For the last time, the Federal Reserve today reported on their weekly purchases of agency mortgage-backed securities (MBS).

In the week ending March 31, 2010, the Federal Reserve purchased a total of $6.074 billion agency MBS.

The Fed has now allocated all $1.25 trillion toward purchases of agency MBS. No funds remain.

The goal of the Federal Reserve's agency MBS program was to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally. Mission accomplished...

Of the $6.074 billion purchases made in the week ending March 31, 2010:

- $3.574 billion was used to buy 30 year 4.5 MBS coupons. 59 percent of total weekly purchases

- $2.500 billion was used to buy 30 year 5.0 MBS coupons. 41 percent of total weekly purchase

15 percent of the mortgage-backed's purchased were Fannie Mae MBS while 85 percent were Freddie Mac coupons. No Ginnie Mae coupons were lifted. All purchases were 30 year MBS coupons (88% last week)

The Fed's daily purchase average during the trading week was $1.215 billion per day, $385 million less than last week.

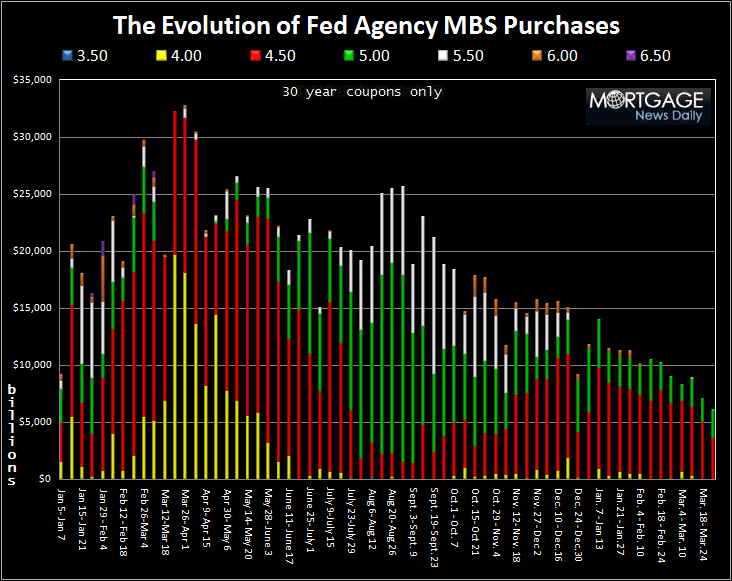

Below is a chart illustrating the evolution of the Federal Reserve's Agency MBS Purchase Program. As the program came to a close, the Fed focused their purchases on new loan production supply, 4.50 (RED) and 5.00 (GREEN) MBS coupons specifically. This helped keep mortgage rates low relative to benchmark Treasury yields.

NOW WHAT?

These posts address the road ahead for mortgage rates, in the short term and the long run:

- What Will Drive the Direction of Mortgage Rates? The Mortgage Rates Equation. READ MORE

- Preparing for the Fed's Exit from the Mortgage Market: Understanding Yield Spreads READ MORE

- How Did Day One Without the Fed Go? READ MORE

This is what I wrote in the lunch hour:

Mortgages continue to feel the pain of the Fed's exit. Selling is broad based with "rate sheet influential" coupons taking the worst beating. If this continues we may see a bit of a snowball effect as servicers will be forced to reduce their holdings of longer life mortgages (duration shedding/convexity). This would pressure MBS yield spreads even wider and push prices even lower. On the bright side it might also signal the end of the first stage of the "NO MORE FED" cleansing processing. If that does happen we should expect to see banks doing a little bargain buying. The MBS market is searching for risk/reward yield spread status-quo!

Day 1 wasn't pleasant for mortgage rate watchers.....

More Fed MBS Purchase Program charts and data to come.....