As might be expected, as the number of foreclosures has dwindled, so has the number of so-called zombies. However RealtyTrac said on Friday their share of all foreclosures has continued to grow. Zombie foreclosures are those in which the delinquent homeowner has moved from the home before the actual foreclosure or sheriff's sale takes place. Vacant properties are at risk for deterioration or vandalism, creating a liability for both lenders and communities.

In its quarterly Zombie Foreclosure Report RealtyTrac says that at the end of January 2015 there were 142,462 homes in the U.S. that were in the process of foreclosure but had already been vacated by the owner, down 6 percent from a year earlier. However that number represented one-quarter of all homes in the pre-sale foreclosure inventory compared to 21 percent in the first quarter of 2014.

Daren Blomquist, RealtyTrac vice president said, "While the number of vacated zombie foreclosures is down from a year ago, they represent an increasing share of all foreclosures because they tend to be the problem cases still stuck in the pipeline. Additionally, the states where overall foreclosure activity has been increasing over the past year - counter to the national trend - tend to be states with a longer foreclosure process more susceptible to the zombie problem."

Blomquist said that in those states with what he called a bloated foreclosure process the increase in zombie foreclosures is positive, signaling that banks and courts are finally moving forward to clear the backlog of properties that may have been in legal limbo for years "In many markets there is plenty of demand from buyers and investors to snatch up these distressed properties as soon as they become available to purchase," he added.

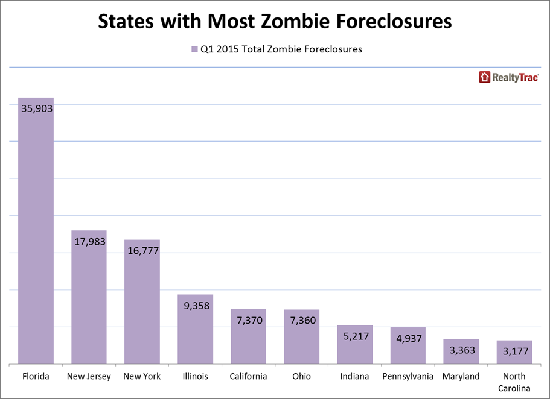

The percentage of vacant homes in the foreclosure inventory soared in two states which have among the longest foreclosure timelines, stretching at times to near five years. Compared to a year earlier zombie foreclosures increased 109 percent in New Jersey to 17,983 and 54 percent to 16,777 in New York, the second and third largest totals in the country. The numbers represented 23 percent and 19 percent respectively of the states' foreclosures.

However, despite decreasing 35 percent since the first quarter of 2013, Florida still topped the list of states in its number of zombies, 35,903, down from 54,908 a year earlier. This was twice the number of second place New Jersey and 26 percent of all foreclosures in the state.

Illinois had 9,358 zombie foreclosures at the end of January, down 40 percent from a year ago but still the fourth highest state total, while California had 7,370 zombie foreclosures at the end of January, up 24 percent from a year ago and the fifth highest state total.

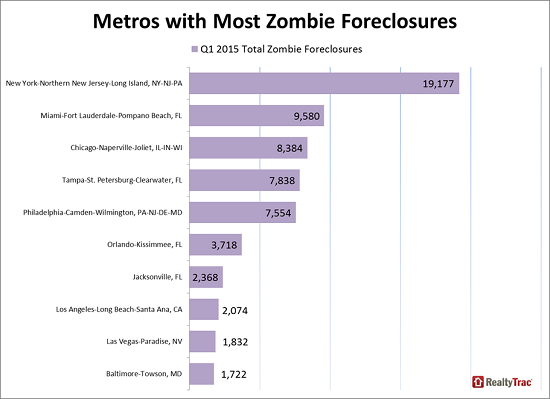

Among metro areas the greatest number were in the greater New York area with 19,177, 17 percent of properties in the foreclosure inventory and a 73 percent increase from a year earlier. The number of zombies decreased from a year ago in the next three cities on the list, Miami, Chicago, and Tampa. Miami was down 34 percent, Chicago 35 percent, and Tampa 25 percent, but the three metros still posted the second, third and fourth highest number of zombie foreclosures among metro areas nationwide: Philadelphia, in fifth place, had a 53 percent increase in zombies from a year earlier and they now represent 27 percent of all foreclosures in that city.

Among large metro areas with significant numbers of zombie foreclosures in the first quarter the highest share were in St. Louis (51 percent), Portland (40 percent) and Las Vegas (36 percent). Metros with the largest increases in the past year were Atlantic City, New Jersey (+133 percent), Trenton-Ewing, New Jersey (+110 percent), and New York (+73 percent).