The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending April 9, 2010.

The survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole.

QUICK RECAP: To quote Mike Fratantoni, MBA's Vice President of Research and Economics:"Applications for government mortgages dropped substantially last week, following the implementation of an increase in FHA mortgage insurance premiums," said "Applications for conventional mortgages also dropped last week, with refinance application volume continuing to drop following last week's jump in rates."

From the release...

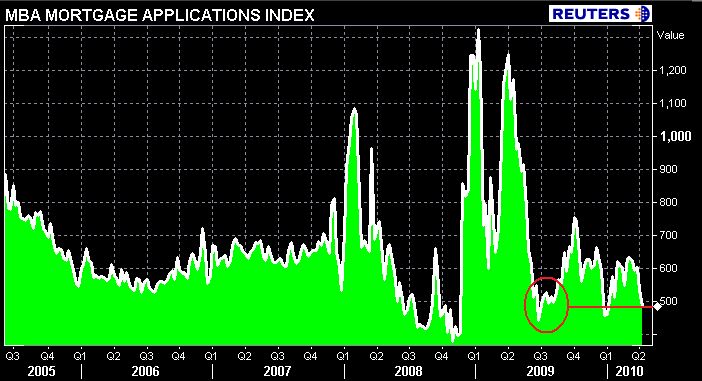

The Market Composite Index, a measure of mortgage loan application volume, decreased 9.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 9.5 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is down 6.2 percent.

This is the third lowest Market Index recorded in the survey since the end of June 2009.

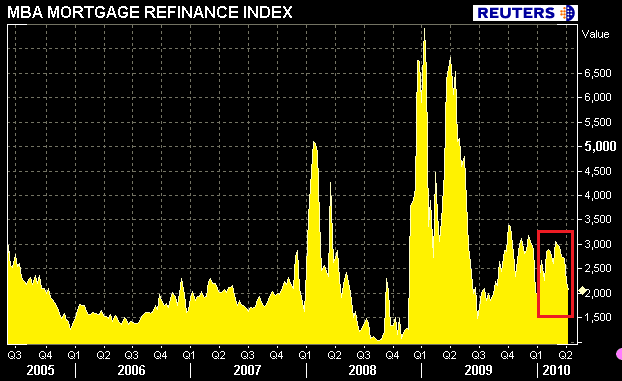

The Refinance Index decreased 9.0 percent from the previous week, marking the index's fifth consecutive decline.The four week moving average is down 8.8 percent for the Refinance Index.The refinance share of mortgage activity increased to 58.9 percent of total applications from 58.7 percent the previous week.

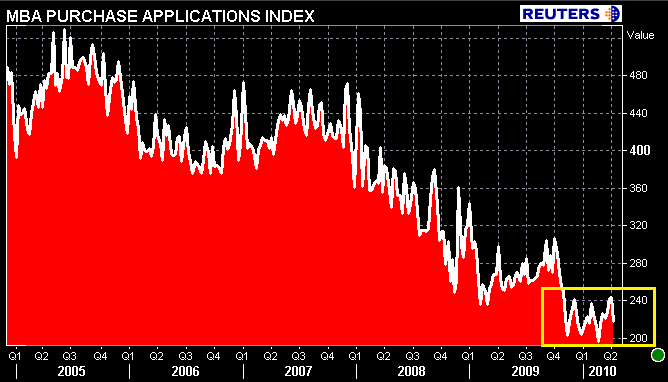

The seasonally adjusted Purchase Index decreased 10.5 percent from one week earlier. The unadjusted Purchase Index decreased 10.0 percent compared with the previous week and was 17.5 percent lower than the same week one year ago.

The decline in purchase applications was driven by government purchase applications, which decreased 19.1 percent from last week, compared to a decrease of 2.0 percent in conventional purchase applications. The four week moving average is down 0.9 percent for the seasonally adjusted Purchase Index.

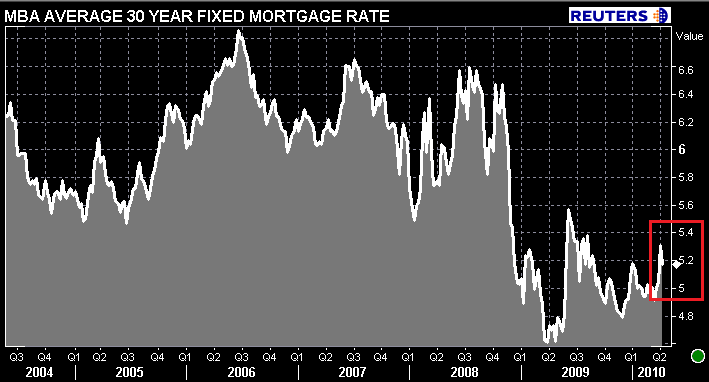

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.17 percent from 5.31 percent, with points increasing to 0.91 from 0.64 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.45 percent from 4.54 percent, with points decreasing to 0.80 from 0.92 (including the origination fee) for 80 percent LTV loans. The effective rate also decreased from last week.

The average contract interest rate for one-year ARMs decreased to 7.02 percent from 7.03 percent, with points decreasing to 0.27 from 0.29 (including the origination fee) for 80 percent LTV loans. The

adjustable-rate mortgage (ARM) share of activity increased to 6.3

percent from 6.2 percentof total applications from the previous week.

While I am not surprised by the continued decline of refinance demand, it is troubling to see purchase applications fail to maintain positive momentum. The homebuyer tax credit expires at the end of April, we should be seeing a more consistent stream of buyer interest at this point. Expect to see purchase apps rebound in next week's report...