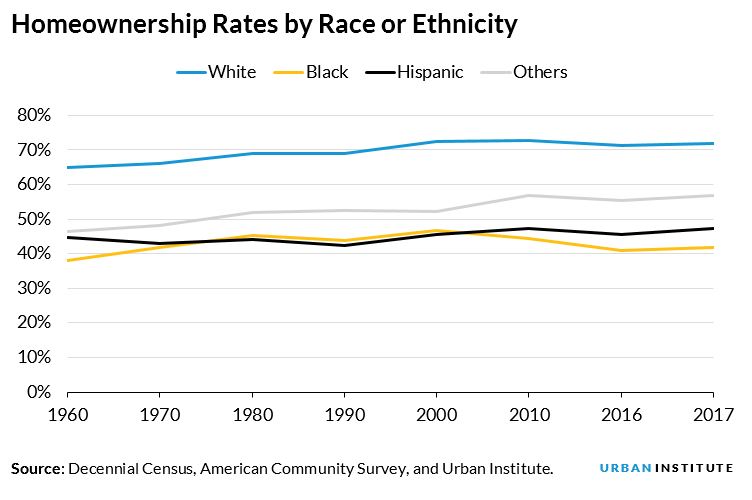

The gap in homeownership rates between white Americans and racial and ethnic minorities has persisted for years with the largest gap among black families. All demographic groups have seen their rates decline from the 2004 peak, but again decline since has been most dramatic for black Americans. Their rate has dropped 5 percent compared to 1 percent for white families and an increase among Hispanics. The rate for Millennial generation blacks is 13 percent today compared to 37 percent for white Millennials.

Alana McCargo, writing in the Urban Institute's (UI's) Urban Wire Blog, says black homeownership rates are now at levels not seen since the 1960s when private raced-based discrimination was legal. She says this sustained gap has been studied, quantified and discussed thoroughly in recent years. It is a cause of concern on many fronts, but especially because of the enormous role it plays in suppressing intergenerational wealth building and economic mobility.

Late last year UI, with financial assistance from the National Associations of Realtors and Real Estate Brokers, convened a meeting with stakeholders to discuss areas where policies on the national and state level might address the issue. McCargo presents the five strategic priorities that emerged from the discussion.

1. Understand forces at the local level

Only four of the largest 31 metropolitan areas with more than 100,000 black households have seen an increase in the black homeownership rate in the last decade. McCargo says we need to understand what is happening locally to cause the declines in the other 27 and also to find what is happening in cities where the rate has increased. Not all cities will have the same causes or need the same solutions so local approaches will be needed to remove barriers related to affordability and get more renters on a path to becoming homeowners.

2. Address housing supply and finance challenges.

The shortfall in the creation of housing stock, Freddie Mac recently put it at 370,000 per year, has led to an affordability crisis, especially at the lower end of the market. At the same time, what McCargo calls an "overcorrection" to the Great Recession by regulators and lenders made it harder to get a mortgage

There needs to be greater understanding of how the housing shortage and tight credit affect communities of color and to quantify how various actions can improve homeownership. McCargo lists preservation, rehabilitation, and construction of affordable housing and access to small dollar mortgages as some potential solutions.

3. Help more renters become homebuyers.

There is a need to analyze how income is calculated in mortgage underwriting and exploring how rental payment history can enter into credit scoring. It is also important to stabilize and broaden the reach of downpayment assistance and low-down payment programs. Any efforts to help renters move into homeownership should assist all renter demographics.

4. Strengthen government mortgage programs.

While the FHA and the VA occupy 12 percent of the overall mortgage market, FHA finances 33 percent of purchase activity for first-time homebuyers and 34 percent of all minority purchase activity. McCargo says both government programs are in need of reforms and improvements and stakeholders must be vigilant to ensure they remain viable and robust. She adds that the housing programs supported by the GSEs Fannie Mae and Freddie Mac and bank portfolio and local finance programs through community development financial institutions (CDFI) and housing finance agencies (HFA) can be better leveraged to do more for this segment of the population.

5. Sustain homeownership through all economic cycles.

Keeping people in their homes after purchase is the key to building housing wealth. We need to better understand how homeowners can use tools and programs to navigate all economic cycles, including taking a closer look at mortgage servicing and safe home equity lending products.

The author concludes that changing the course of such an enormous and entrenched problem as the black homeownership gap will "require intention, a renewed knowledge base, and the partnership of many stakeholders in the housing ecosystem. We'll also need a plan. These five strategies are a starting point."