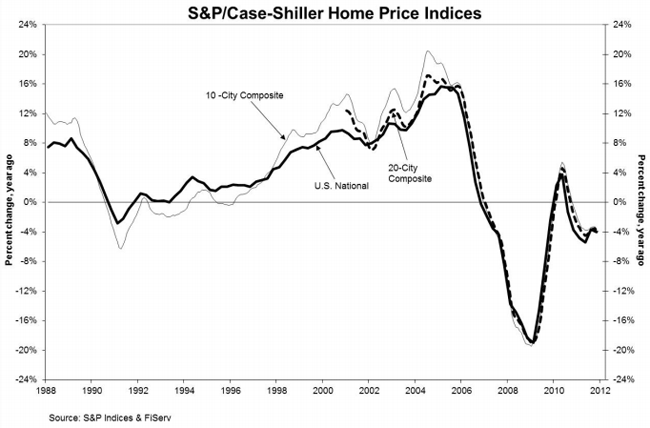

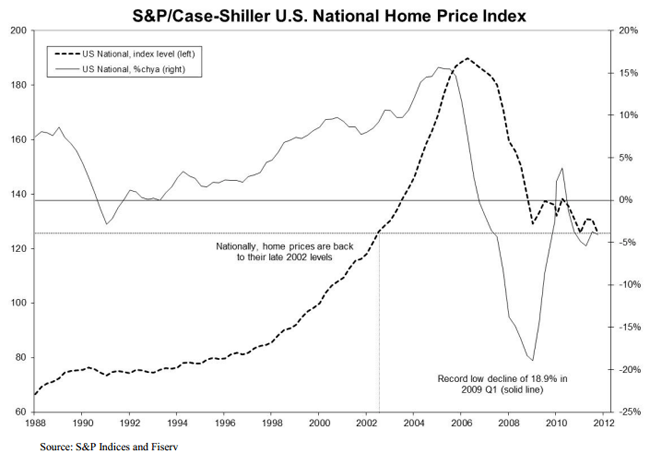

All three of the S&P/Case-Shiller Indices hit new post-crisis lows during December. The year ended with the national composite, which is reported only every three months, down 3.8 percent during the fourth quarter of 2011 and 4 percent lower than it was one year earlier. Both the 10-and 20-City Composites fell by 1.1 percent in December over November and were down 3.9 percent and 4.0 percent from their respective levels in December 2010. The indices further increased their year-over-year decline from the -3.8 percent noted for both city composites in November. The National Composite Index is now 125.67, the 10-City Composite is 149.89 and the 20-City is 136.71.

S&P recommends using the non-seasonally adjusted index figures for analysis but does provide a seasonally adjusted set as well. During the fourth quarter the national index was down 1.7 percent while the 10-and 20-City indices each decreased 0.5 percent from November to December.

Only two of the 20 metropolitan statistical areas (MSAs) in the composites were up in December over November. Miami and Phoenix increased 0.2 percent and 0.8 percent respectively. Washington, DC was the only MSA to post an annual increase (0.5 percent) while four MSAs, Atlanta, Las Vegas, Seattle, and Tampa had average home prices that registered new lows. The Case-Shiller base of 100 was established in 2000 and Atlanta (87.30), Cleveland (97.73), Detroit (68.39), and Las Vegas (90.71) are now below that 100 benchmark with Phoenix (101.91) not far behind.

Measured from the respective pre-crisis peaks in June and July of 2006, the 10-City and 20-City Indices have each fallen 33.8 percent as has the national composite and national prices are now back to the levels last seen in late 2002.

David M. Blitzer, Chairman of the Index Committee at S&P Indices said "With this month's report we saw all three composites hit new record lows. While we thought we saw some signs of stabilization in the middle of 2011, it appears that neither the economy nor consumer confidence was strong enough to move the market in a positive direction as the year ended."

Neil Dutta, Economist at Bank of America Merrill Lynch commented, "It's pretty clear that the consensus continues to under-estimate the decline in home prices. The December number is probably looking a little better than the numbers for the coming year. Foreclosures are going to increase in this year. That's going put pressure on home prices and consumer spending and household balance sheet."

Bloomberg Video: Homebuyers in `Wait-and-See' Mode Now, Shiller Says