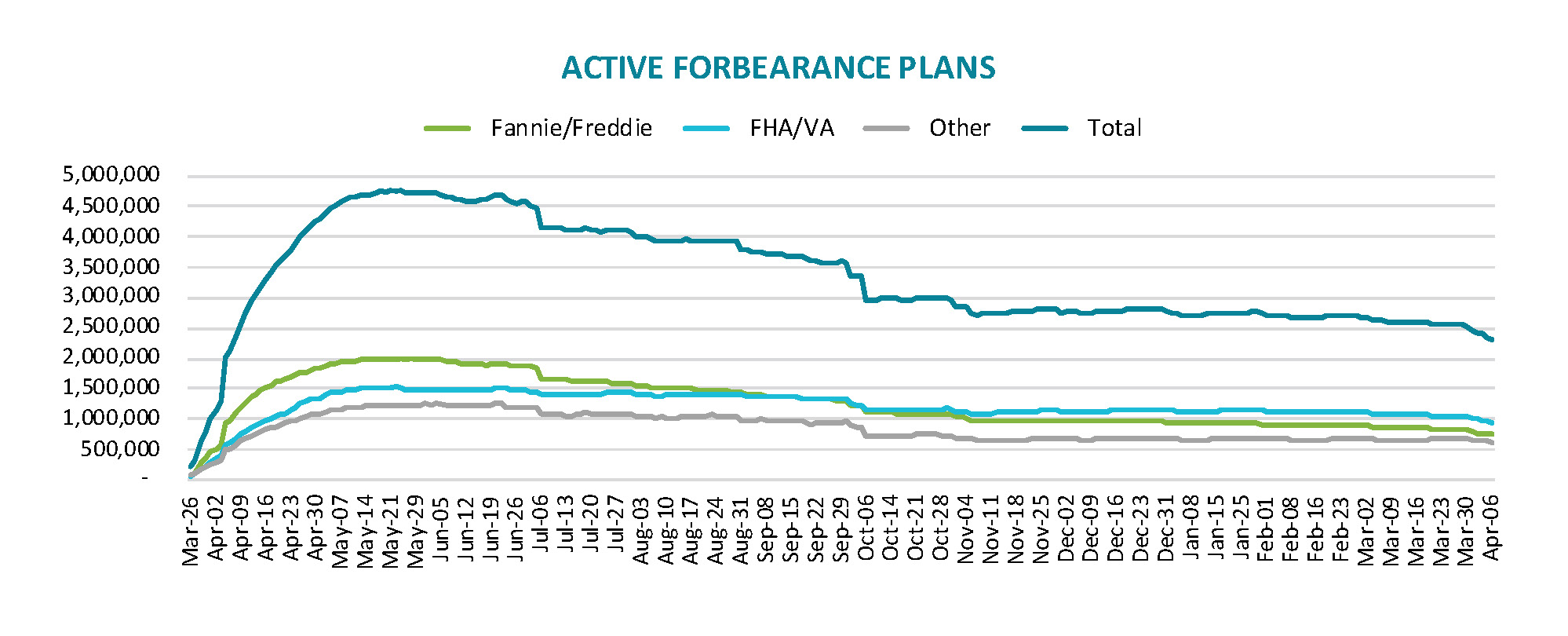

Black Knight reports that the number of loans in forbearance programs declined last week for the sixth straight time and it was the largest drop in six months. As of April 6, the number of loans in active plans was 2.312 million or 4.4 percent of all homeowners with mortgages. This is down by 228,000 from the previous Tuesday, a 9 percent drop in a single week.

A company spokesperson said the decrease was not unexpected. It was driven largely by those who entered the program shortly after it was authorized exiting their plans at the 12-month mark. That would have been their final expiration point prior to recent extensions.

The improvement was widespread. All investor classes saw significant improvement in their numbers. The largest change was among those loans serviced for FHA and VA, down 94,000. This was followed by downturns of 69,000 and 65,000 in GSE (Fannie Mae and Freddie Mac) and portfolio/private label security (PLS) plan forbearances, respectively. At the end of the reporting period there were 753,000 GSE, 954,000 FHA/VA and 605,000 portfolio/PLS loans remaining in programs.

An estimated 280K homeowners exited forbearance this week, and there have been an estimated 158,000 starts or reentries over the last four weeks. The exiting homeowners represent more than half of all loans being reviewed for extension and removal. For context, as recently as last week, roughly 8 out of every 10 plans reviewed for extension/removal activity resulted in the extension of forbearance. The number of starts and restarts were down 18 percent from the preceding four-week period.

In total, this puts the number of active plans down by 323,000 over the last month - a 12.3% reduction and the strongest rate of improvement since early November. This is also a 2.45 million loan decline (-51 percent) from the spring 2020 peak.

Black Knight notes there are another half-million plans with April month-end expirations, so the possibility remains for further improvement through this month and into May.