Nearly half of the homeowners who could refinance their homes have not done so despite the prolonged availability of record low mortgage interest rates. Fannie Mae's Economic & Strategic Research Group recently conducted two separate analyses of data from the company's National Housing Survey (NHS) to find out why. Results were published recently by Li-Ning Huang, Ph.D. Senior Manager of the group in Fannie Mae's FM Commentary blog.

Responses to the NHS (conducted in the first quarter of 2013) indicate that 40 to 50 percent of those surveyed had not refinanced the mortgage on their current home. Further, only 25 to 30 percent said they had refinanced in the past three years as mortgage rate declined to historic lows. Among the group that had not refinanced in the last three years only 10 percent said they were "very likely" to refinance in the future. A Federal Reserve study conducted in 2001 and 2002 confirmed this behavior, finding that only about half of homeowners with mortgages refinanced at least once after buying their homes.

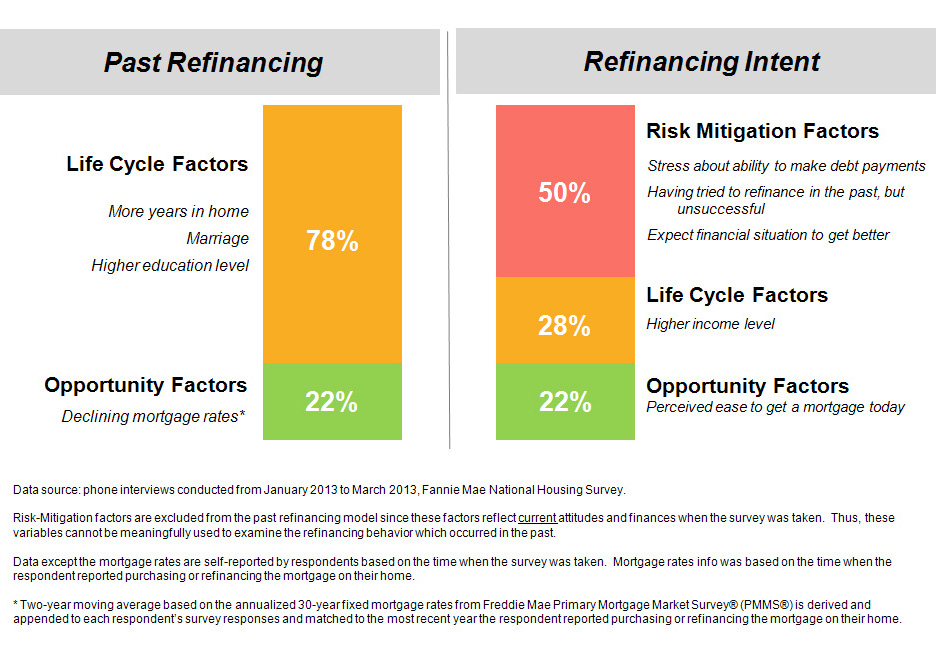

Fannie Mae's first analysis looked at the factors associated with having refinanced in the past and the second studied the factors that could motivate the intent to refinance over the following 12 months. Factors were grouped into three categories:

- Life Cycle. (Age, marital status, education level, income, children in home, years in home.)

- Opportunity: (Perceived ease of getting a mortgage, mortgage rate regime (declining, stable, rising).)

- Risk Mitigation. (Stress over payments, concern about job loss, prior failure to get a loan, perceived underwater status, doubt about wisdom of homeownership, expectation of improving finances)

Life cycle factors were the dominant variable borrowers associated with their past refinancing behavior, especially the number of years the borrower had owned the home. Most had refinanced after six to 15 years. Marriage and higher education levels were also associated with homeowners' past refinancing behavior. Among opportunity factors previous refinancers most frequently cited declining mortgage interest rates.

Borrowers who want to refinance in the next 12 months think differently from those who have not refinanced. Such borrowers want to mitigate their risk and are specifically more worried about their personal finances and want to refinance to get them under control. Many have "tried to refinance but have been unsuccessful." Borrowers who perceive it will be easy for them to get a mortgage are more motivated to refinance and life cycle status such as income is also a driver.

The important role that life cycle factors play in past refinancing behavior suggest that a borrower's financial experience and literacy, possibly gained through homeownership length and education, may encourage mortgage refinancing. Findings suggest that a better awareness of one's financial situation could encourage consumers to consider refinancing and to take action. In addition, resources and tools that help build financial literacy and awareness could lead to higher rates of refinancing.

Huang said the NHS results also show there may be other factors influencing people against a refinance. For example, the considerations of "not enough savings" and "high closing costs" are top refinancing barriers cited in the study. Situational factors such as the relative size of the original and remaining mortgage principal and the number of years expected to remain in the house could affect borrowers' assessment of refinance benefits. Further research into the situational factors that may impact borrowers' decision making as well as borrowers' financial literacy and awareness is needed to provide deeper insights into the issues that influence refinancing behavior.