The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending April 2, 2010.

The survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole.

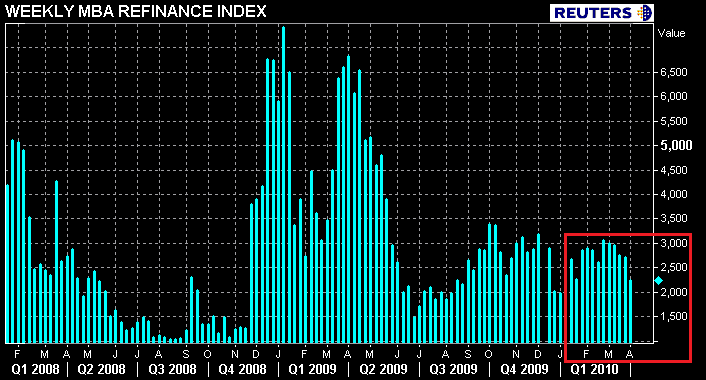

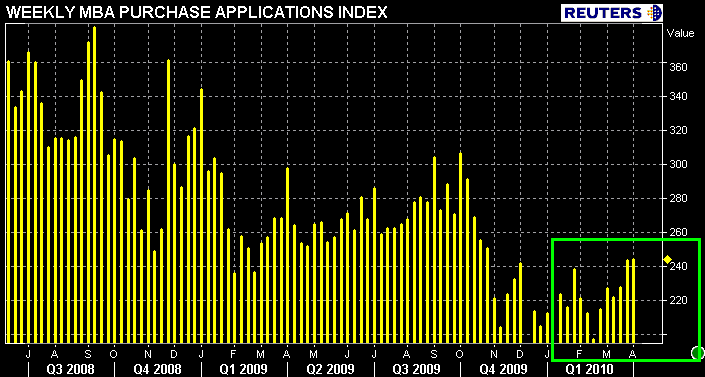

QUICK RECAP: Refinance applications plummeted last week as mortgage rates rose. Purchase applications held steady after making significant improvements in the previous reporting period.

From the release...

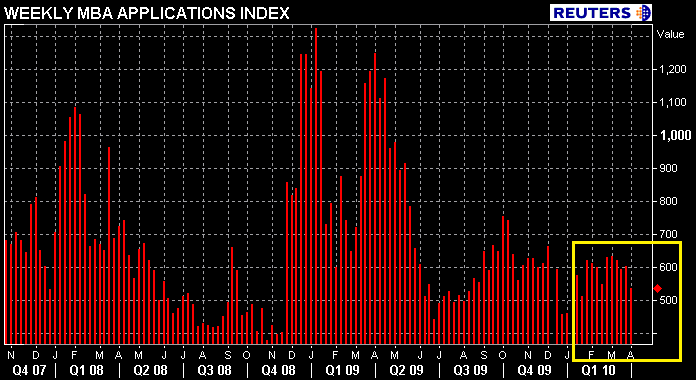

The Market Composite Index, a measure of mortgage loan application volume, decreased 11.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 10.5 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is down 3.8 percent.

The Refinance Index decreased 16.9 percent from the previous week. The four week moving average is down 6.9 percent for the Refinance Index. The refinance share of mortgage activity decreased to 58.7 percent of total applications from 63.2 percent the previous week, marking the lowest share observed in the survey since the week ending August 28, 2009.

The seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. The unadjusted Purchase Index increased 0.5 percent compared with the previous week and was 18.1 percent lower than the same week one year ago. The four week moving average is up 3.2 percent for the seasonally adjusted Purchase Index.

The government purchase index increased significantly for the third straight week and as a result, the government share of purchase applications increased to 49.9 percent, its highest level since February 1990 and the third highest level in the history of the data

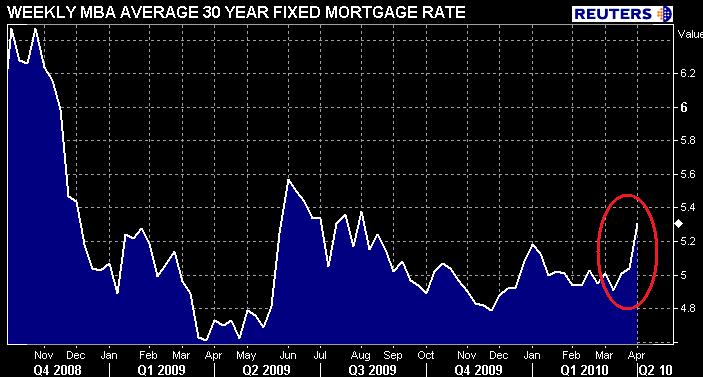

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.31 percent from 5.04 percent, with points decreasing to 0.64 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year rate recorded in the survey since the first week of August 2009. The effective rate also increased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 4.54 percent from 4.34 percent, with points decreasing to 0.92 from 0.98 (including the origination fee) for 80 percent LTV loans. The effective rate also increased from last week.

The average contract interest rate for one-year ARMs increased to 7.03 percent from 6.88 percent, with points decreasing to 0.29 from 0.31 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity increased to 6.2

percent from 5.2 percent of total applications from the previous week.

Michael Fratantoni, MBA's Vice President of Research and Economics says:

"Mortgage rates jumped last week as the Federal Reserve completed their purchases of mortgage-backed securities...Refinance application volume dropped as mortgage rates reached their highest level since August 2009. Purchase volume was essentially unchanged relative to the prior week going into the Easter weekend."

Mike is right. In the reporting period covering the week ending April 2, the Federal Reserve's exit from the secondary mortgage market did play a role in mortgage rates moving higher, but so did rising benchmark Treasury yields. READ MORE

However, since then, localized pressures on the secondary mortgage market associated with the end of the MBS purchase program have faded. "Rate sheet influential" MBS yield spreads have returned to the same levels they were at when the Federal Reserve was buying mortgage-backed securities. Higher mortgage rates this week cannot be blamed on a lack of MBS demand, instead they have been a function of significant increases in benchmark Treasury yields. The lack of new production supply in the agency MBS market has made it look like the Fed never exited! READ MORE

A few other observations...

Unless you've been in denial for the past three months, this next observation just points out the obvious to loan originators: THE MINI REFI BOOM IS OVER!!!! The majority of your business will now be generated from purchase apps.

Points charged on a conventional 30 year fixed mortgage fell 43 basis points to 0.64 from 1.07. That is a big dip! I think this illustrates how competitive the industry is at the moment (or problems with the GFE). Rates rose quickly and borrowers started to panic. This likely resulted in an increased amount of "rate shopping" which forced loan officers to lower their costs to save the deal. Either that or loan officers did not want to re-work Good Faith Estimates so they cut points charged to keep APR from rising. DO EITHER OF THESE OBSERVATIONS SOUND FAMILIAR?