The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending February 26, 2010.

The survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole. Furthermore, in a low mortgage rate environment, such a trend implies consumers are seeking out lower monthly payments which can result in increased disposable income and therefore more money to spend on discretionary items or to pay down other debt.

From the release:

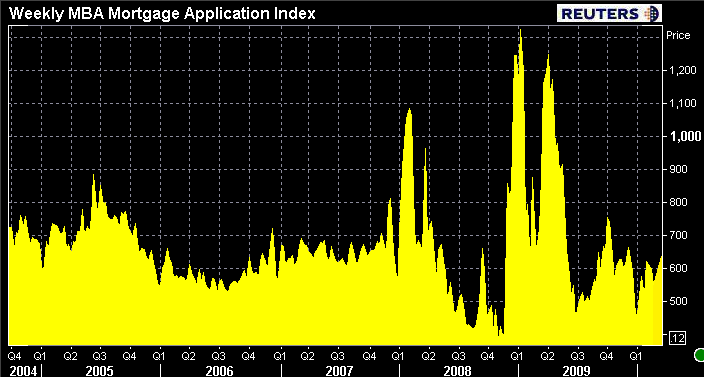

The Market Composite Index, a measure of mortgage loan application volume, increased 14.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 15.5 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is up 0.4 percent

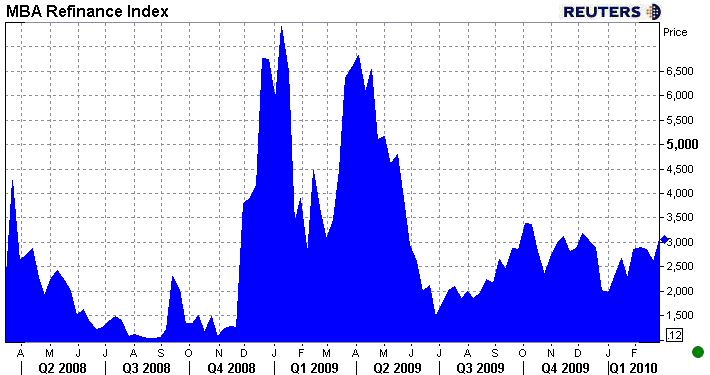

The Refinance Index increased 17.2 percent from the previous week. The four week moving average is up 1.8 percent for the Refinance Index. The refinance share of mortgage activity increased to 69.1 percent of total applications from 68.1 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 4.8 percent from 4.7 percent of total applications from the previous week.

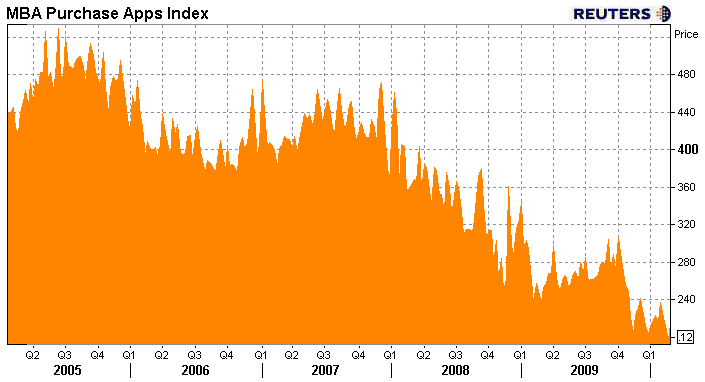

The seasonally adjusted Purchase Index increased 9.0 percent from one week earlier. The unadjusted Purchase Index increased 11.7 percent compared with the previous week and was 9.8 percent lower than the same week one year ago. The four week moving average is down 2.7 percent for the seasonally adjusted Purchase Index

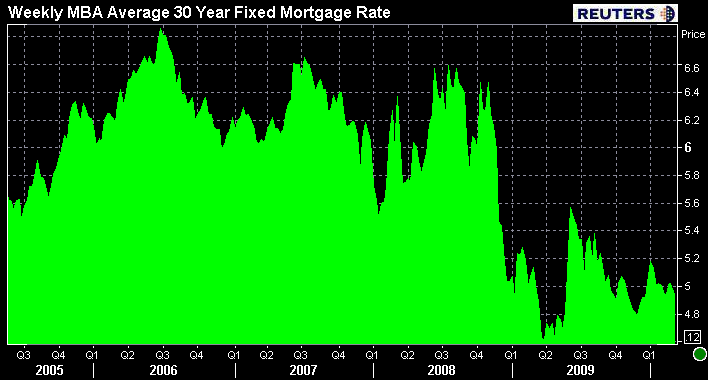

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.95 percent from 5.03 percent, with points decreasing to 0.99 from 1.34 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.27 percent from 4.35 percent, with points increasing to 1.36 from 1.31 (including the origination fee) for 80 percent LTV loans. This is the lowest 15-year fixed-rate observed in the survey since the week ending November 27, 2009. The average contract interest rate for one-year ARMs decreased to 6.77 percent from 6.80 percent, with points decreasing to 0.29 from 0.33 (including the origination fee) for 80 percent LTV loans.

Michael Fratantoni, MBA’s Vice President of Research and Economics said:

“Mortgage applications rebounded last week, particularly refis, as rates dropped back below 5 percent.... Purchase activity remains subdued, with application volumes remaining within the narrow range seen in the last few months.”

Plain and Simple:While purchase loan apps are putting along near 12 year lows, lock desks got busy toward the end of last week as rates dipped below 5.00% and coverage on it picked up (at least on MND). We believe current mortgage rates are near what will turn out to be the lowest levels of 2010, this is a message we have been broadcasting on the Mortgage Rate Watch blog. With that in mind, given the fact that search traffic on that blog channel increased substantially last week....we wonder if borrowers might just be listening to our voice and taking advantage of rates below 5.00% while they are still available.

Feedback? One has to believe the thought of rising interest rates would draw out new purchase and refi loan demand. I suppose a month of bad weather can be leaned upon as an excuse for slowness in the purchase market. Still, if loan demand is really there, it should show up over the course of the next month, before the Fed exits the MBS purchase program.

Now for the hard part....getting these borrowers qualified and closed!

Consumers: be extra attentive to document requests from your loan officer and don't be afraid to ask questions. The last thing you want is a monkey wrench getting thrown into the deal that raises fees and forces re-disclosure.

Originators: best of luck on getting this wave of refinances to the table.

READ MORE about the lack of qualifed borrowers