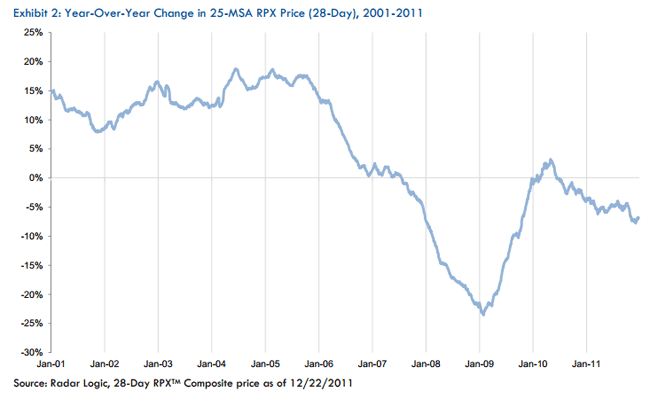

Radar Logic's RPX Composite price for 2011 reached its lowest point in December since the housing crisis began. The Composite, which tracks housing prices in 25 major U.S. metropolitan areas, fell 6.8 percent during the year ended December 22 to $173.76 per square foot, a price last seen in February 2003.

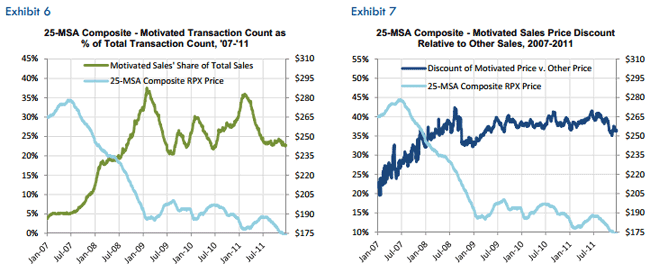

This decline was driven by an 8 percent decrease in home prices in what Radar Logic calls the traditional market, i.e. non-distressed sales. The latter contributed less to the decline by comparison as prices for foreclosures have declined just 5 percent during the same period. The average distressed home now sells at a price 39 percent lower than other sales.

Sales activity in the traditional market increased 32 percent on an annual basis and distressed sales declined from 30 percent of total transactions to 23 percent, a -9 percent change. Total sales increased 19.6 percent.

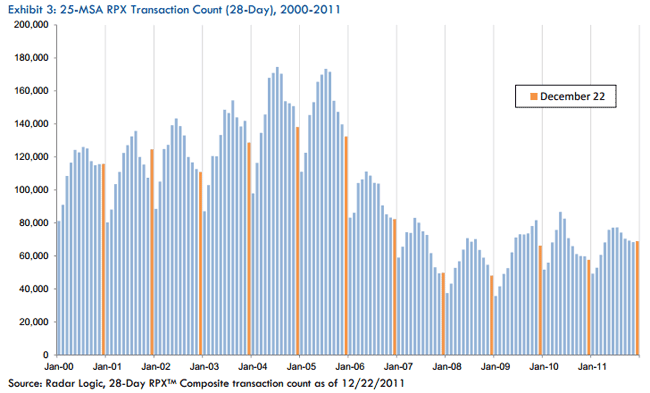

Radar Logic notes that sales activity appears to be increasing every month despite that the most recent reporting period is in what is usually considered a seasonal trough. This could be the result of a "confluence" of several factors.

- Prices are still at decade low levels and, while buyers have seemed reluctant to purchase even at these levels, perhaps that is changing. The same might be true for sellers' willingness to accept the lower prices for their homes.

- Investors seeking to buy distressed properties to rent may have exhausted that supply and are turning to the non-distressed market for product.

- Perhaps we are used to seeing such depressed levels of activity that any increase appears stronger than it really is.

Even these observations taken together, Radar Logic said, do not explain why, while sales activity has apparently increased, this has not yet prompted any improvement in prices. "It will be telling," the report says, "to watch the data for the next few months."