A consumer survey conducted by Thomas Reuters and the University of Michigan indicates that it is sellers who are holding the housing market at low levels.

In survey results released today, approximately 75 percent of homeowners who participated in the survey viewed current home buying conditions as favorable because of attractive home prices and low interest rates. However, nine out of ten of those home owners viewed the conditions for the sale of their own home as unfavorable, not because of lack of buyers, but because of price declines.

The survey authors viewed these responses as predicting a long-term drag on the housing market for both economic and psychological reasons. There is, the report said, a significant barrier to purchasing a new home if the potential buyer's current home is "under water," that is more is owed on the house than the house can be expected to sell for. Even homeowners with equity will be constrained in providing a down payment for a new property if their equity has fallen below 20 percent.

The loss of value of the home also presents a psychological barrier because people are reluctant to sell houses at a value lower than it had in the past. The report likened it to stock market investors who sell their winners but hold on to the losers.

The authors said that one implication of their survey results is that "forecast models based on the past dominance of buying will overestimate future trends unless selling conditions are also incorporated."

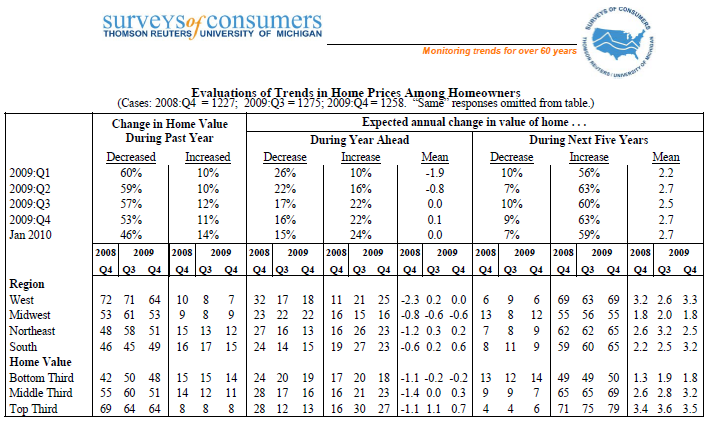

Homeowners do see some improvement in the market, however. 46 percent of survey respondents felt that their home had lost value in the last year, but in the survey conducted during the fourth quarter of 2009, 53 percent of respondents reported a decline and one year ago the figure was 60 percent. 14 percent felt that their home's value had increased during the past year.

The number of homeowners who expected the home to gain value over both the short and long term also increased. 24 percent expected that the value would go up over the next year while 15 percent, the lowest response since early 2007, expected a further decline. This is a significant improvement over the attitude one year ago when 26 percent of respondents expected a loss in value at a mean average of -1.9 percent. Respondents to the most recent survey, however, aren't looking for much of an increase in values; the average expected increase was 0.0 percent.

MND's Adam Quinones adds...

"There has been much debate as to the amount of shadow inventory that has yet to hit the housing market. Many analysts speculate that a continued rise in prime mortgage delinquencies and high non-prime loan foreclosure rates will add to an already inflated level of housing inventory and pressure home prices lower. I have a slightly different perspective. To reduce the cost of maintaining the condition of foreclosed properties, banks have delayed the liquidation process and allowed delinquent borrowers to remain in their homes. In addition to that, by delaying the liquidation of foreclosed properties, banks have avoided large asset value write-downs . I expect banks to continue to utilize this strategy, but it won't last forever. Once the housing market starts to pick up recovery momentum, banks will begin to slowly liquidate their inventory of foreclosed properties. Hopefully they will do so in a manner that does not greatly disrupt local supply/demand."

Over the next five years 59 percent of respondents expect to see a rise in the value of their houses albeit a small one. The mean increase was estimated at 2.7 percent. 7 percent expected that their house would decline over the next five year. Last quarter 63 percent were looking for an improvement over 5 years and 9 percent expected a decline.

Here is a table summarizing the survey results: