The Making Home Affordable Program (HAMP), a joint effort by the Departments of the Treasury and Housing and Urban Development to prevent foreclosures, is reporting that 168,708 homeowners have now graduated from the HAMP trial modification program and have active permanent modifications by the end of February. This works out to a 12.4 percent conversion rate, a modest improvement from January when the permanent modification conversion rate was 9.2 percent.

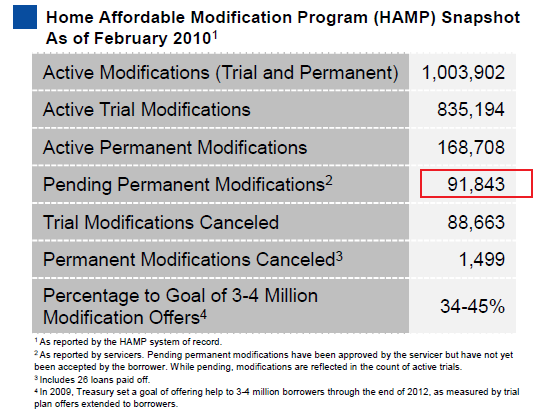

The program, which began last spring, has now enrolled 1,094,064 borrowers in modifications which lower mortgage payments to a maximum of 31 percent of monthly income. 1,354,350 invitations to participate in the program have been extended to distressed homeowners. This is 34 to 45 percent of the goal of 3 to 4 million set for the end of 2012. At present 835,194 loans are in some phase of the trial period, a number which includes the pending permanent modifications. To date 88,663 trial modifications and 1,499 permanent modifications have been cancelled. The report does not give any reasons for the cancellations. In addition, 91,843 borrowers had successfully completed the three month trial period and permanent modifications were awaiting borrower acceptance.

Servicers handling administration of the program can modify loans through a reduction of the interest rate, extension of the term of the loan, and/or forbearance of principal. 100 percent of permanent modifications had a reduction in rate, 41 percent an extension of term, and 27.8 percent received forbearance. The median decrease in monthly payment for those in the program is $518.88, resulting in a median payment of $837.86. These homeowners' lower monthly payment represents a cumulative $2.7 billion in savings. Borrowers who successfully complete the trial program and convert to permanent status are guaranteed the modified payment for at least five years. In addition, those borrowers who make on-time payments for one year under the permanent modification are eligible for a credit of $1,000 on their outstanding mortgage balance.

HAMP estimates that, at present, approximately 1.8 million loans are eligible for a HAMP modification. This is somewhat scary as there are an estimated 6.0 million residential mortgages that are 60+ days delinquent, implying perhaps the worst has yet to come. Approximately 1.6 million of these are either government guaranteed (VA, FHA) loans or serviced by non-participating HAMP servicers. Servicers are encouraged by HAMP to solicit information from delinquent borrowers regardless of their apparent eligibility for the program and solicitations have been sent to 3.84 million borrowers to date.

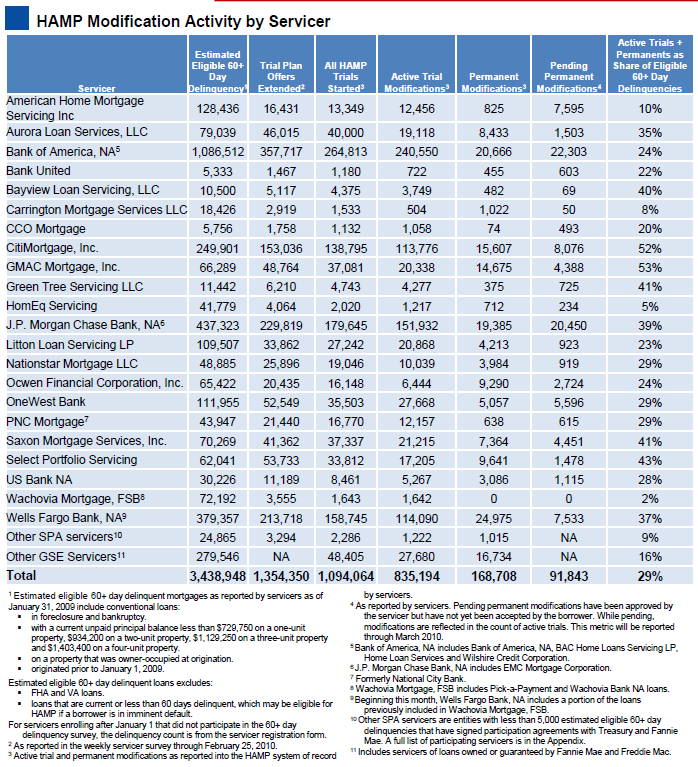

Servicers vary widely in the percentage of borrowers they have enrolled in the program. GMAC and CitiMortgage continue to have the best participation rate, with both reporting slightly more than half of their eligible borrowers are in either trial or permanent modifications. Most major servicers now have a participation rate over 25 percent with the exception of Bank of America. Broken down by investor types, more than 50 percent of HAMP modifications are to GSE loans, 34 percent are held by private investors, and 9 percent are portfolio loans.

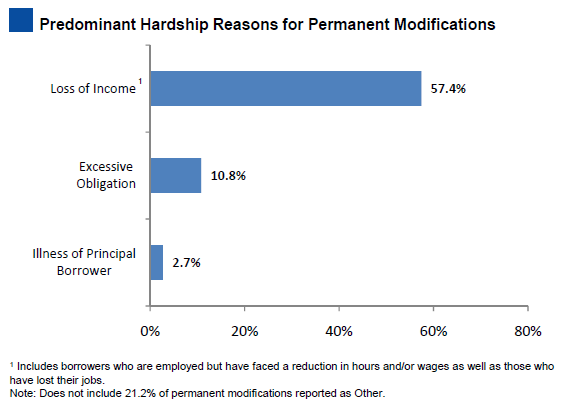

Program participants continue to report that loss of income is the leading cause of their mortgage difficulties, with 57.4 percent reporting that problem. This category includes both unemployment and a reduction in hours or wages. 10.8 percent of borrowers said their programs were caused by excessive obligations and 2.7 percent cited illness.

Again, MND calls attention to the fact that 57.4 percent of permanent loan modifications were made to borrowers who are out of a job or underemployed. The true success of this program is dependent on whether or not these homeowners are able to get a job and continue paying their below market mortgage payment. If not, the loans will re-default.