Freddie Mac announced that it has posted a net income of $619 million for the quarter ended December 31, 2011 and total comprehensive income of $1.5 billion. In the third quarter the company posted $(4.4) billion as both a net and a comprehensive loss. For the entire year of 2011 Freddie Mac had net income of $(5.3) billion and comprehensive income of $(1.2) billion compared to $(14.0) billion and $0.3 in 2010.

The shift from a net loss to a net gain in the fourth quarter reflects lower derivative losses due to a smaller decline in long-term interest rates and a decrease in the provision for credit losses on single-family loans. The shift in comprehensive income primarily reflects the net income for the fourth quarter but also the tightening mortgage spreads on some non-agency AFS securities.

The company had a net worth deficit of $146 million at the end of the quarter and will submit a request to the Treasury Department for a draw in that amount. This will be more than offset by a quarterly dividend payment of $1.7 billion to Treasury on its holdings of Freddie Mac Senior Preferred Stock. With this draw Freddie Mac will have received $7.6 billion from Treasury for 2011 and paid $6.5 billion in dividends. In 2010 its draw requests totaled $13.0 billion and dividends were $5.7 billion. Since being placed in conservatorship in August 2008 Freddie Mac has drawn $72.3 billion from Treasury and paid dividends of $16.5 billion.

During 2011 Freddie Mac financed $1,859,072 residential properties of which 320,753 were multi-family units. This was down from 2,115,302 mortgages in 2010 including 233,952 multi-family units. Total volume in 2011 was $361 billion and $412 billion in 2010. The company also purchased 1,183,304 refinance mortgages in 2011 for a total volume of $247 billion.

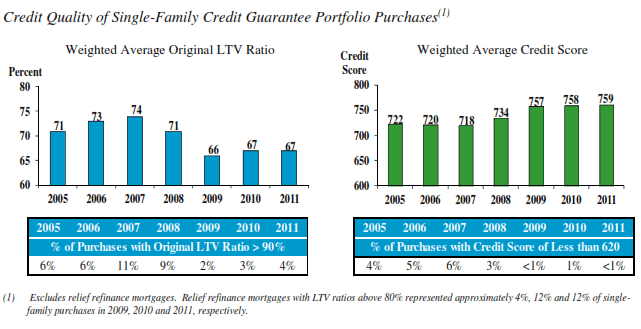

The company said that the loans it acquired after 2008 continue to perform well and during 2011 represented only 1 percent of credit losses while loans originated between 2005 and 2008 represent 90 percent of those losses. The current delinquency rate for the newer vintage loans is 0.30 percent compared to 8.75 percent for those with 2005-2008 originations. The recent loans were underwritten using more stringent standards and have significantly higher loan-to-value ratios and higher credit scores. These loans now represent more than 50 percent of the company's single-family credit guarantee portfolio.

Serious delinquencies were at a rate of 3.58 percent at the end of December which the company said was substantially below industry benchmarks. Freddie Mac continues to participate in numerous foreclosure prevention activities including representation at hundreds of workshops nationwide and expanding its free counseling for distressed homeowners in hard-hit cities. The company's direct activities during 2011 and (2010) included: 109,174 loan modifications (170,277), 33,421 repayment plans (31,210), 19,516 forbearance agreements (34,594), and 46,163 short sales/deeds-in-lieu actions (39,175) for a total of 208,274 (275,256) single-family loan workouts.