending existing home sales rebounded by 1% in December from a record drop in November that was due in part to the original expiration of the homebuyer tax credit, according the National Association of Realtors. More recently mortgage applications for home purchases jumped 10% at the end of January, according to figures from the Mortgage Bankers Association."

"Even more encouraging news came from the Federal Reserve's Senior Loan Officer Opinion Survey which reported that banks have generally stopped tightening standards on most types of loans in the fourth quarter of 2009, with commercial real estate as the exception. However, banks have yet to unwind the tightening that occurred over the last two years. Moreover, substantially fewer banks expected credit quality to deteriorate over the coming year."

Most rates were also higher in a report issued by Fannie Mae earlier in the week. Fannie's weekly yields for conventional fixed rate mortgages for the week ended January 29 were, 4.74 percent for the 30-year, up from 4.68 the week before, and 4.07 percent for the 15-year compared to an earlier rate of 4.04.

Government guaranteed FHA and VA 30-year fixed-rate loans were unchanged at 5.47 while the one-year ARM was up two basis points to 2.45 percent. All Fannie Mae yields are quoted net of servicing fees.