The NAR released Pending Home Sales data this morning.

From the release:

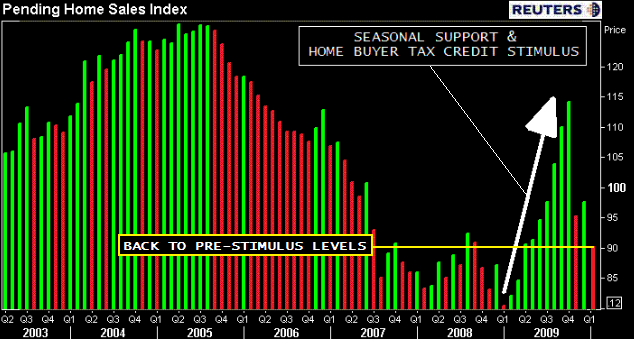

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in January, fell 7.6 percent to 90.4 from an upwardly revised 97.8 in December, but remains 12.3 percent higher than January 2009 when it was 80.5.

A sale is listed as "pending" when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing. Mortgage and real estate professionals know that a signed contract is just the first step in a long process nowadays. The hard part is qualifying and closing!

Since activity spiked over the seasonally supportive spring and summer months, before topping out in October, there has been a drastic drop off in sales contract signings. In all reality I should say the index has returned to pre-stimulus levels.

There is one twist to the above discussed "drastic drop off" that must be mentioned.

Over the past month there has been a steady streak of noticeably weaker than anticipated economic indicators. Declines in manufacturing output, labor demand, retail sales, and housing activity have all been blamed on wintry weather as blizzard conditions in more than one geographic region, accompanied by unusually large amounts of snow and ice accumulation, forced most folks into their homes, shut in from shopping. (online too?)

Lawrence Yun, NAR chief economist says: "Weather is likely to impact housing data....January pending sales, though still higher than one year ago, remain much lower than expected given that a large number of potential buyers are eligible for the expanded home buyer tax credit. Moreover, the abnormally severe and prolonged winter weather, which affected large regions of the U.S., hampered shopping activity in February,”

Looking ahead....

Yun says he expects a turn around late this spring/early this summer: “We will see weak near-term sales followed by a likely surge of existing-home sales in April, May and June,”

The Pending Home Sales index is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. In developing the model for the index, it was demonstrated that closed existing-home sales generally lag the Pending Home Sales Index by two months.

Given the decline in signed sales contracts in January and expectations for another slow month in February (because snow was worse in Feb), Yun's outlook for a pick up in activity sometime in late spring/early summer makes sense...especially when you add in an anticipated spike in buyer demand as the tax credit draws closer to expiration in April (for June closings).

I do not want to paint a super positive picture though, statements like "a pick up in activity" and "spike in buyer demand" may be taken as "everything is going to be OK this spring". The fact is, there are still major structural problems that only time (and jobs) can fix, specifically damaged consumer credit profiles. If you've never had the pleasure of trying to repair a borrower's FICO score, it is not a fast process in any way. It takes time, discipline, and steady income. It will take years of credit rebuilding (or guideline relaxation) before housing demand (qualified) is really restored.

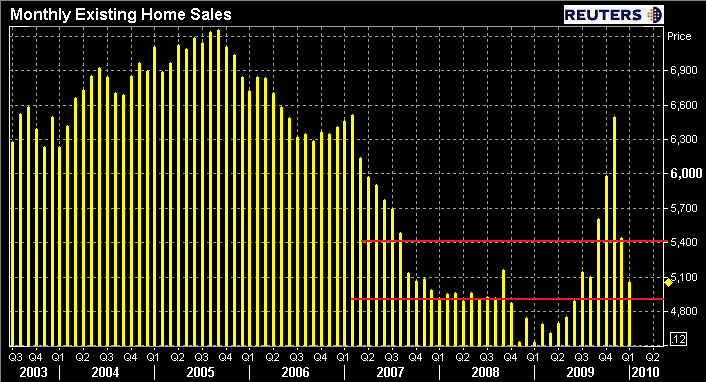

I think we will see existing home sales increase up to 5.4 million annual sales in the early summer with activity slowing down back toward 5.00 million annual sales later in the year.

My point: the rejuvenation of housing demand really is a function of macroeconomic progress, specifically jobs. Considering productivity is running at a record high and firms are investing in technology to make production more efficient...many jobs that were lost over the last two years will likely be lost forever. This does not make me feel warm and fuzzy about sustained positive progress in housing....that recovery will take many years. The market will feel slow for awhile....